Mortgage approvals leap in August

The Bank of England released mortgage approval data for August this morning

What the Bank of England said

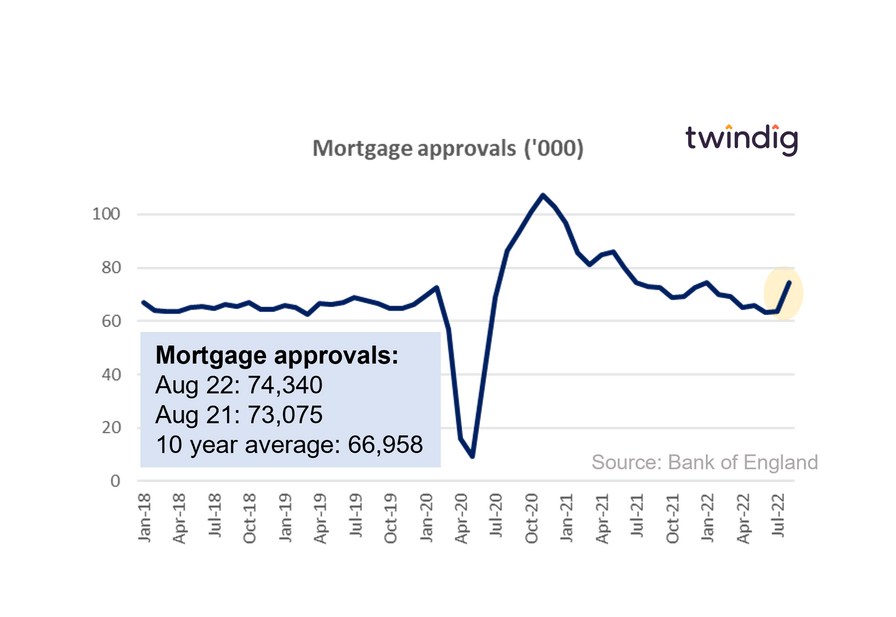

Mortgage approvals for August 2022 were 74,340

This was 16.6% higher than the 63,740 mortgages approved in July 2022

This was 1.7% higher than the 74,340 mortgages approved during August 2021

Twindig take

The leap in mortgage approvals in August was a welcome surprise, after a barrage of bad news following last week's mini-budget, some good news was needed.

In our view, mortgage approvals are the most important lead indicator for the UK housing market. A mortgage approved today typically leads to a housing transaction in the future. However, the world has changed since those mortgages were approved in August and time will tell how many homebuyers were able to complete their transactions and how many had their mortgage offers pulled in the light of the current interest rate uncertainty.

Despite what others may tell you the war in Ukraine is not the cause of the current upheaval in the housing market. So far it has been the mini-budget rather than the cost of living crisis that has been the game changer.

Whilst it has been difficult to keep up with events following last Friday's mini-budget, it is clear that the mini-budget will have a huge impact on the mortgage market, and therefore, also the housing market.

The mini-budget seems to have put the UK Government at odds with the Bank of England, the former trying to increase demand for goods and services and the latter trying to decrease it in order to curb inflation.

To say that the mini-budget was not well received is somewhat of an understatement, and the fact that the International Monetary Fund (IMF) felt the need to voice its concerns speaks volumes. A policy u-turn may be on the way, but if political egos keep the mini-budget unchanged we can expect big increases in interest and mortgage rates in the coming months.

Nine of the UK's biggest mortgage lenders have now taken some mortgage deals off the shelves or increased the prices (mortgage rates) attached to certain mortgage products. Several lenders including HSBC and Santander have suspended new mortgage deals and the Nationwide increased its two-year fixed rate mortgage rate to 5.59%, up from 2.54% three months ago

Worried about your mortgage payments?

In these challenging times, increasing numbers of homeowners are worried about how they will be able to afford their mortgage as interest rates rise. You can use our mortgage calculator to see how a change in mortgage rates might impact you

We have also put a guide together looking at ways you can reduce your monthly mortgage payments