Will Hunt harm or calm the housing market?

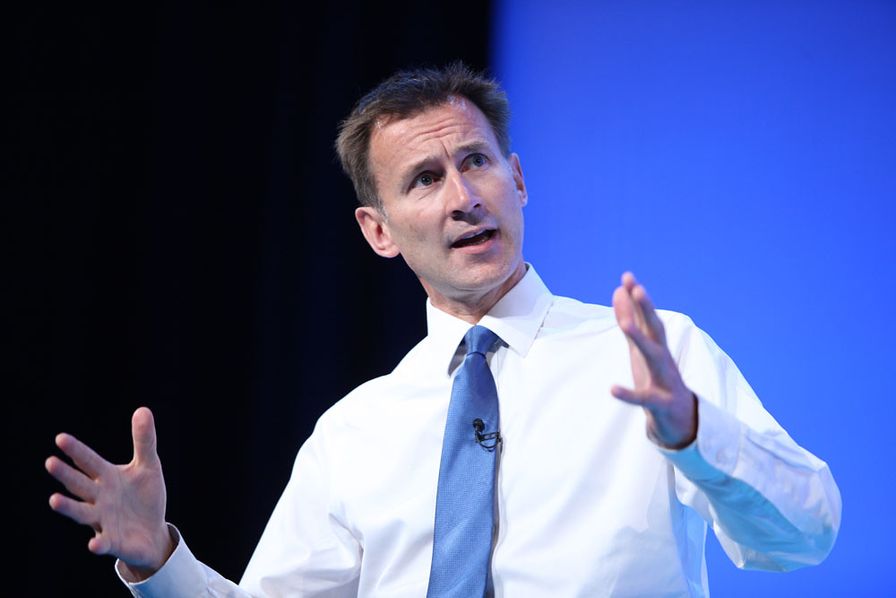

The departure of Kwasi Kwarteng, the u-turn on corporation tax and the appointment of Jeremy Hunt did little to settle the nerves of residential investors. Some asked if these attempts to rearrange the chairs in the cabinet were akin to rearranging deckchairs on the Titanic.

Few would argue against the view that the trajectory of the Kwasi budget put the Government on course for a head-on collision with the Bank of England, the former pushing for growth and the latter trying to restrain it. The net result is Bank Rate, and therefore mortgage rates, need to be increased faster and higher than previously thought. This would hurt homeowners.

However, what spooked the markets most was the lack of detail behind the mini-budget headlines. How were the tax cuts to be funded? The corporation tax cut u-turn is welcome, and it helps a bit, but what we need, is more detail.

The challenges for Hunt

The first challenge for Mr Hunt is to explain in detail how he will balance the books until he has done that the markets will remain unsettled, and the more markets are unsettled, the higher mortgage rates will rise.

The second challenge he faces is to put the housing market back on an even keel. Whilst much of the recent economic turbulence can be traced back to the contents of the mini-budget, unfortunately for Hunt, the housing market started to drift south as living costs and mortgage rates started to head north.

Will Hunt last longer than Kwarteng?

Liz Truss has bowed to pressure twice now, first on the higher rate income tax cut, and secondly on the corporation tax cut. They say things often come in threes, therefore is the only way to silence her critics to call an election to see if the country is with her and her pursuit of growth?

If we do see an early election housing will be a key battleground, especially as the Labour party believe it is they rather than the Conservatives who are the party of homeownership.

We expect to see some radical housing plans from all parties in the next election and Mr Hunt will have to work hard to win the votes of homeowners and aspiring homeowners in the face of rising mortgage rates and potentially falling house prices, both of which play into Labour's hands.

The National Housing Fund

If we were advising the housing or shadow housing minister, we would suggest the formation of the National Housing Fund a new national savings institution that places public money, institutional money and consumer savings directly into the housing market. The National Housing Fund or NHF would provide everyone with an opportunity to build a stake in the UK housing market and allow them to buy, own and sell property one brick at a time irrespective of their wealth, income and background, without the need for a big income, a big deposit and a big mortgage. If we are a nation of homeowners then we believe that everyone should have the opportunity to own property.

You can read more about the National Housing Fund below: