When rising house prices is bad

In this week's episode Daniel and I look at mortgage rates and the first-time buyer prisoner's dilemma, and if rising house prices can be a bad thing?

The best way to watch the podcast is on youtube, but if you are using a player such as Spotify we include the key charts we refer to in the video below:

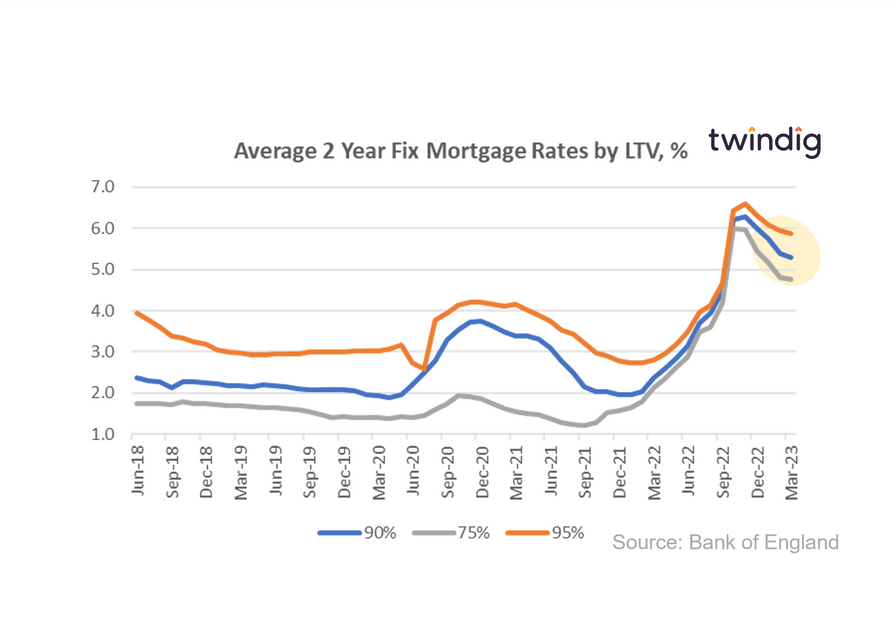

Mortgage rates falling

Mortgage rates continue to fall as the financial markets become more stable and mortgage lenders apply lower risk premiums to their mortgage lending. This will be welcome news to those homeowners looking to remortgage and to those looking to move or buy a home.

Average mortgage rate for 75% LTV 2-year fixed rates mortgages 4.76% (down 6bp)

Average mortgage rate for 90% LTV 2-year fixed rates mortgages 5.30% (down 8bp)

Average mortgage rate for 95% LTV 2-year fixed rates mortgages 5.87% (down 8bp)

Can rising house prices be bad?

We were asked why the podcast often says that rising house prices is a good thing. At one level this question shows the divide between the haves and the have-nots, but on a deeper level it raises the question of accelerating housing wealth inequality.

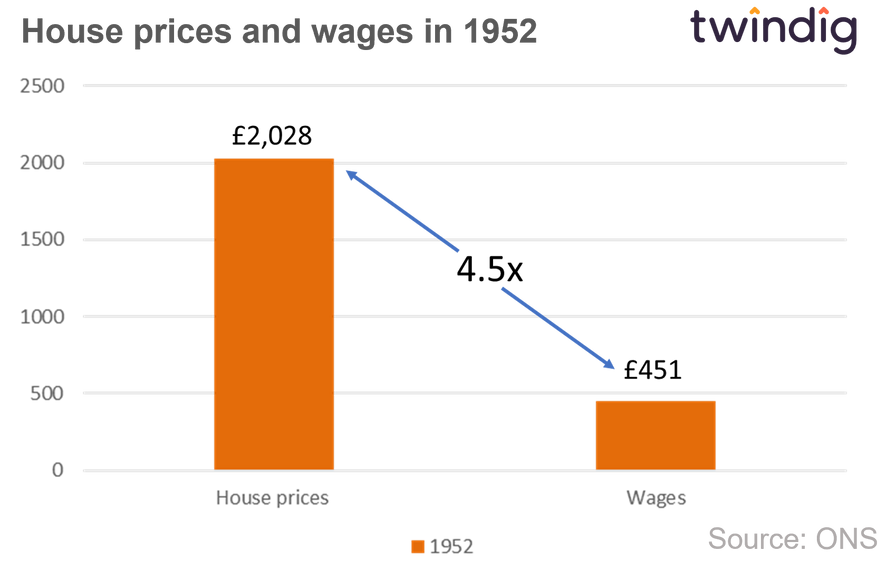

House prices and wages

In 1952 the average house prices was just over £2,000 and average wages were around £450. The house price-earnings ratio was 4.5x

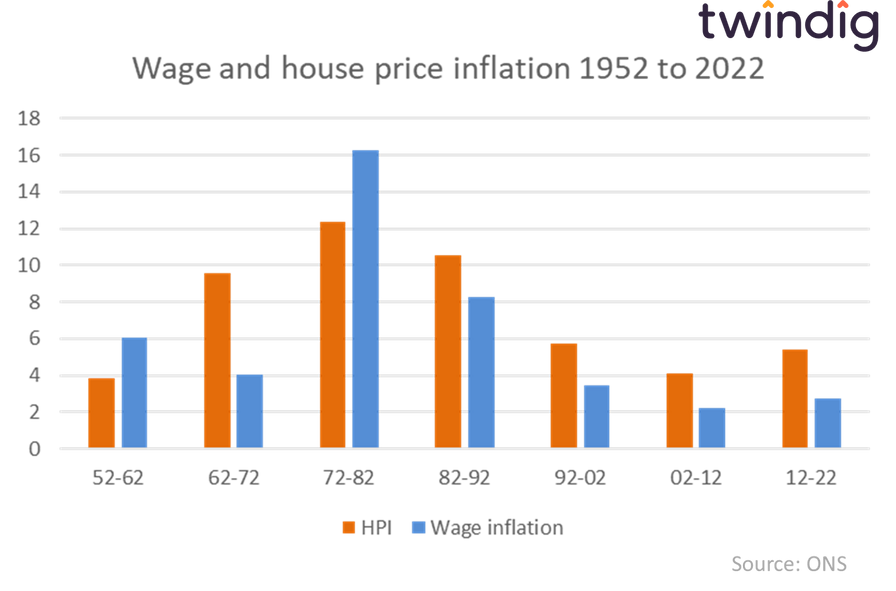

House price inflation

THe chart below shows house price and wage inflation in each ten-year period from 1952 to 2022. House price inflation tends to be greater than wage inflation

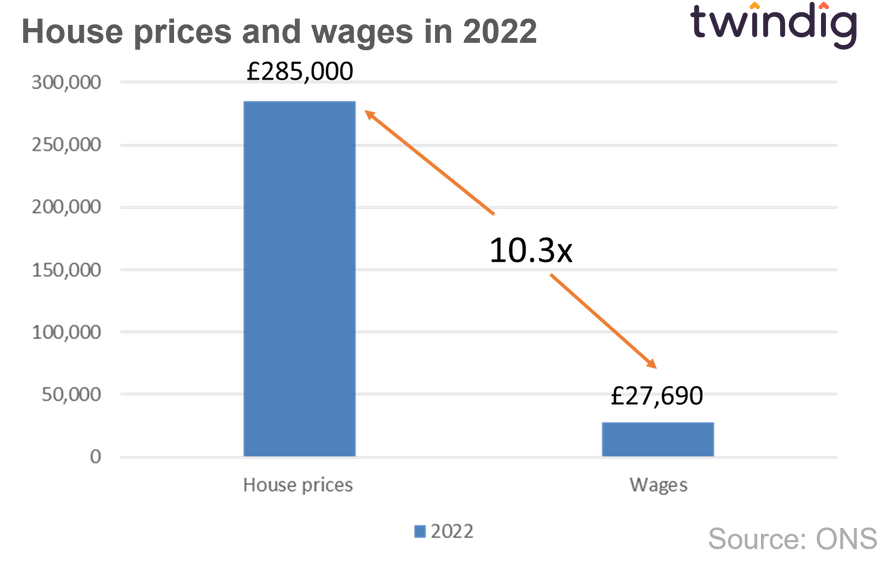

House price-earnings ratio today

The combination of rising wages, credit expansion and inherited property wealth has significantly increased the ratio of house prices to earnings, making it increasingly difficult for aspiring first time buyers to get a foot on the housing ladder.