Houselungo 1 May 22

Why house prices don’t need to fall to solve the affordability crisis

When we talk of a housing affordability crisis the consensus is that house prices need to fall to address the issue of affordability. We disagree. We believe the solution to the affordability crisis is to take a fresh look at the way we finance our homes.

Are house prices just too high?

There is a growing tension between the have and the have nots when it comes to residential property and the battle lines are drawn in several ways:

between older and younger households,

investors and renters,

homeowners and homebuyers, and

those with access to the bank of mum and dad and those without.

The argument in all cases is similar, those on the housing ladder have pulled the ladder up and out of reach of those either trying to get on the ladder or trying to climb further up the housing ladder. House prices are therefore too high, preventing those who want to get onto the housing ladder from gaining a foothold.

Market forces have forced up house prices

Blame is often put at the feet of free-market ideals which, some say, have turned our homes from a place to live into a financial asset, which in turn has pumped up house prices. Government policy should therefore seek to reduce house prices, to lower the ladder so that more can get onto it, rather than supporting a system that has increased the desirability of and demand for homeownership facilitating house price rises.

Let's build build build

The main policy response to the housing crisis is to build more homes, in the belief that prices are high because we have a shortage of homes, therefore increasing the supply of homes will alleviate some of the pressure on house prices.

House prices are unlikely to go down

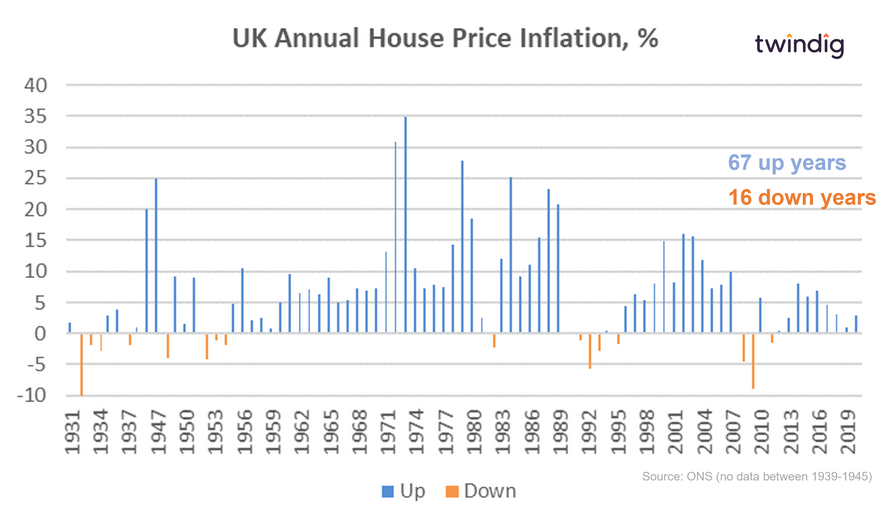

Whilst we should not use history to predict the future, history can teach us a lot about house prices. They rarely fall.

Since 1931 house prices have only fallen in 16 years.

But a house price crash is coming, right?

It is natural to think that after a period of significant, and unexpected house price growth house prices may fall. Few anticipated that house prices would rise so much during the (global) COVID-19 pandemic. As lockdowns led economies across the globe to enter severe recessions, house prices went up, and they went up a lot.

However, if we look at history house price crashes are very rare indeed. If ever house prices were to fall then the perfect storm was probably not the COVID-19 pandemic, but the Global Financial Crisis, which centred around excessive risk-taking by financial institutions in the residential mortgage markets.

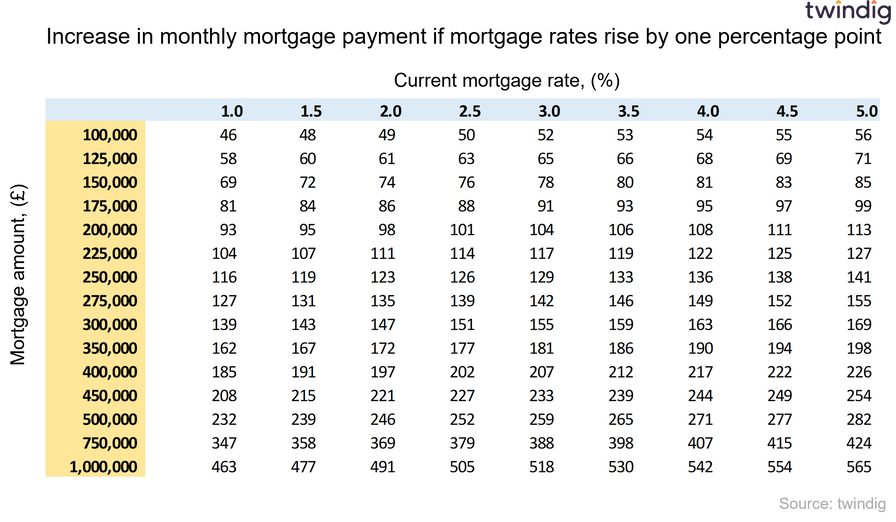

Will my mortgage payments increase by £1,000

Rishi Sunak, the Chancellor of the Exchequer, told Cabinet colleagues this week that he expects Bank Rate to increase to 2.5% over the next year. He warned that a one percentage point rise in the typical mortgage would add an extra £700 to the mortgage costs each year (or just under £60 per month).

However, few of us regard ourselves as 'typical', so team twindig has put together a mortgage payment calculator and ready reckoner tables to help you see how a one percentage point increase in mortgage rate would impact you.

Will my mortgage payments increase if interest rates rise?

This will depend on what type of mortgage you have.

Fixed-rate mortgage

If you have a fixed-rate mortgage the mortgage rate will not change during the fixed-rate period, therefore your mortgage payments will not increase during the length of time your mortgage rate is fixed.

Standard Variable Rate mortgage

If you have a Standard Variable Rate (SVR) mortgage your mortgage provider will likely pass on any increase in Bank Rate to you. If the Bank of England raises Bank Rate by one percentage point, your mortgage rate is likely to increase by the same amount.

Bank or Base Rate Tracker mortgage

If you have a Bank Rate or Base Rate Tracker (BTR) mortgage any change in the Bank of England's Bank Rate (either up or down) will be passed on to you. Your mortgage rate will therefore track the changes in Bank Rate.

Two in five looking to move home this year

he Nationwide released their house price index for April 2022 on Friday

What they said

Average UK house price £267,620

Annual house price inflation 12.1%

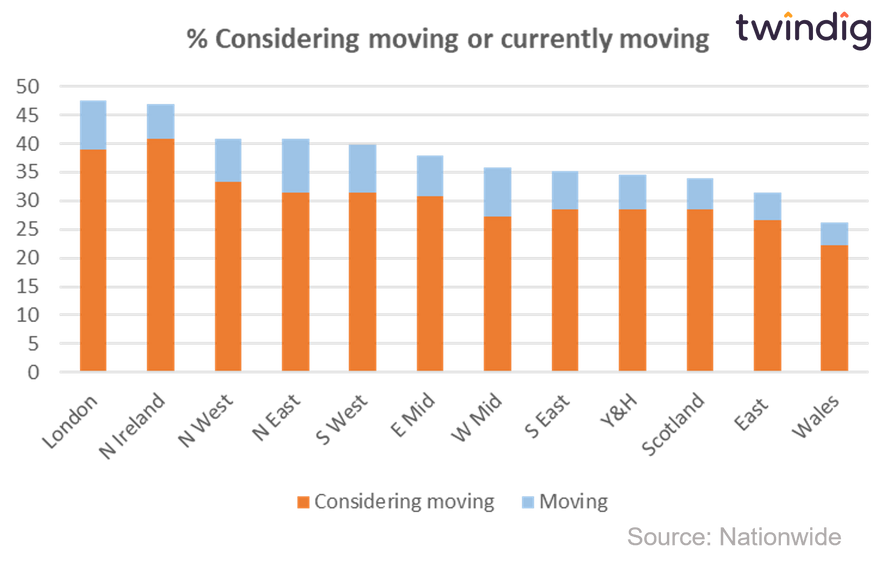

Survey reveals 38% actively looking to move home or considering a move

Twindig take

Although house price growth slowed to 0.3% in April and to 12.1% in the year to April 2022, however, it is still the 11th time in the past 12 months that annual house price inflation has been in double digits.

The Nationwide has, like us, been surprised that housing demand has remained so buoyant following the end of the stamp duty holiday and in the face of rising living and mortgage costs. Therefore they surveyed around 3,000 consumers across the UK to gain a better insight into what is going on.

The results were surprising. Overall 38% of those responding to the survey stated that they were either in the process of moving or considering a move.

House price winners and losers in the South West

The latest data from the Land Registry reveals that the average house price in the South West of England is currently £312,700.

On average house prices in the South West of England increased by 1.2% or £3,650 over the last month

Over the last year (last 12 calendar months) average house prices in the South West of England increased by 12.5% or £34,710.

However, across the South West of England, there is a big spread of house prices at the Local Authority level ranging from £208,000 in the City of Plymouth to £451,000 in the Cotswolds. The average price of a home in the Cotswolds is more than two times the average house price of a home in the City of Plymouth.

Twindig Housing Market Index

The Twindig Housing Market Index fell by 3.2% to 77.6 this week, which came as a surprise as house prices rose and heavyweight housebuilders reported burgeoning order books.

On Friday the Nationwide reported that house prices rose again, albeit at a slower rate in April, and April was the 11th month out of the last 12 where annual house price inflation has been in double digits. However, Nationwide did report that they expect the UK housing market to slow in the coming quarters.

Will the housing market slow?

We don't think so, the housebuilders reported growing order books and house price inflation ahead of build cost inflation and a survey from the Nationwide found that almost 2 in 5 (38%) of people are either considering moving home this year or are in the process of moving home. It seems that rising mortgage rates and living costs do not impact those able to move, although we appreciate that not everyone is lucky enough to be in that category.