Housepresso 2 October 22

Are House prices on the turn?

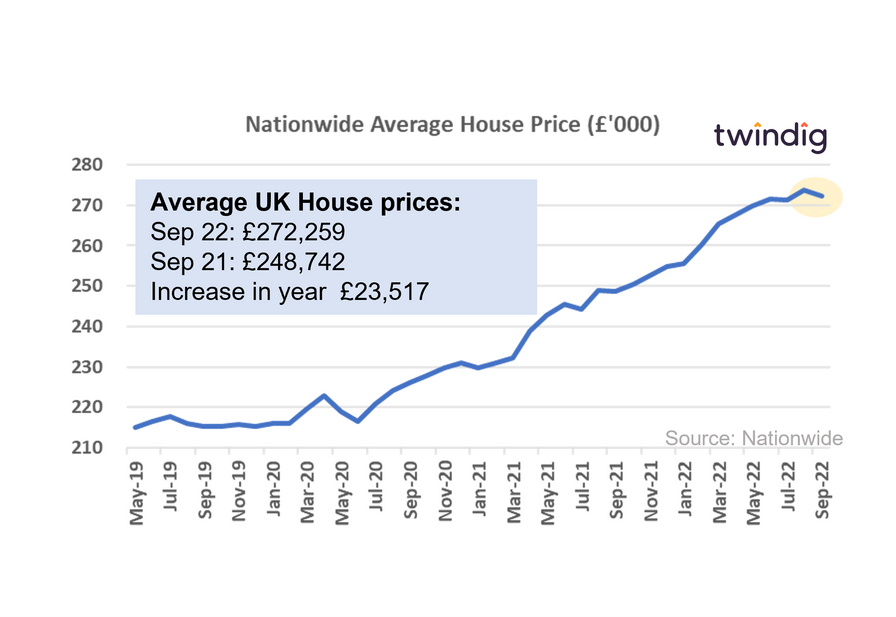

Are we at the turning point? Although annual house price inflation in September remained very robust at 9.5%, house prices slipped a little in September, with average prices falling by almost £1,500 before seasonal factors were taken into account (house prices were unchanged on a seasonally adjusted basis).

Has the cost of living crisis finally placed a powerful punch on the property market or has the mini-budget scored an own goal?

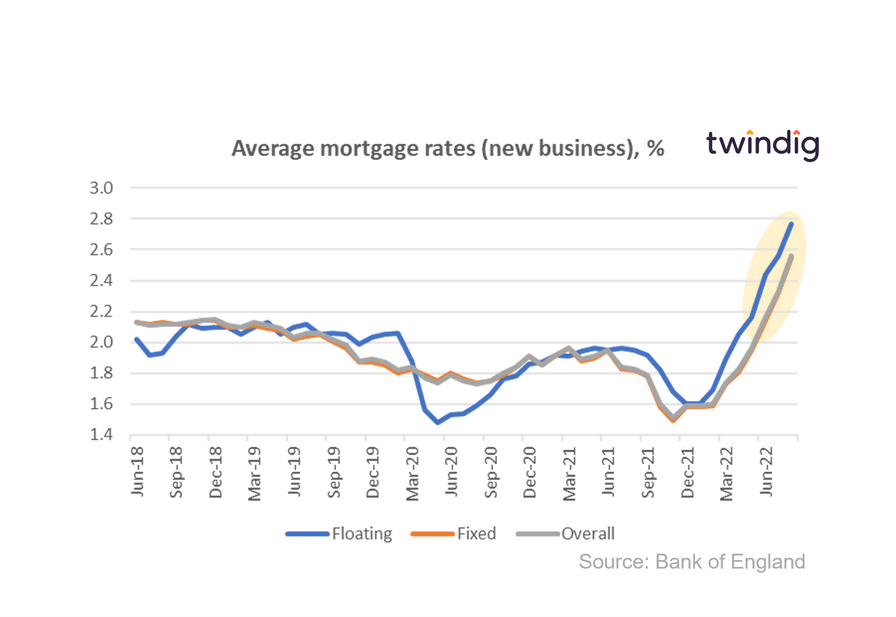

Mortgage rates rising faster than house prices

Whilst the Nationwide reported this week that annual house price inflation was 9.5% (dipping below 10% for the first time since last October) average mortgage rates have increased by 40% over the last year, 4x more than house prices, and following the 'mini-budget' that rate of increase is, unfortunately, going to accelerate.

Mini-budget Housing podcast

Earlier this week I caught up with the Guild of Property Professionals CEO, Iain McKenzie and Holly Hibbett to discuss the implications of the mini-budget on the UK housing market and what it means for house prices and interest rates.

Thinking outside the homeownership box

Homebuyers and homeowners are increasingly worried about mortgage rates rising and house prices falling. Is the answer just to buy increasingly smaller and smaller homes or is now the time to think outside the box and change the way we finance our homes and manage house price risk?

Twindig Housing Market Index