Housing transactions rise whilst Government spending falls

Housing transactions rose again in October as the housing market continues to have the wind in its sails, which is just as well as the this week's Spending Review was rather moribund. Deficits and unemployment will rise for some time, but that should mean interest rates remain lower for longer - calm seas for mortgage holders.

HMRC Housing transactions

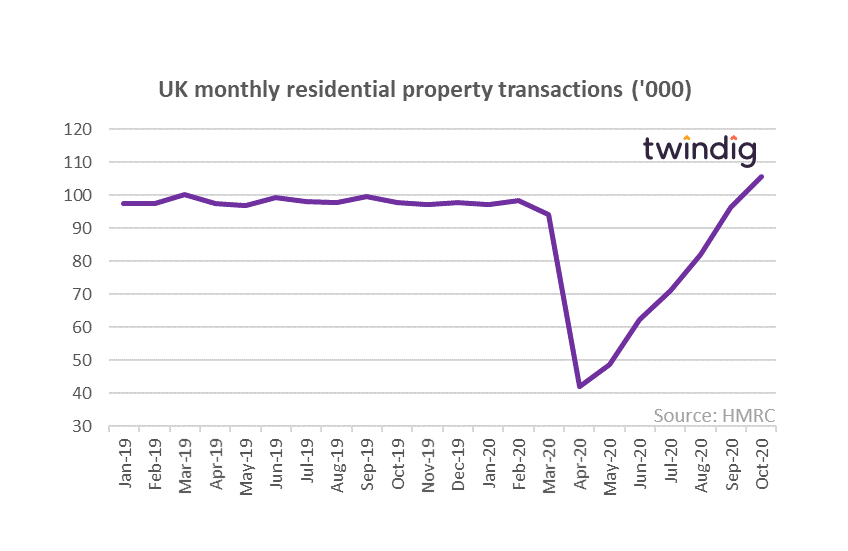

The HMRC reported provisional data on housing transactions for October 2020

What they said

Housing transactions in October 2020 105,630

This is up 9.8% compared to September 2020

This is up 8.1% compared to October 2019

Twindig take

It is good news that residential housing transactions increased in October 2020. The recovery in housing transactions continues to look v-shaped. We estimate that so far this year COVID-19 has led to around 200,000 fewer housing transactions and we do not expect these 'lost' transactions to be made up in the remainder of 2020.

It remains to be seen how much impact the stamp duty holiday is having on transaction levels, we do not know whether the recovery would have happened without it. The evidence from the house price indices suggests that much of the benefit of the stamp duty holiday has been eaten up by house prices rises. The holiday has therefore benefitted sellers more than buyers. Without the stamp duty holiday house price inflation may have been weaker (house prices lower) and we may have seen higher transaction volumes without the stamp duty holiday.

UK Government Spending Review 2020

What they said:

The OBR forecast the economy will contract this year by 11.3%, the largest fall in output for more than 300 years.

Underlying debt – after removing the temporary effect of the Bank of England’s asset purchases – is forecast to be 91.9% of GDP this year.

The OBR expects unemployment to rise to a peak in the second quarter of next year, of 7.5% - 2.6 million people.

National homebuilding fund £7.1bn to unlock up to 860,000 homes

Reconfirmation of £12.2bn for the Affordable Homes Programme (AHP) £67,777 per home

Twindig Take

The Sending Review did not make for pleasant reading and the OBR report it quoted was also somewhat sombre. It reminded us of the hangover which followed the credit crunch, but without the party beforehand. However, although we have a long and winding path to economic recovery, the direction of travel is positive even if it travels along a rather bumpy and twisty route.

There are some silver linings for the housing market amongst the grey clouds, the £7.1bn national homebuilding fund is helpful, although it works out at £8,256 per home against the average build and land cost of around £200,000.

The reconfirmation of the £12.2bn Affordable Homes Programme (AHP) is also helpful and works out at a supportive £67,777 per home.

The budget deficit also raised a few eyebrows: due to elevated borrowing levels underlying debt is forecast to continue rising in every year, reaching 97.5% of GDP in 2025-26. However, on the flip side it suggests that Bank Rate will not be increasing significantly for the foreseeable future, which is good news for borrowers (but less so for savers..).

Twindig AorB - The House Price Game

If you haven't had a chance to play Twindig AorB, you really should..

Twindig AorB

The House Price Game

Climb the property ladder by choosing, which of two properties (A or B) is the most expensive

Sounds easy doesn’t it, give it a try….