Are you a typical landlord?

Are you a typical landlord?

Twindig has delved into the data from the latest English Private Landlord Survey to see what the typical landlord looks like, how many properties they own and how much their rental properties are worth. So are you a property Paul or a Loretta landlord?

How many properties does the typical landlord own?

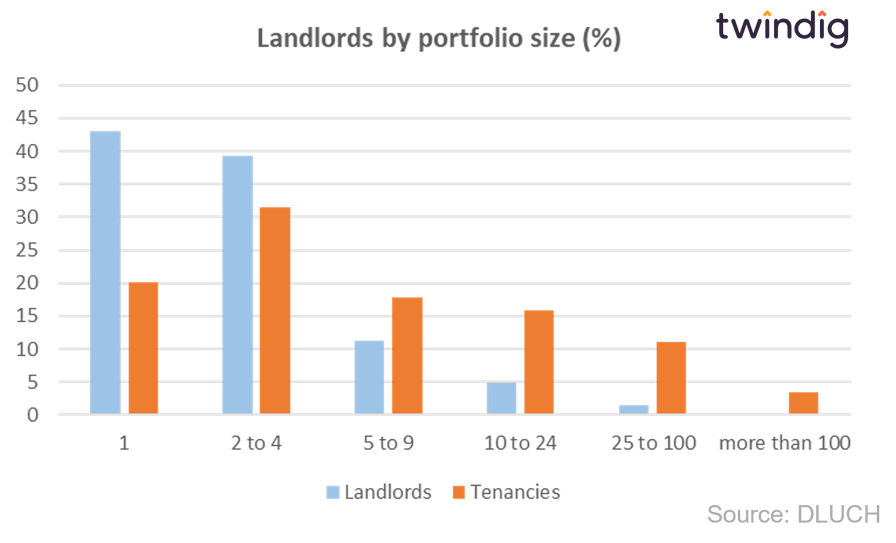

Just under half of all landlords (43%) own one property, these landlords make up 20% of tenancies. A further 39% own between two and four properties making up 31% of tenancies, and the remaining 18% of landlords own five or more properties, representing almost half (48%) of tenancies.

How old is the typical landlord?

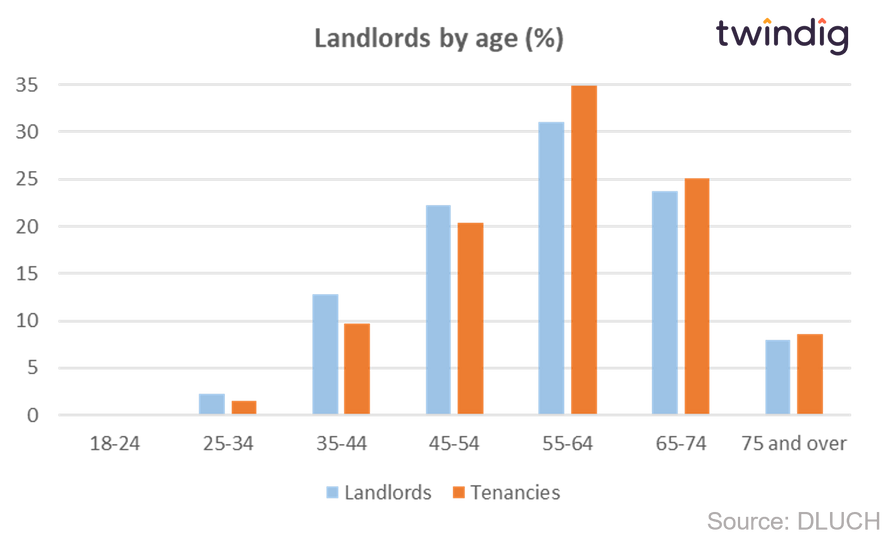

The median age of an individual landlord was 58, almost two thirds (63%) of landlords were aged 55 or older, representing 68% of tenancies.

Landlords are typically older than the general population. At the time of the 2011 Census, the median age for the population of England and Wales was 39 years

The truth about rent rises

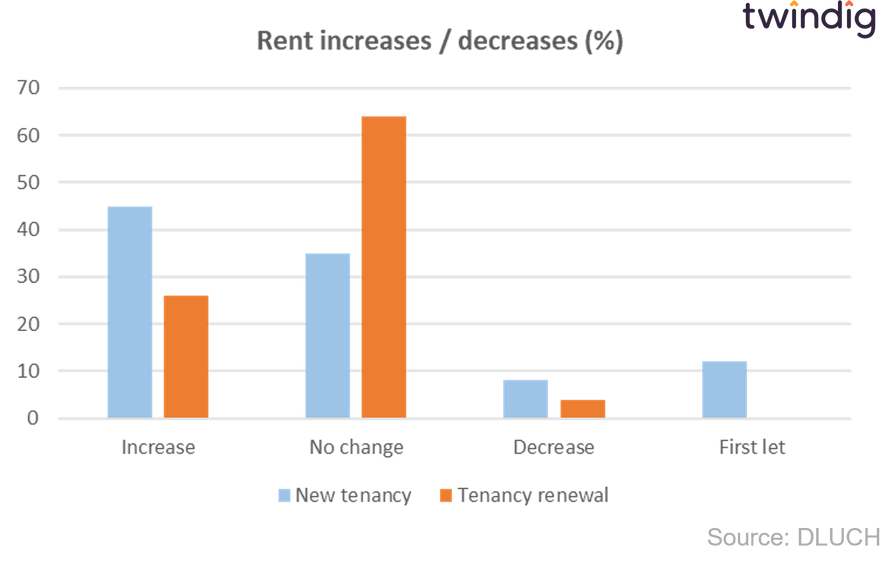

Whilst for new tenancies, nearly half of landlords (45%) said they increased the rent compared to the previous tenancy, 35% kept the rent at the same level, and 8% decreased the rent.

For renewals of existing tenancies, 64% of landlords kept the same rent, 26% increased it, and 4% decreased the rent on renewal.

So with renewals despite what some newspapers report, the most likely outcome is for the rent to remain unchanged.

How many landlords use a letting or estate agent?

If you don't use an estate or letting agent you are in good company, just under half (49%) of landlords said that they did not use a letting or estate agent. Landlords with one property were more likely to say they did not use an agent (64%). The more properties you have, the more likely you are to use an estate agent, with almost two thirds (64%) of landlords with five or more properties using an agent.

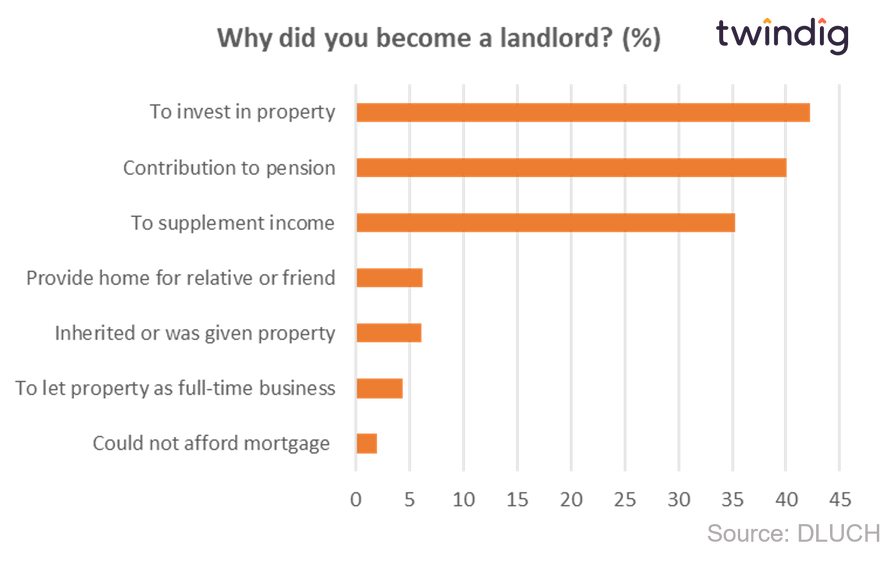

Why did you become a landlord?

Landlords were asked to select the reasons they originally became a landlord. The two most prevalent reasons were a preference for investing in property rather than other investments (42%) and as a pension contribution (40%). Around a third (35%) said they wanted to supplement earnings or income. Smaller proportions said it was to provide a home for a relative, child or friend (6%), or because they inherited or were given their first rental property (6%). Only 4% originally became a landlord in order to let property as a full-time business

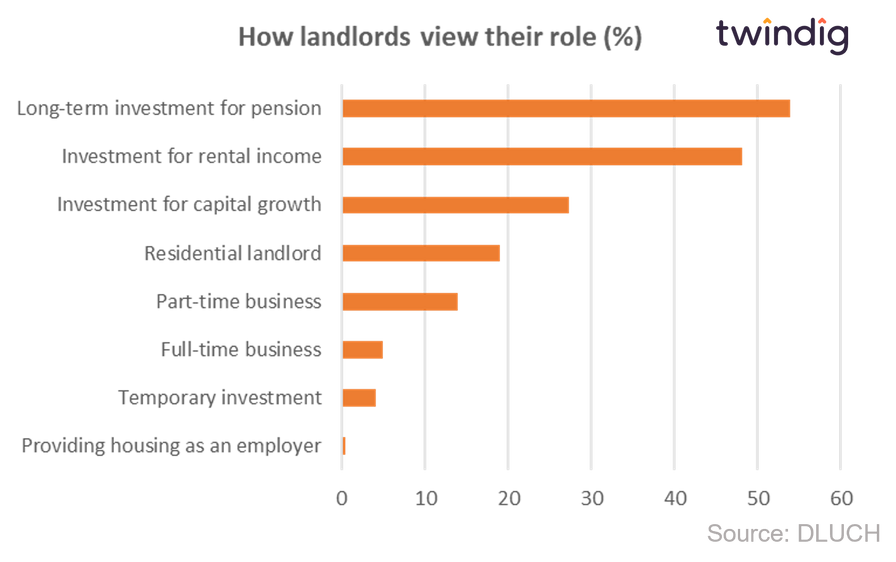

How do landlords view their role?

The majority of landlords report that they invest in property or are a landlord for part of their long term pension planning.

Following pension provision almost half of landlords are in the business for rental income and more than one in four (27%) for capital (house price) growth.

Interestingly, less than one in five view themselves as a landlord, although for 14% of private landlords managing their properties is a full time business and a further 5% view it as a part time business.

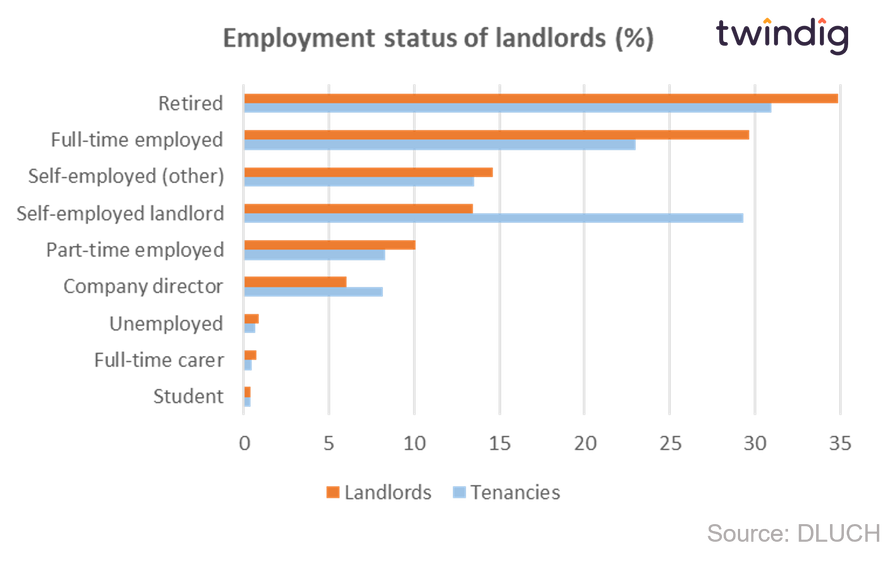

Landlord's employment status

More than one in three (35%) of landlords are retired, closely followed by just under 30% who are in full-time employment.

Around 14% of landlords accounting for around one in three tenancies (29%) class themselves as self-employed landlords.

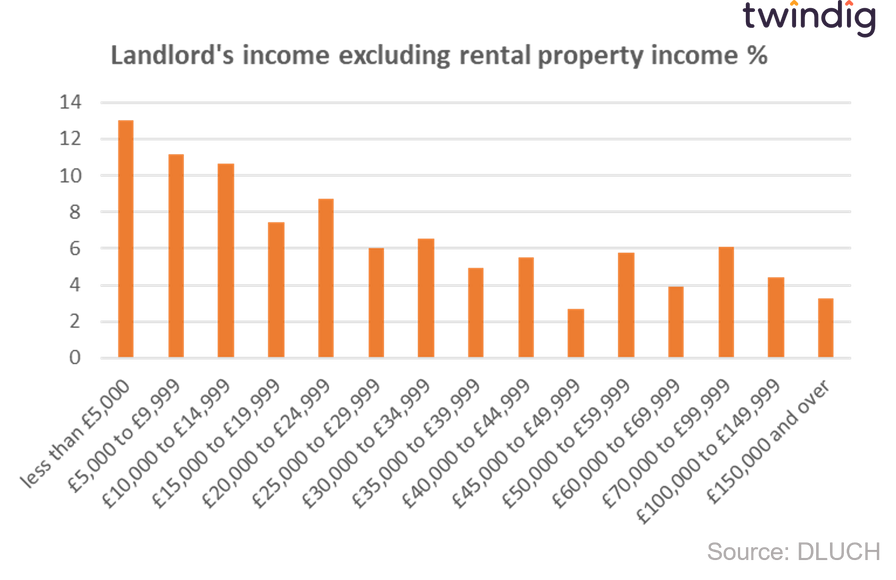

How much do landlords earn?

We show in the chart below the spread of landlord's income, excluding their rental income. Perhaps reflecting the large number of landlords who have retired around 13% earn less than £5,000 per year and just over one in ten earn between £5,000 and £10,000.

The median level of non-rental income was £24,000, this is £1,000 lower than it was in 2018

How much do landlords earn from their rental properties?

The amount a landlord earns from their rental properties varies enormously, this is not surprising when we factor in the differences between landlords with respect to number of properties, the size of their properties and their location.

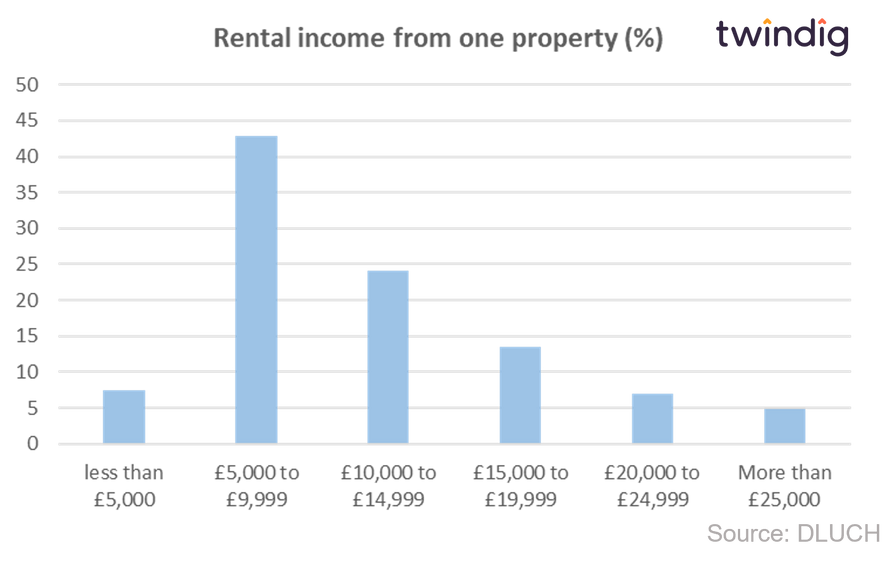

Rental income from one rental property

For those landlords with just one rental property, almost half have rental income of less than £10,000.

Just under one in four (24%) earn between £10-15,000 from their property with around 5% (1 in 20) earning more than £25,000 a year from their single rental property.

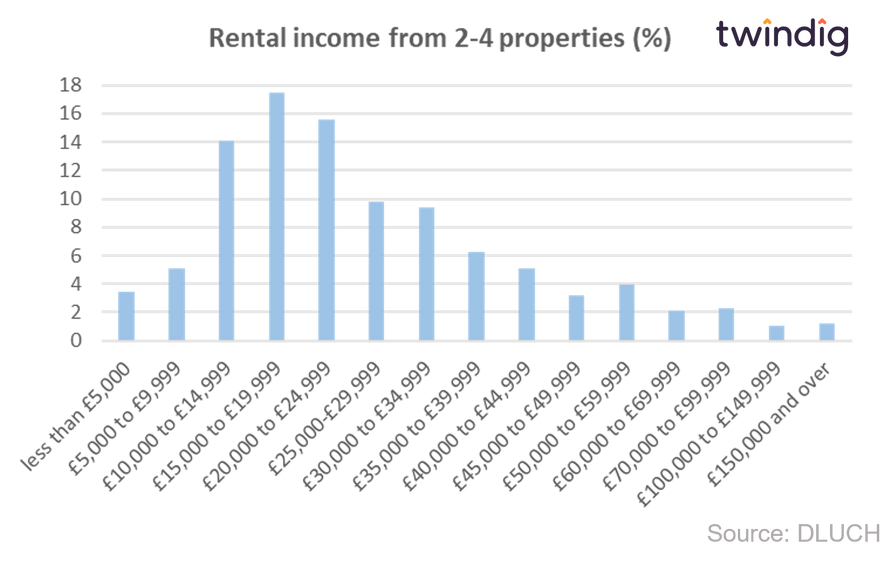

Rental income from two to four properties

For those landlords with between two and four properties, the rental income spread s much larger. Whilst 3.5% earn less than £5,000, almost one in five (17.5%) earn between £15-20,000 from their rental properties. Just over half (56%) earn less than £25,000 from their two to four properties, with 44% earning more than £25,000. Around 2.5% of landlords in this category are fortunate enough to earn more than £100,000 a year from their rental properties

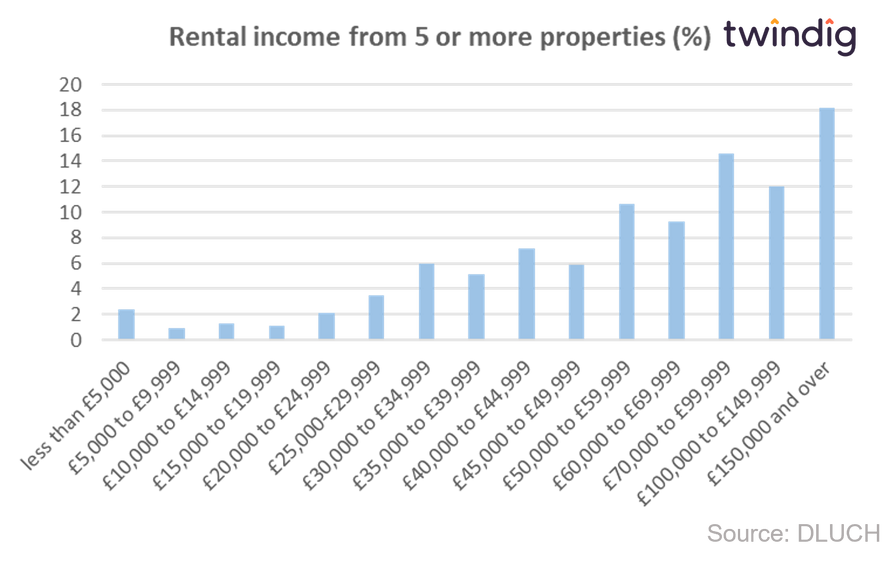

Rental income from five or more properties

Those landlords with five or more properties (Not surprisingly) have the highest rental income, although some, even with five or more properties have rental income of less than £5,000. However, almost one in three (30%) have a rental income of more than £100,000. These higher levels of income are more correlated with the number of properties in their portfolio than the rents received from individual in their property portfolios.

How much are buy to let investor's properties worth?

Much like the spread of rental income, the spread of rental property portfolio values is also very broad. We look in turn at single rental property values, portfolios of two to four properties and those property portfolios containing five or more properties.

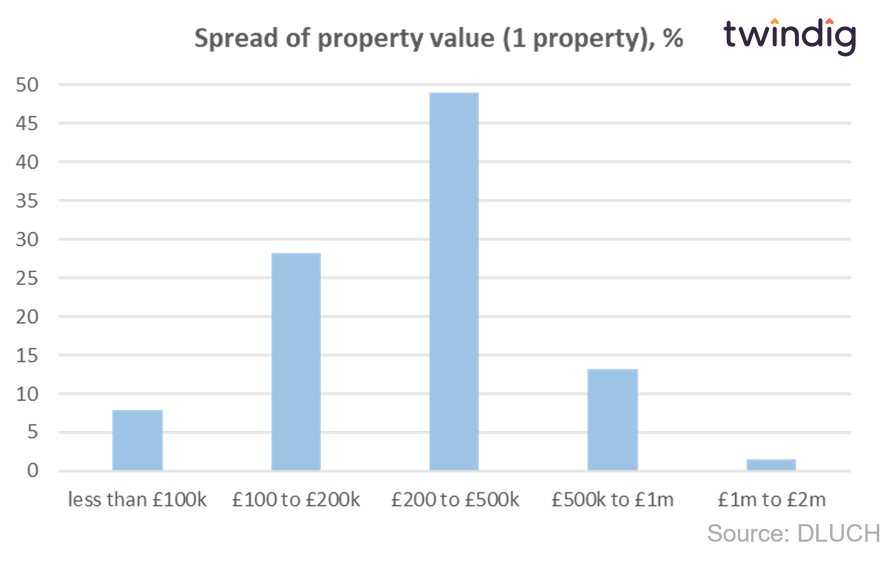

Value of single rental property portfolios

The spread of rental property values for single property landlords is very similar to the overall distribution of national house prices, with almost half (49%) of the rental properties worth between £200,00 and £500,000. Just over one in three (36%) rental properties are worth less than £200,000 with 15% worth in excess of half a million pounds.

Value of two to four rental property portfolios

Turning to rental property portfolios containing between two and four properties, around one in three (36%) of portfolios are worth between £200,000 to £500,000 and almost 2 in 5 (37%) are valued between £500,000 and £1,000,000. This once again suggests that the spread of properties in the private rented sector is not too dissimilar to the market as a whole with the thriving buy to let sector offering a broad range of homes for rent across the country.

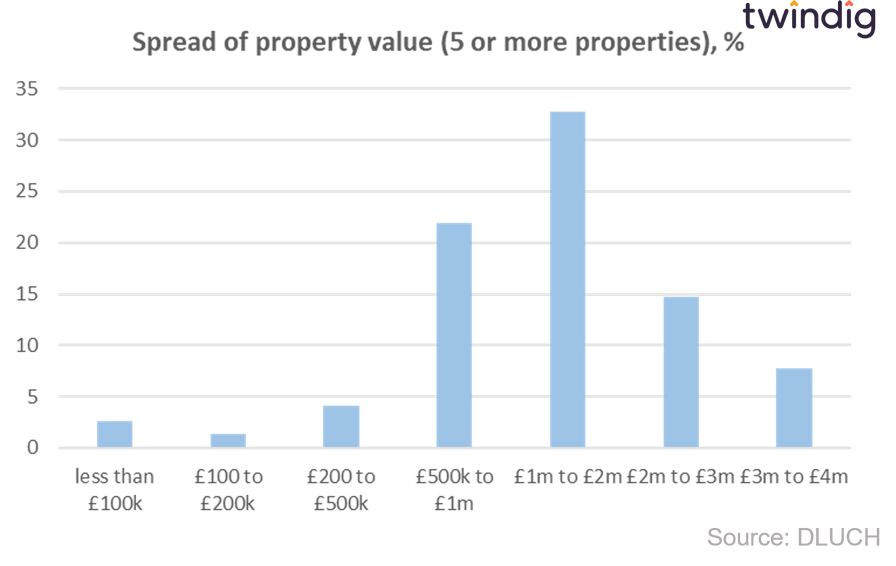

Value of rental property portfolios with 5 or more properties

Looking at the larger rental property portfolios, the sweet spot is in the £1 to £2 million range where one in three (33%) portfolios can be found.

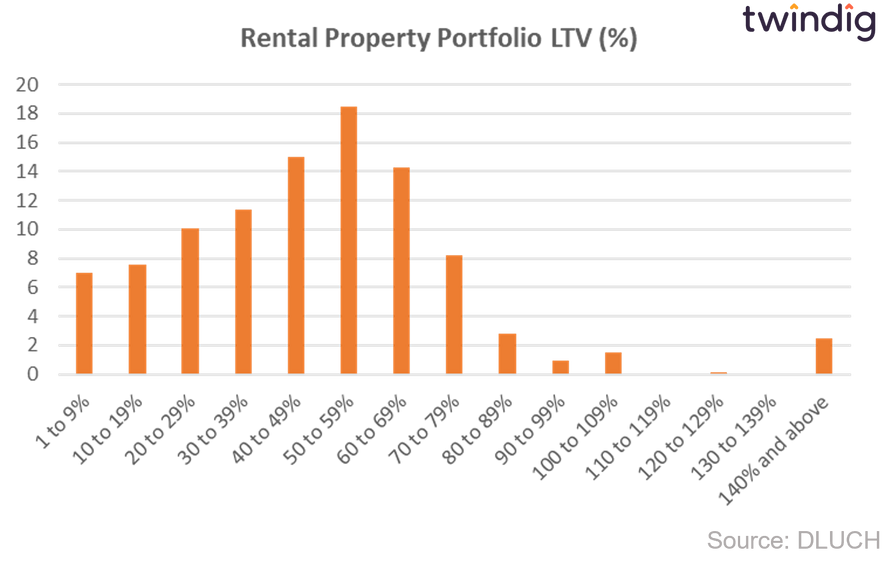

Landlord property portfolio LTV

Landlords have a significant amount of housing equity tied up in their property portfolios. Just over half (51%) have 50% or more equity in their rental portfolios. A very small number, just over 2% are very highly indebted with a rental property portfolio loan-to-value of 140% or more.

We show the full spread of rental property portfolio loan-to-values in the chart below

Landlord portfolio sources of funding and finance

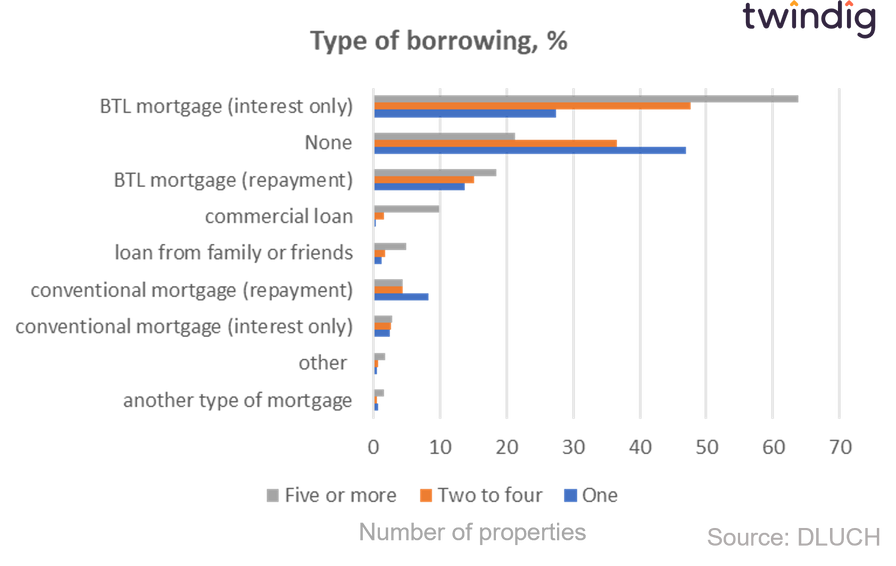

When it comes to financing rental or buy to let property portfolios specialist buy to let interest-only mortgages appear to be the flavour of the month and the most popular form of finance for those landlords with two or more properties.

Almost half (47%) of landlords with one property have no mortgage and their rental properties are debt-free. For those with two or more rental properties, 'debt-free' is the second most frequent funding situation, as we said above, there is an awful lot of landlord owned equity in the private rented housing sector in the UK.

The third most popular form of financing across the whole range of rental property portfolios is the specialist BTL repayment mortgage.