Mortgage approvals remain heightened, although not as high as they were

The Bank of England released its mortgage approval data for August this morning

What they said

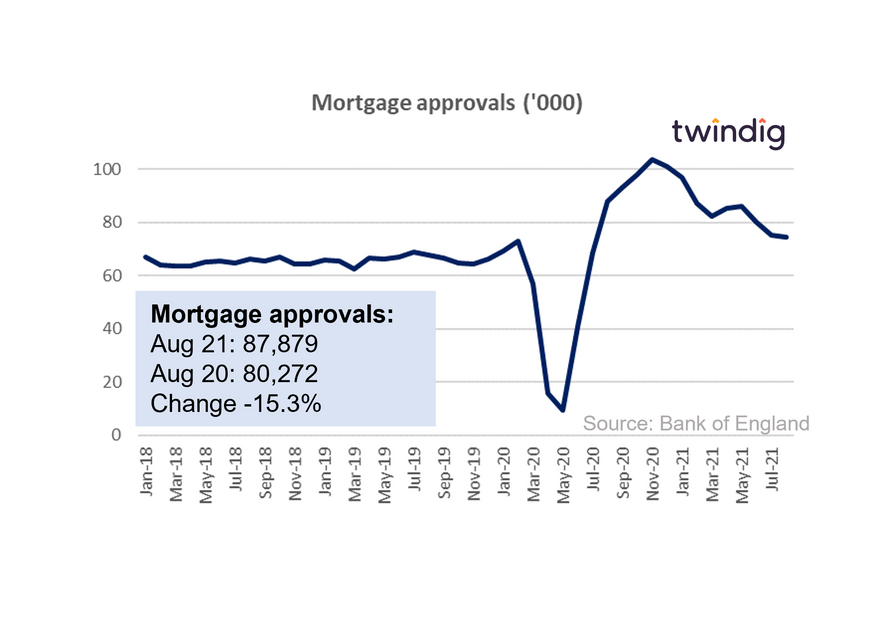

Mortgage approvals in August 2021 were 74,453

This is 15.3% or 13,426 lower than in August 2020

0.9% or 673 lower than July 2021

Twindig take

Mortgage approvals fall again, is this a taste of what is to come? Although the Stamp Duty holiday still has one more month to run, the Bank of England mortgage approvals were 0.9% or 673 lower in August 2021 than in July 2021, and 15.3% or 13,426 lower than they were in August 2020.

In our view, mortgage approvals are the most important lead indicator for the UK housing market. A mortgage approved today typically leads to a housing transaction in three months time.

In August last year, the Stamp Duty holiday was just getting into its stride, in August this year, the Stamp Duty holiday was starting to wind down.

Without the stimulus of the stamp duty holiday will housing market activity fall? We assess that housing market activity will fall in the short term because many will have pulled their purchases forward to benefit from the stamp duty holiday. However, after a short lull, we expect housing market activity to return to more normal levels.

The five-year and ten-year averages for mortgage approvals are 68,600 and 65,100 respectively, suggesting that August's 74,453 is between 8% and 14% above normal levels.

At the moment, therefore, activity in the housing market activity remains heightened, albeit not as high as when the Stamp Duty holiday was in full swing.