Was the Stamp Duty Holiday just for the rich?

Who really benefitted from the Stamp Duty holiday?

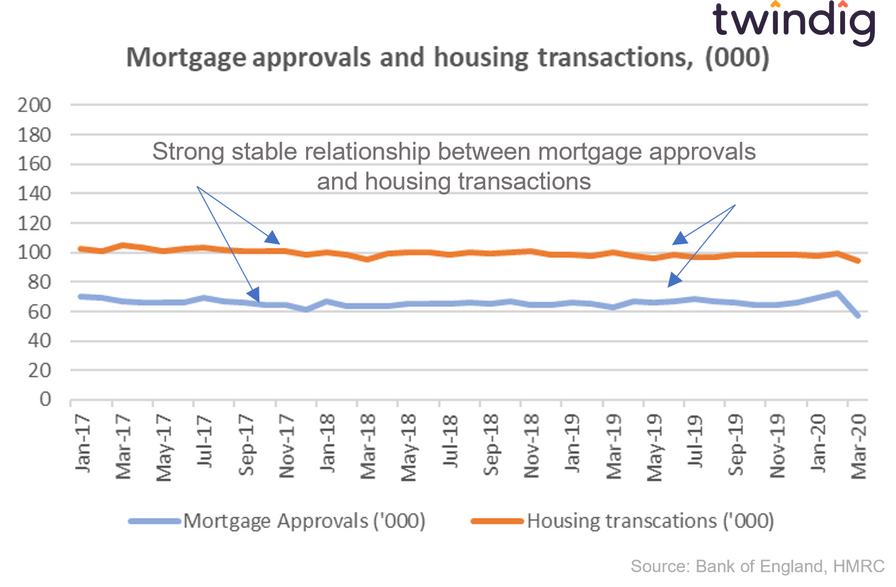

There is a strong correlation between mortgage approvals and housing transactions. This should not be a surprise given that the average house prices are multiples of average earnings. The majority of house purchases are funded at least in part by a mortgage.

As illustrated in the graph of housing transactions and mortgage approvals below, around two-thirds of housing transactions are supported by a mortgage. However, this relationship changes when the level of Stamp Duty Tax is about to change.

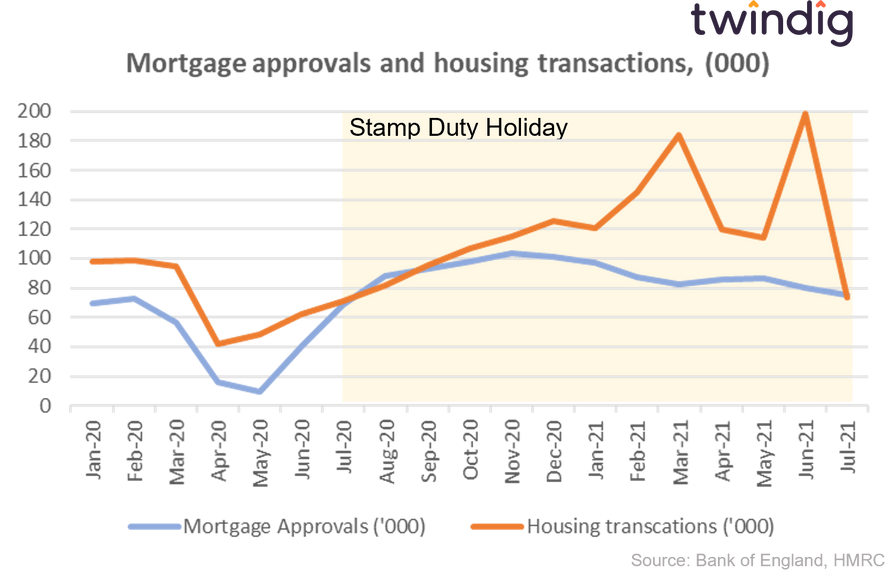

If we zoom into the period of the pandemic we see that housing market activity fell in March and April, but by May (two months before the start of the stamp duty holiday) housing transactions had already started to recover.

Furthermore, mortgage approvals in July 2020 were back to their pre-pandemic levels, which begs the question was the Stamp Duty Holiday needed?

Two points leap out from the graph points are clear from mortgage approvals ‘peaked’ in November and cash buyers made hay whilst stamp duty was on holiday.

Mortgage approvals peaked in November

This makes sense given the natural lag between a mortgage being approved and a housing transaction completed. Those looking to complete before 31 March 2021 will have needed a mortgage in place before the end of December 2020. The extension of the Stamp Duty holiday from March to September appears to have had little or no impact on the number of mortgages approved.

Cash buyers making hay

The long-running relationship between mortgage approvals and housing transactions broke down as we approached the initial stamp duty holiday deadline, the break started in January 2021 and reached extremes in March (the initial deadline) and June (the £500,000 Stamp Duty threshold extended deadline).

In these two months, the number of housing transactions was more than double the number of mortgages approved. We find it noteworthy that in a time when tax revenues were declining and many households were suffering under financial stress, those with the most money were able to take the biggest advantage of the stamp duty holiday and the tax savings. In July 2021 the cash buyers appeared to have disappeared and housing transactions were inline with mortgage approvals.

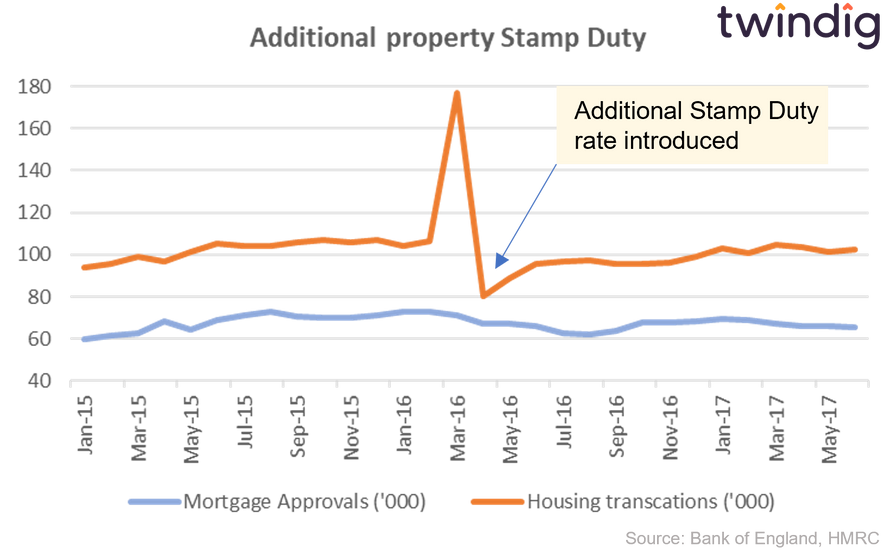

This was perhaps an unintended consequence of the stamp duty holiday, but one we have seen before…

In March 2016, an additional stamp duty charge was introduced for those buying additional properties, whereby 3% was added to the Stamp Duty rate if the home being purchased was not a person’s primary residence. This lead to a rush of activity as those that could afford a second home looked to complete their purchase before the rise in Stamp Duty tax.

If we had known the Stamp Duty holiday was to a large extent a tax break for the cash-rich would we have thought it was still the right policy? Should we have used the money to help those financially stretched by the pandemic, rather than those with a financial surplus?