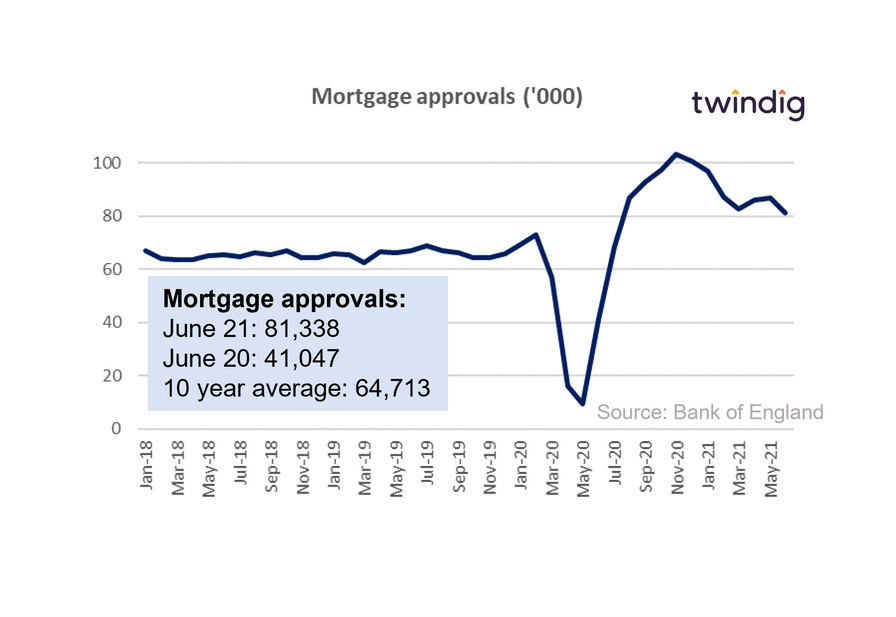

Mortgage approvals doubling up in June 21

The Bank of England released its mortgage approval data this morning for June 2021

What they said

Mortgage approvals in June 2021 81,338

This is 98% higher than in June 2020 (41,047)

This is 26% higher than the 10 year average of 64,713

Twindig take

Mortgage approvals in June 21 were 81,338 almost double their level a year ago (41,047), but were 6.5% lower than May 21 as we headed towards the first of two Stamp Duty Holiday cliffs. As of 1 July 2021 the Stamp Duty Holiday only applies to homes costing up to £250,000 rather than £500,000.

However, the new stamp duty holiday threshold of £250,000 is still higher than the average UK house price. Yesterday the Nationwide reported that average UK house prices were £244,229, so plenty of house purchases will still benefit from the stamp duty holiday.

Mortgage approvals in June were 26% above their 10-year average and we expect them to remain above average until the stamp duty holiday comes to an end on 30 September this year.

Aside from the stamp duty we also note that the latest Bank of England Credit Conditions survey reported that lenders expect to increase mortgage supply and reduce mortgage rates over the coming months which will also underpin approvals, in our view.

The main constraint for mortgage approvals is likely to be a shortage of homes for sale, with limited amounts of stock on the market we may see a further tempering of mortgage approvals.