Houselungo 2 October 22

Are House prices on the turn?

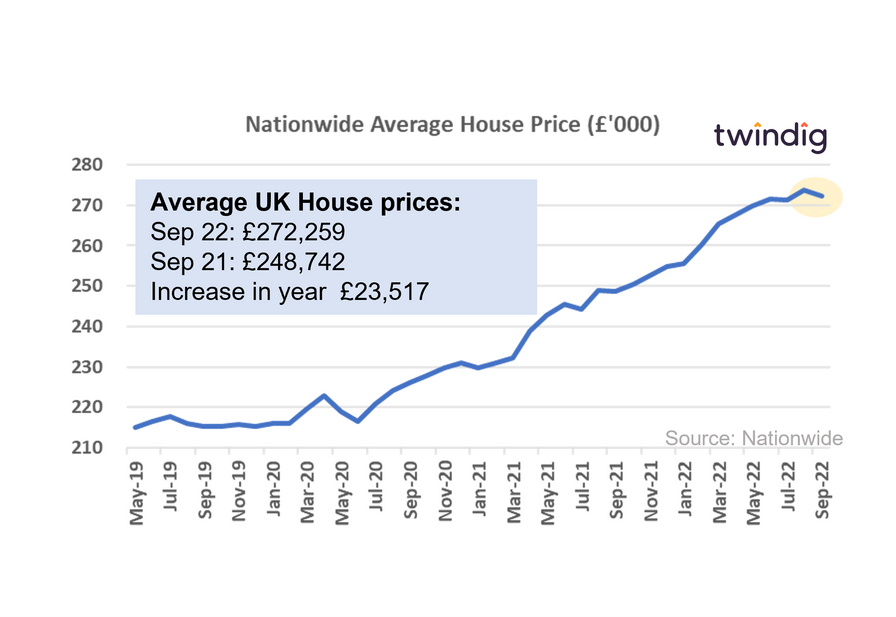

The Nationwide released its house price index for September on Friday

What the Nationwide said

Average house price in September 2022 was £272,259

House prices fell by 0.6% or £1,492 in September (although unchanged after tracking into account seasonal factors

Annual house price inflation 9.5%

Twindig take

Are we at the turning point? Although annual house price inflation in September remained very robust at 9.5%, house prices slipped a little in September, with average prices falling by almost £1,500 before seasonal factors were taken into account (house prices were unchanged on a seasonally adjusted basis).

Has the cost of living crisis finally placed a powerful punch on the property market or has the mini-budget scored an own goal?

The Nationwide comments that over the last month mortgage approvals have been below pre-pandemic levels and RICS have said for a couple of months that the level of new buyer enquiries has been softening. But, and it's a big 'but', a shortage of homes for sale has kept supply tight and house price firm.

Following the events of the last Friday's mini-budget (yes that was only a week ago) the dynamics in the housing market have changed. At the start of the pandemic, a temporary stamp duty holiday led to a surge in housing market activity. This time around, a permanent stamp duty cut, along with other tax cuts, appears to risk causing the housing market to stall as hundreds, if not thousands, of mortgage products have been taken off the shelves and several lenders have shut up shop for new buyers altogether.

The last time we saw such turmoil in the mortgage market was during the Global Financial Crisis when the level of housing activity halved and house prices fell by almost 20%.

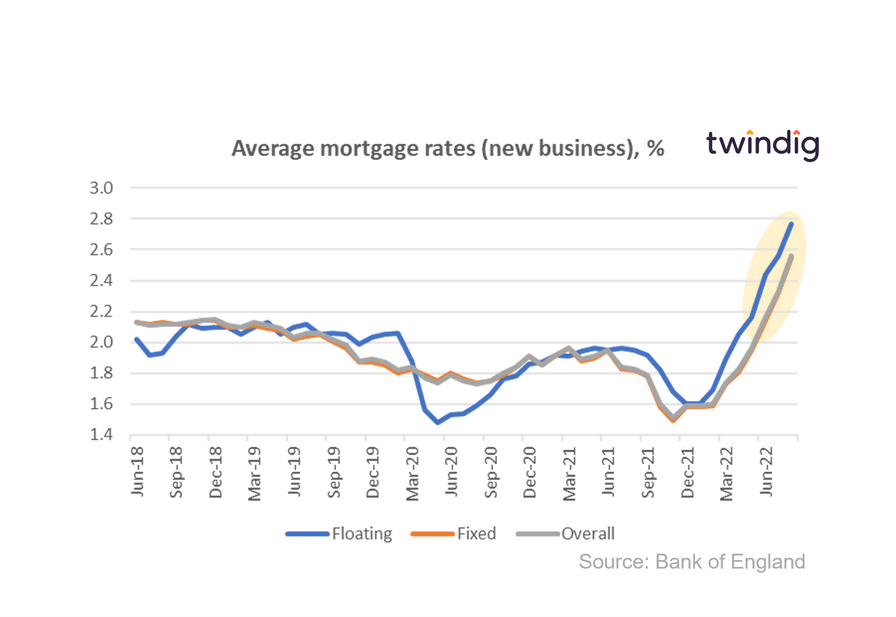

Mortgage rates rising faster than house prices

The latest data from the Bank of England revealed that overall average mortgage rates for new business increased again in August 2022, rising by more than 8%

What the Bank of England said

The average floating mortgage rate for new business 2.77%

The average fixed mortgage rate for new business 2.55%

The average overall mortgage rate for new business 2.56%

Twindig take

Whilst the Nationwide reported this week that annual house price inflation was 9.5% (dipping below 10% for the first time since last October) average mortgage rates have increased by 40% over the last year, 4x more than house prices, and following the 'mini-budget' that rate of increase is, unfortunately, going to accelerate

Following the mini-budget, it is difficult to keep up with events in the mortgage market. As is clear from the chart above, mortgage rates were rising before the mini-budget and those rises are likely to accelerate from here.

Mini-budget Housing podcast

Earlier this week I caught up with the Guild of Property Professionals CEO, Iain McKenzie and Holly Hibbett to discuss the implications of the mini-budget.

In the mini-budget podcast we discuss:

Why there seems to be a conflict between the Government and the Governor of the Bank of England

Where could interest rates and mortgage rates go from here?

How raising interest rates curbs inflation

Why exchange rates matter even when you aren't going on holiday

The current temperature of the housing market

What the mini-budget means for house prices

Thinking outside the homeownership box

Homebuyers and homeowners are increasingly worried about mortgage rates rising and house prices falling. Is the answer just to buy increasingly smaller and smaller homes or is now the time to think outside the box and change the way we finance our homes and manage house price risk?

We buy our homes at a fixed point in time, but increasingly are spreading the cost over decades, and as many are finding out, this opens the gates of uncertainty, and the mortgage payments you have to make over the years to come may be much larger than those you hoped for.

Can we learn from the pension market?

Aside from housing, our most significant investment tends to be our pensions. When we retire, our pension pot may well have a similar value to our home, but it will have been purchased month by month over our working lives rather than on a single day. If we trust this method to provide for us in our retirement and leisure years, should we not try to apply its model to the housing market?

Twindig Housing Market Index

Well, it has certainly not been a dull week for the UK housing market... It is fair to say that the markets did not react well to Kwasi Kwarteng's mini-budget. The impact on the housing market has been huge, as banks and building societies rushed to take mortgage products off the shelves in the face of such interest rate uncertainty. Housebuilders' shares tumbled as investors feared that housing transactions would stall, and the house price doomsayers relished every opportunity they had to get on their housing market soap boxes.

If there was any doubt about what housing market investors thought about last week's mini-budget, the Twindig Housing Market Index sums it up very clearly and concisely, it fell by 11.5% this week to 61.6. To up that into context, this was the biggest fall since 20 March 2020 (the start of Lockdown 1) taking the Twindig Housing Market Index to its lowest level since 22 May 2022. At that time we were in lockdown, in the first wave of a global pandemic and we had no vaccine. Now we are unlocked, we have vaccines, but are in the first wave (or term) of the Kwasi / Truss Government.