UK housing market: Housing market continues to hot up despite lenders trying to put on the brakes

Housing transactions (the yin) in August were 21% higher than they were in July and almost back to pre-Covid levels and the housing market recovery in sales at least is starting to look v-shaped. This is all the more remarkable given the fact that the yang (rising house prices and increasing mortgage lender down valuations) should be tempering the recovery. It seems that, for now, only crunching through the lockdown tiers will take the wind out of the UK housing market’s sails. If you want to keep a close eye on the market you can now follow any home in the country on Twindig whether or not it is currently for sale.

Housing transactions data for September

This week the HMRC released their provisional data for housing transactions in September 2020

What they said

Housing transactions totalled 98,010 in September 2020

This is 21.3% higher than August 2020

This is only 0.7% lower than September 2019

Twindig Take

If it looks like a ‘V’, walks like a ‘V’ talks like a ‘V’ is it a ‘V’ shaped recovery? Provisional HMRC data for housing transactions in September 2020 at 98,010 is close to the level in September 2019. Housing transactions are certainly punching above their weight, but can it continue. With redundancies rising and mortgage lending criteria tightening is this a false dawn rather than a recovery? Whilst the UK housing market seems to be powering ahead despite the pandemic, stricter lockdowns as seen in Wales will stop it in its tracks.

Land Registry House Price Data

The Land Registry released its house price data for August 2020 this week

What they said

UK house prices have increased by 2.5% in the last year

UK house prices increased by 0.7% in August 2020

The highest annual growth was in the East Midlands where average house prices grew by 3.6%

Twindig Take

The latest Land Registry House Price Data shows that house prices in England & Wales increased again in August to £251,439 an increase of more than £8,900 since the start of Lockdown. If one was not aware of the pandemic one might ask what has been stimulating the UK housing market. We also note that house prices were up more than £5,000 before the announcement of the Stamp Duty Holiday, which begs the question - was it needed and is it causing more harm than good?

There is a danger that if Lockdown II widens and deepens those who bid high to secure their home and pushed hard to complete their house purchase may regret buying at what might turn out to be a very keen price

UK Mortgage Market Down Valuations On the up

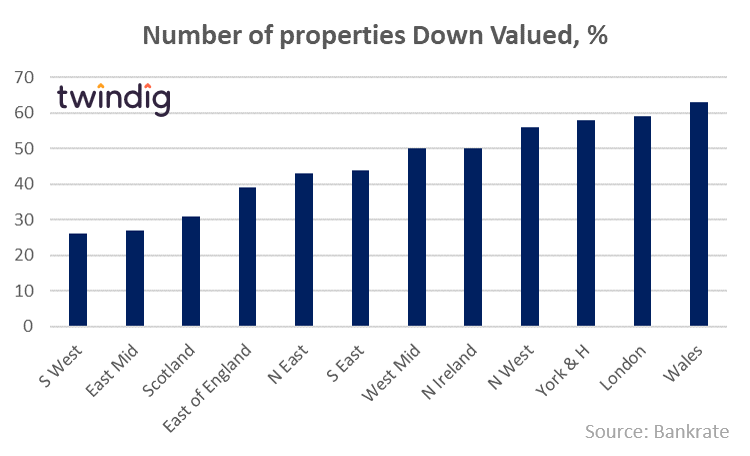

Bankrate a part of Zoopla published its ‘Devaluation Report’, which looked at how mortgage lenders have reacted to the recent surge in house prices.

What they said

46% of buyers had been subject to down valuations by their chosen mortgage lender

50% of buyers aged 18-34 received a down valuation

37% of buyers aged 45 and over received a down valuation

Twindig Take

It was probably only a matter of time before rising asking prices were tempered by mortgage lenders. In our view, the money homebuyers are saving as a result of the Stamp Duty Holiday has been used to increase the amount, they can offer on the home they are trying to buy. The result is house prices are rising. Mortgage lenders have decided in many cases that these higher prices are not justified by the underlying housing market and are therefore not willing to lend the full amount asked for. First Time Buyers are likely to be the hardest hit as they are typically wanting to use a higher loan to value mortgage than a homeowner and they usually have access to smaller deposits. This means that they are the least likely to be able to fill the funding gap from alternative sources.

The Twindig Market Move price suggests what the price of a home would be if it had moved in-line with its local market since the last time it sold. The market move price is therefore arguably closer to the underlying market fundamentals that the asking price suggested by the estate agent who won the instruction. You can find the Market Move price for your home on Twindig.com

Bellway full-year results

Bellway one of the UK’s biggest housebuilders released results this week for the year ending 31 July 2020

What they said

Revenue down 31%

Profit Before taxation down 64%

Reservations up 31% in the nine weeks since 1 August

Help to Buy used by 57% of customers since 23 March 2020

Twindig take

The impact of the lockdown on Bellway’s volumes was stark and provided a clear guide as to what might happen if the UK enters another full lockdown. However, when the housing market is open for business demand is strong. Bellway has benefitted from two things: a shortage of second-hand homes for sale and Help to Buy. Help to Buy accounted for 57% of sales since 23 March 2020 compared to 35% in FY 2019. The increased use of Help to Buy suggests that whilst the country as a whole is not in full lockdown, the high loan to value mortgage market certainly is.