7 reflections on the Petitions Committee Stamp Duty Debate

Whilst the Government chose not to use the debate as an opportunity to either extend or end the Stamp Duty Holiday, Jesse Norman did appear to adopt fictional radio talkshow host Fraser Crane's opening catchphrase as his sign off. Although he didn’t quite say ‘good afternoon United Kingdom, I’m listening’ he did say the ‘Government will continue to listen carefully’.

1. Buying and selling a home is stressful

It is clear that buying a home, selling a home and perhaps attempting both at the same time is a frustrating and stressful process at the best of times and only made worse when trying to complete before the looming end of the Stamp Duty Holiday.

2. Homes are unaffordable

Several MPs were quite impassioned as they spoke about constituents who would not be able to afford their home or complete their purchase if they missed the stamp duty holiday deadline.

3. House prices have risen more than the Stamp Duty savings

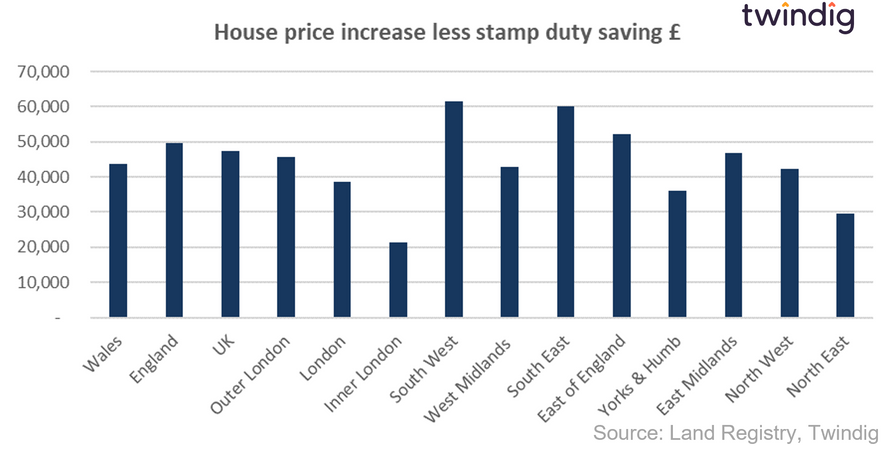

None of the MPs reflected on the simple fact that house prices across all regions have increased by significantly more than the potential stamp duty savings since the Stamp Duty Holiday was announced. The Stamp Duty Holiday has made homes more unaffordable rather than helped those most in need to get a foot on the housing ladder. The main beneficiaries are those who have been able to sell their homes at price assisted by the Stamp Duty Holiday.

Based on our analysis of the Government’s data, average house prices as reported by the Land Registry have risen by £14,692 since the start of the Stamp Duty Holiday to £249,600, just under a quarter of a million pounds and the Stamp Duty holiday saving is £2,493. The homebuyer is, therefore, worse off to the tune of £12,199 and the home-seller better off by almost £15,000.

4. Thousands of transactions may collapse

MPs suggested that thousands of housing transactions which may collapse should stamp duty become payable. This certainly sounds alarm bells if a swing of 1% of the house price (£2,493 Stamp Duty) on a house costing £249,600 would make the purchase unviable then perhaps some buyers are overstretching themselves.

5. No one suggested renegotiating house prices

It was interesting that none of the MPs saw a potential solution to all those caught between the rock and the cliff edge did not suggest that buyer and seller seek to renegotiate the price. The sellers on average have seen house prices rise by almost £15,000 since the start of the Stamp Duty Holiday (just over £2,000/month). Even if the seller took the full £2,493 (less than 17% of their gains) on the chin they would still have gained more than £12,000.

6. Stamp Duty Land Tax needs reforming

There was broad support from all parties that the structure of the current Stamp Duty Land Tax system should be reformed and whilst reformation was not the subject of the debate it was one thing that everybody seemed able to agree on.

7. The Government, like Fraser Crane, is listening

As the debate drew to a close Jesse Norman stepped up to speak on behalf of the UK Government. The Government responded that the temporary Stamp Duty holiday had stimulated the UK housing market as intended. Jesse Norman also reflected that Scotland and Wales have both decided not to extend the stamp duty holiday. He commented that he could not comment on taxation policy outside of a fiscal event, but that the Government was listening to the voices and concerns of the interested parties, after which in true Fraser Crane style, he left the building.