Mortgage rates leap in July as Bank rate jumps

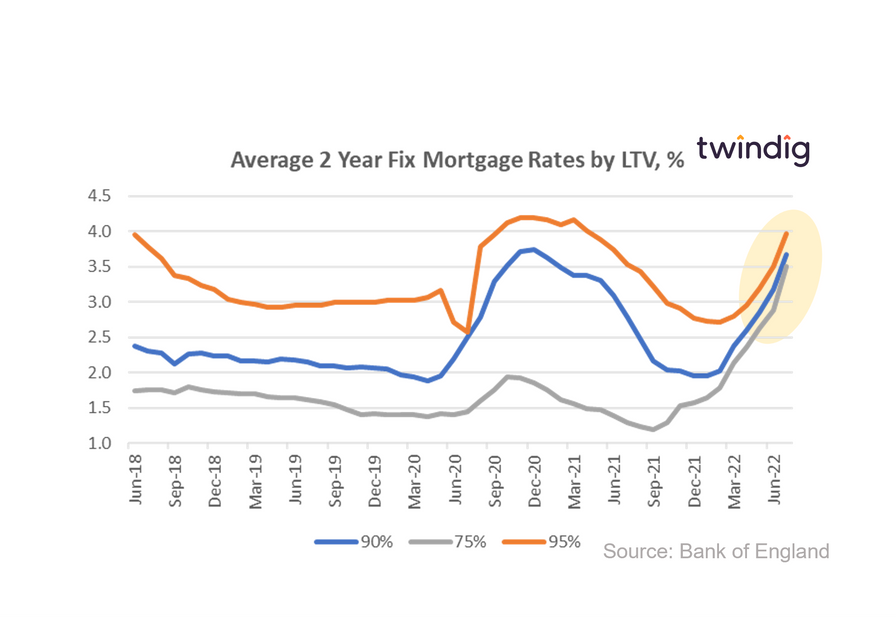

The Bank of England released average mortgage rates by Loan to Value (LTV) today

What they said

Average mortgage rate for 75% LTV 2-year fixed rates mortgages 3.51%

Average mortgage rate for 90% LTV 2-year fixed rates mortgages 3.67%

Average mortgage rate for 95% LTV 2-year fixed rates mortgages 3.97%

Twindig take

July saw the biggest leap in mortgage rates for 2-year fixed rate 75% LTV mortgage we have seen increasing by 63 basis points (more than yesterday's Bank Rate rise) or 21.9% to 3.51%.

Since November 2021 Bank Rate has increased by 165 basis points, whereas the average rate for 2-year fixed rate 7%% LTV mortgages has increased by 198 basis points, more than doubling from 1.53% in November 2021 to 3.51% in July 2022.

To put that in context the monthly cost of borrowing £100,000 on a 25-year repayment mortgage has increased from £401 in November 2021 to £498 in July 2022 a rise of £97 per month (up 24%). It is no surprise therefore that some of the heat has been taken out of the housing market and that mortgage approvals have fallen for the last five months in a row.

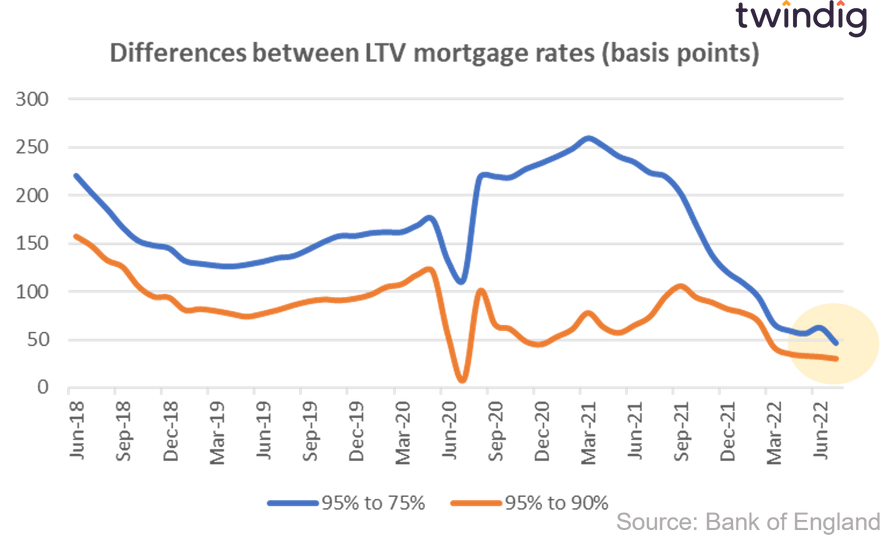

What surprises us most is how the spreads (the differences between the mortgage rates of the various mortgage products) have narrowed. The rule of thumb is the higher the Loan to Value (LTV) the higher the risk (If house prices fall 6% and you have a 95% LTV mortgage the lender has a problem, but a 6% fall is less of a concern to them with a 75% LTV mortgage). In July the gap in mortgage rates between a 2-year fixed rate 75% LTV and a 2-year fixed rate 95% LTV mortgage was 46 basis points compared to 260 basis points in March 2021. This suggests that lenders are viewing lending as riskier today than they did in March 2021 perhaps lenders thank that the housing market is on the turn...

To see how mortgage rate changes will impact your monthly mortgage payments you can use our mortgage calculator below