Mini-budget, big stamp duty cuts

Major Stamp Duty Cuts

The UK Chancellor of the Exchequer, Kwasi Kwarteng made significant cuts to stamp duty as part of his mini-budget this morning.

Why did the Chancellor cut stamp duty?

The Chancellor cut stamp duty as part of his mini-budget because he believes that:

"homeownership is the most common route for people to own an asset, giving them a stake in the success of our economy and society."

Therefore

"to support growth, increase confidence, and help families aspiring to own their own home, I can announce that we are cutting stamp duty."

By how much was stamp duty cut?

The amount of stamp duty cut depends on whether you are a first-time buyer, buying your primary residence or buying an additional property

First-Time Buyer stamp duty cuts

As of today, First-time buyers will only start paying stamp duty on homes costing more than £425,000 up from £300,000 an increase of £125,000.

This equates to a potential saving of up to £6,250

Enhanced First Time Buyer Stamp Duty Relief

The Chancellor also increased the number of homes that qualify for first-time buyer relief. Relief is now available on homes costing up to £625,000 up from £500,000.

If a first-time buyer buys a home costing more than £625,000 they will not be eligible for the first-buyer stamp duty relief and will pay the same amount of stamp duty as a homemover

Primary residence stamp duty cuts

From today (23 September 2022) Stamp Duty is only payable on homes costing more than £250,000, a doubling of the tax-free amount from £125,000

This cut equates to a stamp duty saving of up to £2,500

Additional properties stamp duty cuts

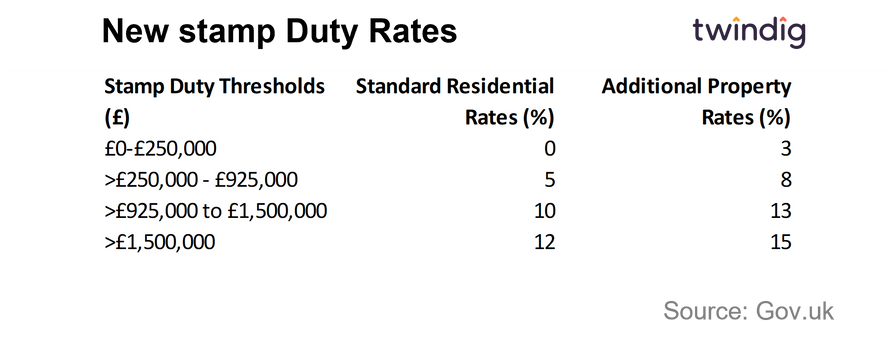

There were no changes to the way the purchase of additional properties (homes other than your primary residence) are taxed. The tax thresholds will follow those of a primary residence, but the tax rate will be three percentage points higher

How much Stamp Duty will I Pay?

To find out how much stamp duty you will pay if completing your purchase after 23 September 2022 you can use the Twindig Stamp Duty Calculator by clicking on the button below

The New Stamp Duty Tax Rates and Thresholds

We show in the table below the new stamp duty tax rates and thresholds announced today in the mini-budget

For more details on today's stamp duty cut announcement you can look at the Stamp Duty Fact Sheet below: