Three graphs explaining why stamp duty cuts do not work

There is still an awful lot of chatter about stamp duty cuts in the press today, but if the UK Government is planning to use them to ‘Get Britain Moving’, I do not think it will work. In this short article, we look at three graphs (two stamp duty holidays and one stamp duty increase) which suggest that there is little correlation between the level of stamp duty and the level of housing transactions

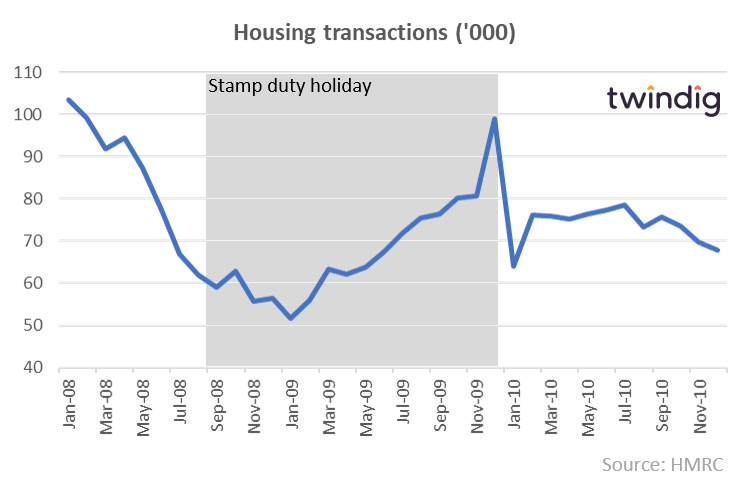

Stamp Duty Cut 1: 3 Sep 2008 – 31 Dec 09

Housing transactions trended downwards rather than upwards between September 2008 and January 2008 and only reached their pre-holiday levels in March 2009. The spike at the end of the holiday and subsequent dip suggests that rather than stimulate more housing transactions it merely gave an incentive for those already considering moving to move a month earlier. Once the holiday was over housing transactions fell back

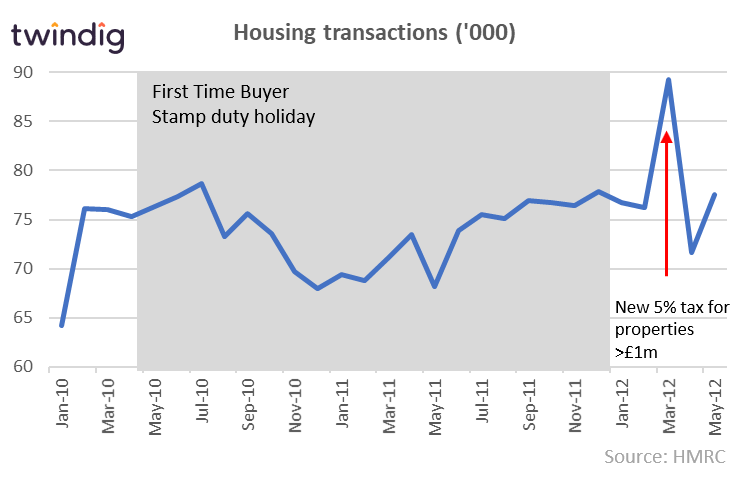

First Time Buyer Stamp Duty Cut 2: 25 Mar 2010 –1 Jan 12

Difficult to see how a stamp duty cut stimulated housing transactions, as transactions were below their pre-holidays levels for much of the holiday itself and the spike in transactions came after the holiday. However, rather than a spike in first-time buyer activity, this was more likely to be cash buyers rushing to beat the increase in Stamp Duty effective from April 2012.

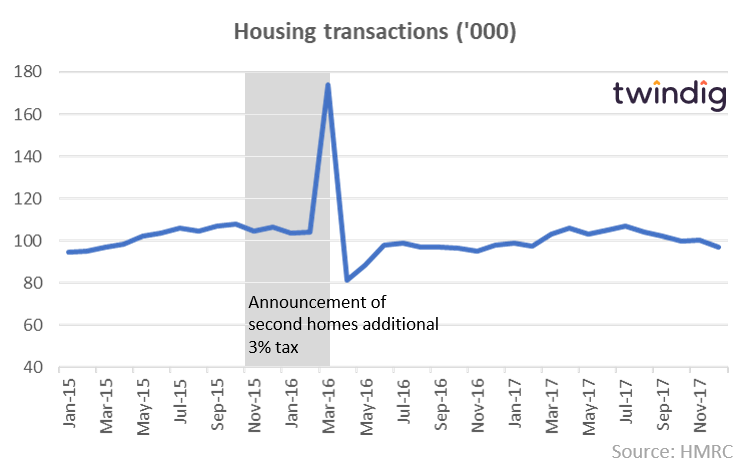

Stamp Duty Increase: Announced Nov 15 effective April 16

The Autumn Statement in November 2015 announced that from April 2016 any home purchase that was not to be the buyer’s primary residence would pay an additional 3% Stamp Duty. This increase, therefore, fell on second homes and buy to let properties. Once again we see a big spike in activity the month before the Stamp Duty change takes place, but in this case, it is difficult to argue that this increase in Stamp Duty had a noticeable impact on the underlying level of housing transactions.

Conclusion

The empirical evidence from Stamp Duty cuts (and increases) does not support the view that cutting stamp duty stimulates the UK housing market and or that raising it weakens it.