A property logbook could save you £15,000

Picture Credit: Rachel Price

Why a property logbook could save you £15,000

If you are selling a home and you miss the Stamp Duty Holiday deadline, your buyer will be facing a Stamp Duty Bill which could increase by up to £15,000.

If contracts have not been exchanged before the deadline, they may seek to pull out of the transaction altogether or request that you reduce the asking price by the amount of additional Stamp Duty they have to pay, which could cost you up to £15,000.

If you have a property logbook, you are more likely to complete before the end of the Stap Duty Holiday and save you up to £15,000.

How a property logbook saves you £15,000

A property logbook puts all the documents you need to sell your home in one place. It is a secure digital location where everyone who needs access to these crucial documents (such as solicitors, mortgage brokers, conveyancers, estate agents) can access them at a touch of a button or click of a mouse. This saves time and time certainly means money – potentially £15,000 of stamp duty tax savings. A property logbook saves you time which will save you money.

Why is the Stamp Duty Holiday deadline such an issue?

There are just not enough solicitors and conveyancers to complete all the housing transactions currently in progress and estate agents are run off their feet so they are not able to manage the chains as effectively as they are in quieter times.

Following the announcement of the COVID Stamp Duty Holiday the UK housing market has seen higher levels of activity that at any time since the credit crunch. There are not enough hours or people on the ground (in the office or working from home) to get all the work done.

Enter stage left the property logbook. If you have a complete property logbook, it is much easier for your solicitor, conveyancer, estate agent and mortgage broker to get all the work they need to get done before the end of the Stamp Duty Holiday.

Will the Stamp Duty Holiday be extended?

It might be, but we think that is unlikely. House prices and housing transactions were going up before the Stamp Duty Holiday began and both have been accelerating ever since. Therefore, the amount of Stamp Duty Tax the Government is giving away is also going up, whilst, at the same time, overall tax revenues are falling. At the moment, the Government needs to raises taxes, not lower them to balance the books.

What do I need to include in my property logbook?

When selling your home you will need to get all of the following documents into your property logbook.

Proof of Identity

You know the drill to check you are who you say you are, part of the ‘Know Your Client’ legal obligations for mortgage lenders and solicitors

Property Title Deeds

You will need to show that you are the owner of the home you are attempting to sell. You’d be surprised, but it happens, some people try to sell a home they don’t own

TA6 Property Information Form

The TA6 includes a lot of important information such as where the boundaries to your property are, details any guarantees you may have (roof, windows etc), planning permission and building control sign off for any major alterations you have made to the property. Twindig has online TA6 Property Information forms already ready for you to complete

Documents relating to the TA6 form

You will need to copies of all the documents referred to in the TA6 Property Information Form. Once again, Twindig can help we have a secure online vault where you can safely upload and store digital copies of all these important documents.

TA7 Leasehold Information Form

If your property is leasehold rather than freehold, you will also need to complete the TA7 Leasehold Information Form. The TA7 includes information about the lease. Information such as how the lease is managed, the maintenance and service charges, how the building is managed, the procedure by which you can make complaints, how or if alterations can be made to the building.

LPE1 form – Freeholder / Managing Agent

With a leasehold property, you will also have to ask the freeholder or managing agent to complete an LPE1 form (Leasehold Property Enquiries form).

TA10 Fittings and Contents form

The TA10 this form clearly explains what is and what is not included in the sale of your home on a room by room basis i.e are you leaving the fridge, the curtains, the pool table in the games room..? TO make it easier for you Twindig has the TA10 Fittings and Contents form for you online making it easy to complete and very quick and easy to share .

Energy Performance Certificate (EPC)

You will also have to have an up to date EPC, these are valid for up to 10 years.

Documents to help you sell

You may also consider putting in your property logbook the following documents which you can show prospective buyers, the more information you provide the quicker they will be able to make their buying decision. More information is also likely, in our view, to increase their ability to see themselves living there. There is a mixture of the mundane and the exciting

Where the stopcock is

What day is bin day

Where are the best pubs, restaurants and café’s nearby

How much your utility bills and council tax are

Where can I buy a property logbook?

The good news is that Twindig provides you with a free property logbook. We have set up the TA forms for you and a secure place to store all the documents you need to store.

We call our property logbooks a Twindig, which means ‘digital twin’. A Twindig is a digital twin or digital representation of your home.

How do I get my free Twindig property logbook?

Simply visit twindig.com, register your property and start uploading documents to your Twindig and completing your TA forms.

The truth about Stamp Duty

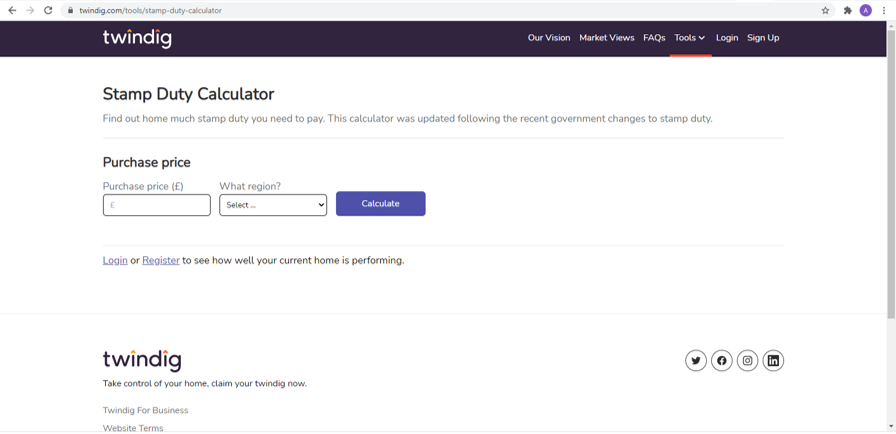

With the Stamp Duty holiday race well and truly on, you can use the Twindig Stamp Duty Calculator to calculate how much stamp duty you will need to pay on your house purchase.

If property logbooks are such a good idea why are they not mandatory?

That is a very good question. The simple answer is that we believe in the carrot, not the stick and the benefits of property logbooks are clear. Property logbooks pave the way for quicker housing transactions.

With clear information readily available a completed property logbook means there is less risk of misunderstanding between buyer and seller and it is easier for solicitors, conveyancers, mortgage brokers, mortgage lenders and estate agents to complete the work they need to do to get you moving.

You may also be comforted to know that the Ministry for Housing Communities and Local Government (MHCLG) supports the property logbook initiative and is working with Residential Logbook Association (RLBA) to get Britain moving.