Houselungo 6 June 21

A lungo length look at this week's housing market news

House prices increased by £4,000 in May

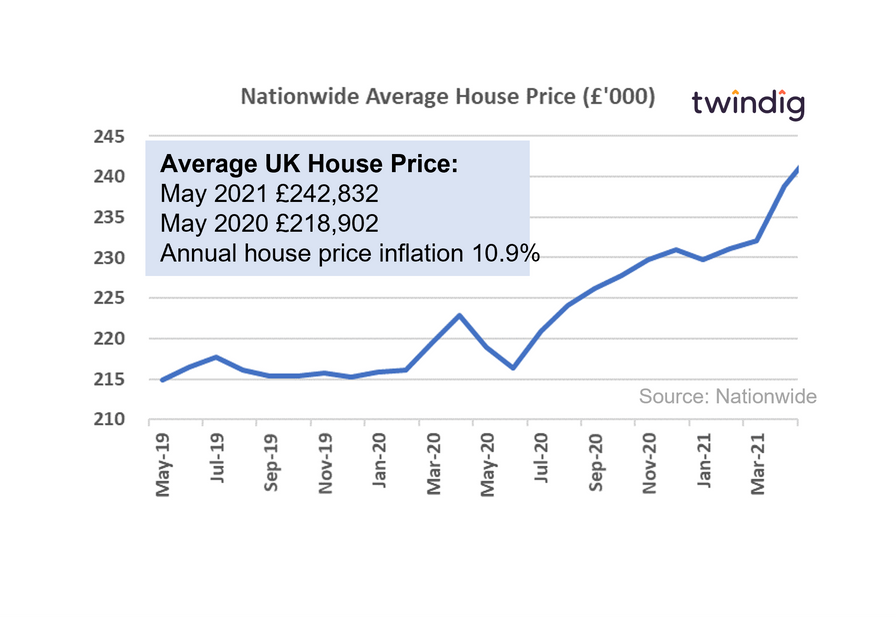

The Nationwide released their house price index for May 2021 this week

What they said

Average house prices £242,832

Annual change 10.9% or +£23,930

Change last month 1.8% or +£4,000

Twindig take

The space race is on, as annual House price inflation hits 10.9% or £1,994 per month according to the latest Nationwide House Price Index, with an increase of £4,000 in May. This means that the average house in the UK earns more than the homeowner who lives in it. Nationwide believes that the Stamp Duty Holiday, working from home and COVID-19 has led to a 'race for space' as households seek bigger homes and more outside space in less urban areas. However, this space race will leave many aspiring buyers left behind and grounded as house prices become too high in the sky to reach.

Mortgage approvals up 438%

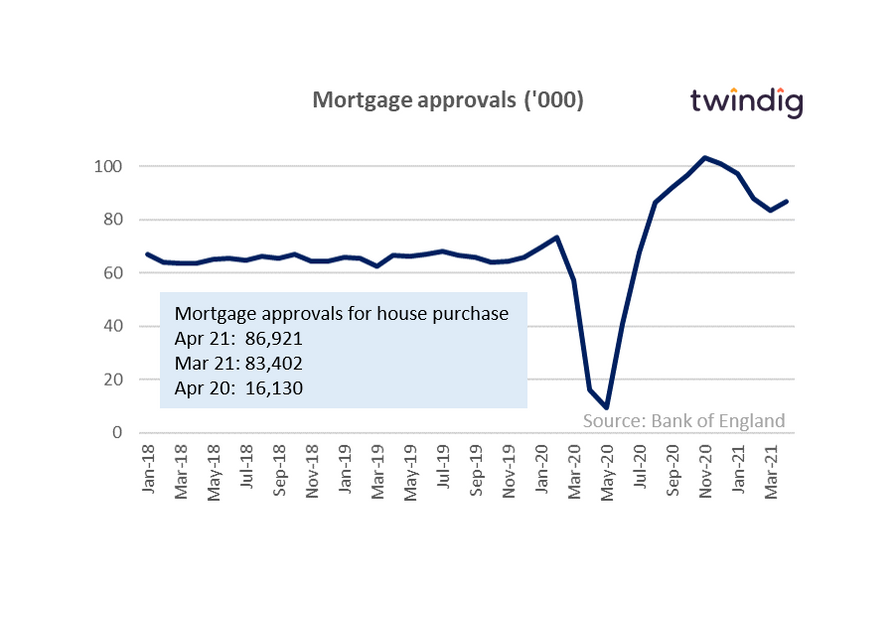

The Bank of England published mortgage approval data for April 2021 this week

What they said

Mortgage approvals for house purchase were 86,921 in April 2021

This was 4.2% higher than in March 2021

438% higher than April 2020

Twindig take

Mortgage approvals in April 2021 were 438% higher than in April 2020. Whilst it is easy to calculate big numbers as we lap the lockdown I lows, perhaps what is more interesting and useful to know is that April 2021’s 86,921 house purchase mortgage approvals is 28% higher than the five-year average and 36% higher than the 10-year average. Homebuyers have certainly responded to the extension of the Stamp Duty Holiday in March 2021 and with the available stock in short supply house prices are likely to continue to increase.

Mortgage rates - floating up, fixed down

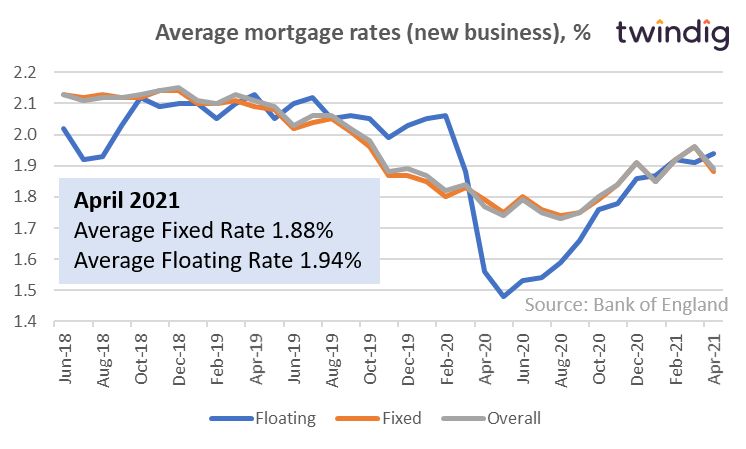

The Bank of England published mortgage rate data for April 2021 this week

What they said

Average new business rates for floating rate mortgages 1.94%

Average new business rates for fixed-rate mortgages 1.88%

Twindig take

After almost one year of floating-rate mortgages being cheaper than fixed-rate mortgages, the situation has reversed, is this the tide turning or a short-term reversal? Time will tell, but for now, both fixed and floating rate mortgages remain very affordable for those who have sufficient equity or deposit to access them. As the economic recovery gathers pace and assuming the current dawn is not a false one, the chances of an increase in Bank Rate rises so perhaps now is the time to lock in a long term fix.

Will rising house prices lead to increased mortgage rates?

What could a rise in bank rate mean for me?

Many mortgages are linked to Bank Rate either directly or by lenders variable-rate mortgages. If the mortgage rate on a £100,000 25 year mortgage increased by one percentage point from 2% to 3% the mortgage payments would increase by around £50 per month for a repayment mortgage and around £80 for month for an interest-only mortgage.