Rightmove: tails they win, heads they win

Rightmove announced its FY2021 results this morning

What they said

Revenue up 48% to £304.9m

Underlying operating profit up 67% to £231.0m

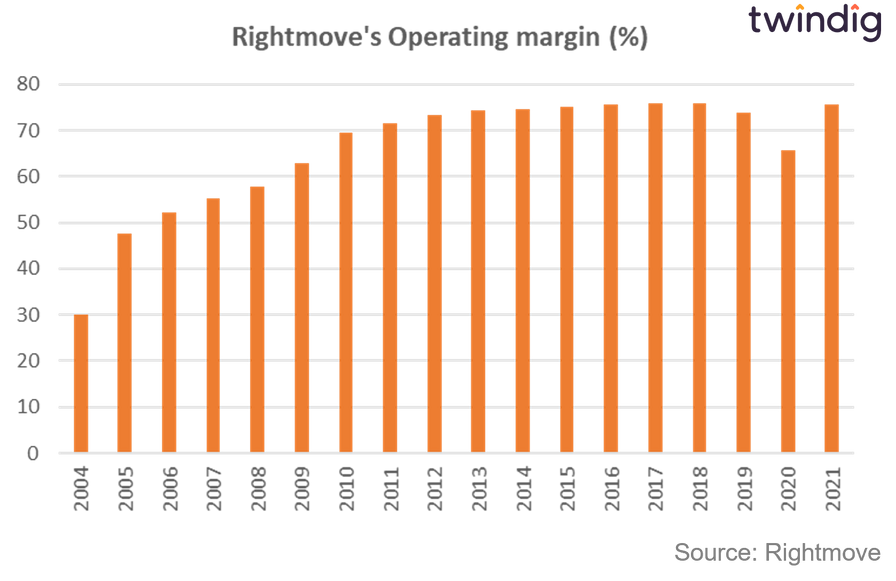

Underlying operating margin 75.7%

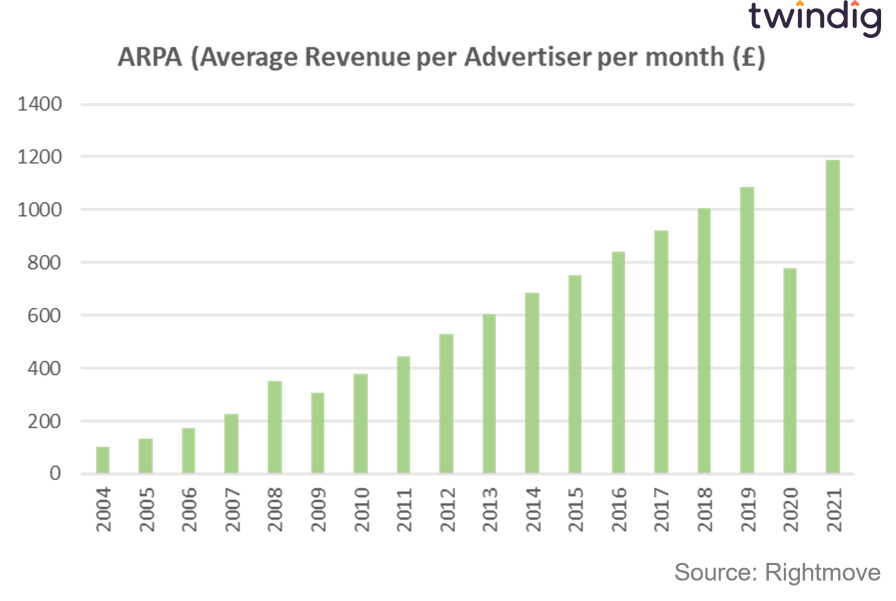

ARPA up £411 to £1,189

Twindig take

What a difference a year makes

Rightmove has delivered a record set of results in 2021 with ARPA at a new high and operating margins once again above 75%, meaning that 75p out of every pound of revenue is pure profit. Our obsession with property remains and Rightmove remains keen to capitalise on our nation's legal addiction.

However, there was a moment, and it turns out to have been just a moment, when estate agents had finally had enough of Rightmove. In their moment of need, as the pandemic struck, it seemed that Rightmove's time might just be up. As the housing market was closed it did not immediately step in to lend a hand and that dithering looked, for a moment, like it might have been the wrong move for Rightmove.

But, the pandemic only fuelled our property addiction. As lockdowns, led us to spend more time at home, we also spent more time looking at homes. Rightmove was there to help us scratch our property itch and where there are property eyeballs to be seen estate agents will be found.

Rightmove may have had a wobble, but what did not kill it has only made it stronger.

A great business

Rightmove's business model remains the best we have ever seen. It has profit margins that defy gravity, it has seen challengers come, go and co-exist, and even if they do stay, none has yet caused Rightmove any concern. It took a hit during the pandemic, but its wounds healed quickly, the attempted coup did not work and as Nietzsche said 'What doesn't kill you, makes you stronger'.

Making money out of houses without touching them

Rightmove doesn't buy houses, it doesn't sell houses, it doesn't even generate the content that renters, homebuyers and homeowners clamour to see, but it makes more money than any estate agent ever has.

Digital consultant or property drug dealer?

Whereas a consultant charges you for telling you the time after borrowing your watch, Rightmove collects the content from estate agents that drives its traffic and then charges them to put their content on the portal.

Rightmove call it the virtuous circle of the network effect, but estate agents call it daylight robbery, but they appear as addicted to Rightmove as those of us who spend hours scrolling through its content. The content is free to the general public, but we are hooked, for many of us property is a drug, and many of us might even pay for it?

Would we even notice just one more tiny little monthly subscription to add to those of our phones, Netflix, sky sports, disney+, AppleTV? A few pounds for us would mean millions of extra profits for Rightmove.

Daylight robbery, a victimless crime or just economics?

Some agents complain about the cost, but pretty much every agent keeps on paying. The main frustration is that Rightmove was founded by the estate agents, and all sold their stake during the credit crunch, the shares have risen by around 30x since then.. ouch.

The challengers come and promise the estate agents that they will keep Rightmove's escalating fees in check, the data suggests that they don't (see the ARPA graph below), but the hope that they will has kept several in business. The rhetoric is rarely long-lived and most appear to settle for being junior partners in a cosy oligopoly with Rightmove taking lions' share of the pie and the rest fighting over the crumbs.

Operating margins back to normal, after a dip last year as the pandemic struck, Rightmove's margins returned to 75.7% (more than 75p of every pound of revenue is profit)..

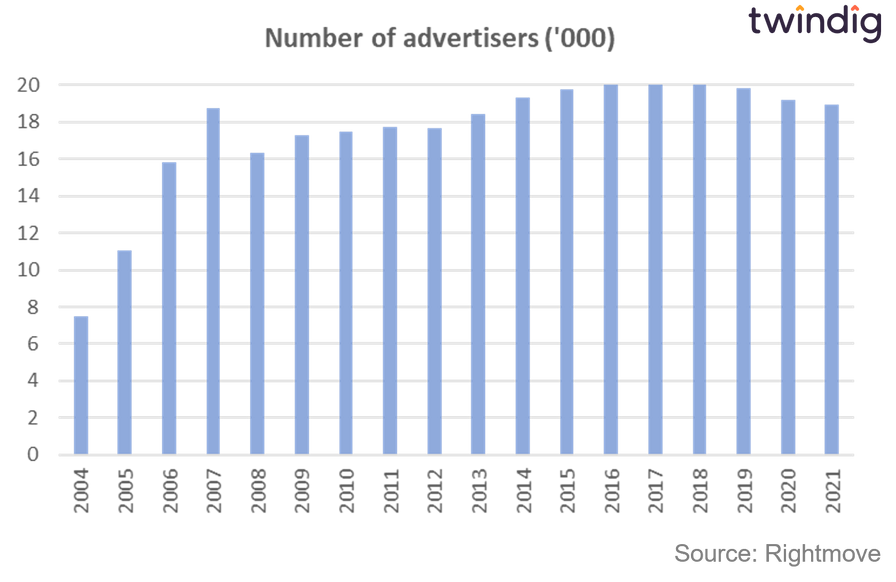

Advertiser numbers have fallen slightly, but this is more a factor a reduction in the number of new build developments. Housebuilders have seen new homes selling like hot cakes and so have reduced their advertising spend. Meanwhile, the number of estate agency branch customers actually grew in the year.

Will Boomin finally burst Rightmove's bubble?

The latest challenger is Boomin, the brainchild of the brother's Bruce of Purplebricks fame. They certainly caused a stir in the estate agency market with their promise of disrupting the market and slashing fees for one and all.

Purplebricks shares hit a high of almost 500p in July 2017 and now stand at around 18p, 27x lower than their peak. The Bruce Brothers will be hoping their challenge to the portal market has a bigger bark and bite than that of Purplebricks.

Boomin is free for estate agents until 31 March 2022. Founding agents have had a year to assess the merits and value of Boomin. If the formula is judged to be a winning one expect a raft of press releases from Boomin talking about how many agents have become paying customers after the trial, how many leads have been generated and how much business has been won.

However, if conversions for Boomin are not matched by defectors from Rightmove, rather than disrupting the portal market have they just created another mouth to feed, another drug for estate agents and the homebuying public to get a taste for?

Win or lose Rightmove wins

If agents support Boomin there is little evidence so far that their support is coming at a cost to Rightmove as ARPA, estate agency branch numbers, and profits are growingincreasing. If Boomin bubble bursts, Boomin will join the long list of those who have come and gone.

Can you defy the laws of Economics?

We appreciate that there are no laws of economics, but economic theory suggests that supernormal profits get competed away. It is remarkable to see that even in a bad year, in the midst of a global pandemic operating margin only slipped from 73.8% to 65.7% and yet rises to 75.7% the following year, a year still impacted by COVID.

Can these profits get competed away? We still think they will, at these levels they will always remain a target for some, however, Rightmove's resilience is astounding, but never say never. One day, maybe not today and maybe not tomorrow, but one day a David will emerge to slay Rightmove's Goliath.