Home stretch property market predictions for 2023

Following on from our round-up of 2022, this week I joined Iain McKenzie and Holly Hibbett from the Guild of Property Professionals to discuss what might happen in the UK housing market next year

In this podcast we discuss our forecasts for

Economic growth - will we be in recession in 2023

Inflation

House prices

Interest rates

Housing transactions

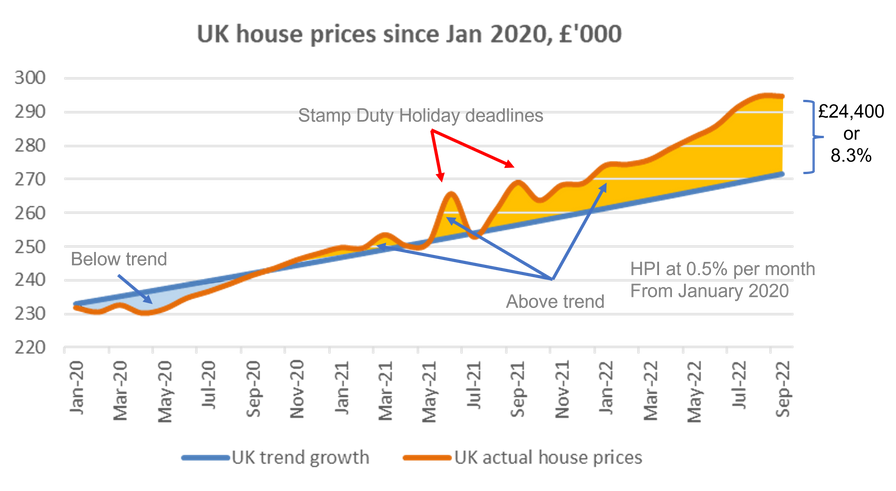

2023 House price for forecast

Our take is that house prices are currently around 8% above levels implied by their long-term growth rate. We are not saying that the past is a predictor of the future, but the long-term growth rate has been consistent over a very long period. This suggests that house prices are 8.3% or around £24,400 over valued. We therefore believe that house price will fall by 8% during 2023.

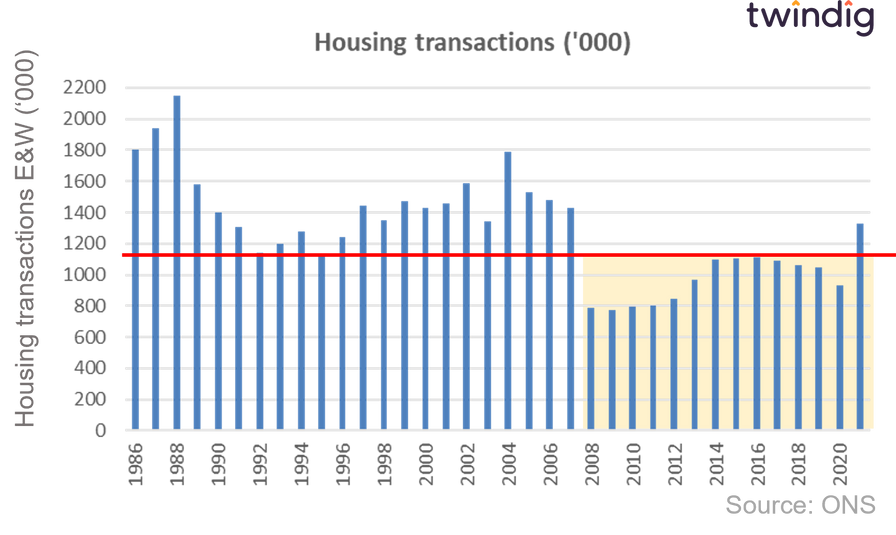

2023 Housing transactions forecast

We expect that in the UK we will see 2022 we will see around 1.25 million housing transactions (down from c1.5m in 2022), and that this figure will fall to around 960,000 in 2023 as mortgage rates start to bite and house price falls lead to homebuyers delaying their house purchases.

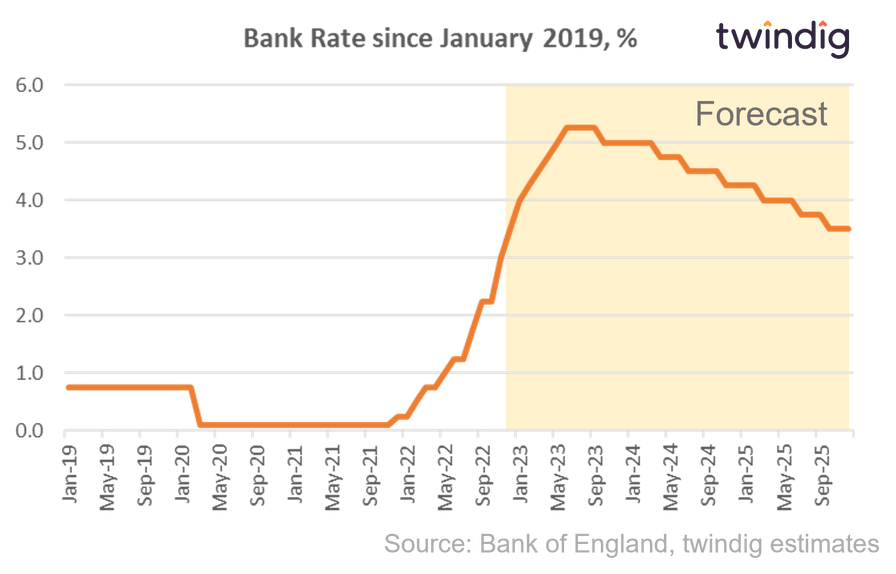

2023 Interest rates forecast

We expect that Bank rate will continue to increase in the first nine months of 2023 and peak in September 2023 at around 5.25% (although some commentators are already talking of a lower peak of 4.75%).

We expect Bank Rate to start falling from September 2023, but to fall more slowly than it increased.

2023 Inflation forecast

We believe that inflation peaked in October 11.1% and fell to 10.7% in November 2022. We expect inflation to follow a broadly downward path during 2023 and we estimate that inflation will have fallen to 3% by the end of 2023