Help to Green: When climate, pensions and property collide

The climate is heating up, house prices are going up and the pension ticking timebomb is about to blow up.

The UK Government has a target to reach net zero emissions by 2050

Government Data states that UK homes are responsible for 15-22% of greenhouse gas emissions

Fewer than 40% of homes in the UK have an Energy Performance Certificate (EPC) rating of C or better.

The average UK pension pot at retirement is around £62,000

For many in the UK, homeownership is out of reach as the average home costs around £280,000

In this article, we look at how these three disparate problems collide and how they might join together to solve all three problems at once. We briefly look at each problem in isolation before identifying the common thread that might lead us to the solution for pensions, property and the planet.

We need Help to Green: The planet is heating up

The UK Government wants to see as many homes as possible to have an EPC rating of C by 2035. Chris Stark the head of the UK’s Climate Change Committee believes that insulation together with renewable power is the answer.

So if this is such a good idea, where is the catch? The catch is the cost. The UK Government estimates that the cost of getting all homes to a C rating to be between £35-65bn. The cost to individual homeowners can be large Rob Jones told the BBC that it cost £36,000 for his four-bed Edwardian home in Manchester to move from an EPC ‘E’ to a rating of ‘B’. He is using around 40% Less energy, but it will take at least 20 years for him to recoup the cost.

Mr Stark believes that the Government needs to step in with grant aid as the costs to the individual homeowner are too high, but the social costs of not reducing greenhouse gas emissions are higher still.

We need Help to save: Pensions are about to blow up

We are encouraged to save for our pension, and we know it is important to save for our pension. There is tax relief available on pension savings and our employers also put money into our pension pot. However, we are not saving enough. The average UK adult retires with a pension pot of around £62,000, which is not enough to fund the average retirement of 20 years.

Despite much encouragement, we do not save enough for our pensions, although, we generally need no encouragement to put money into property. However, it is very difficult to put property into a pension. Surely the way forward is a property related pension product, a way to save for a pension by investing in residential property?

We need Help to Buy: House prices are going up

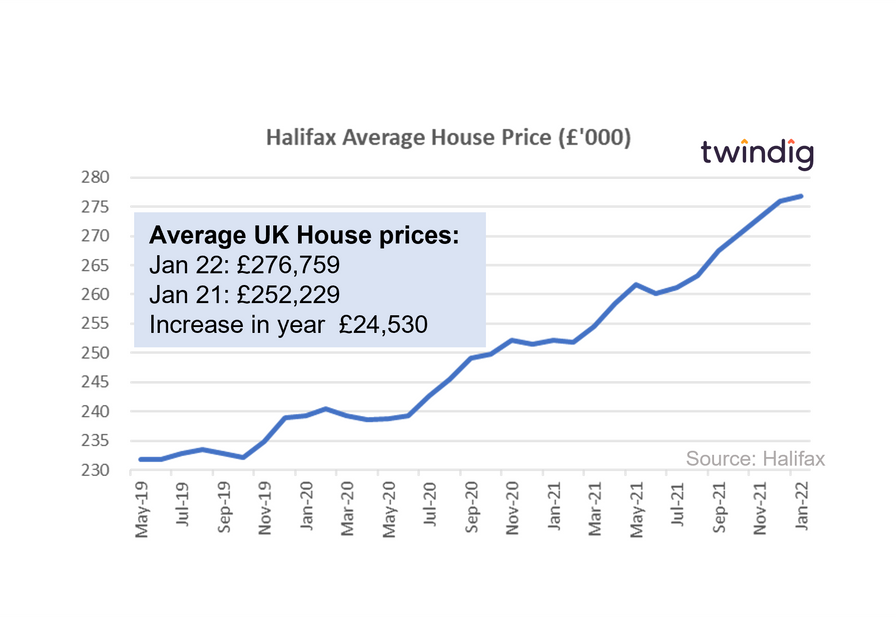

The January 2022 Halifax house price index reported that the average house in the UK cost £276,759. House prices have increased by more than £37,500 since the first COVID-19 lockdown in March 2020. The average full-time wage in the UK is about £31,000. The average house costs almost nine times the average full-time salary.

Mortgage lenders have to ration the number of mortgages they sell that are more than 4.5x the homebuyers salary. The average full-time worker could therefore secure a mortgage of around £140,000 leaving them to find a deposit of £136,000, a deposit almost as big as their mortgage.

The answer is property

The amount of wealth tied up in our homes is staggering, about £7.7 trillion. To put this into context £7.7 trillion is about double the value of all the companies listed on the London Stock Market. The amount of mortgage debt in the UK is around £1.7 trillion, £6 trillion of housing equity is therefore owned outright and those without mortgage debt tend to be older homeowners.

Older homeowners are often asset rich, but cash poor

We have a situation where older households have a lot of housing wealth, but not a big enough pension pot. Older households tend to be relatively asset rich but cash poor. A solution to this asset:cash problem would be to sell part of their home. The cash proceeds could be used to fund a higher standard of living, a chance to benefit from the rising value of their home whilst still being able to enjoy their home.

Who would buy part of a home?

Many aspiring homeowners are unable to get a foot on the housing ladder due to the high level of house prices. They cannot secure a big enough mortgage and they do not have a big enough deposit. It is difficult to raise a big deposit and building a deposit is not helped by the fact that interest earned on a savings account does not keep pace with house price inflation, which pushes homeownership further and further out of reach.

Currently, the only way to get exposure to the housing ladder is to physically own a home. There is no way to save for a home by actually investing in the housing market. We hope that will soon change.

Imagine if a Help to Buy ISA, rather than being a tax-free low interest savings account was a savings product where your savings grew in line with house prices. This way your deposit would keep pace with house prices. We believe that many aspiring homebuyers and probably their parents and grandparents would be interested in a true help to buy ISA.

Help to Buy meets Help to Pension

A property-based Help to Buy ISA would allow pensioners to enhance their pension, to better enjoy the fruits of their labour, whilst allowing those without housing wealth the opportunity to start building housing wealth.

Help to Green: Tieing it all together

Our homes are responsible for up to 22% of greenhouse gas emissions, but the financial cost of improving the energy efficiency often puts them out of reach. We would like to do our bit to save the planet, but we cannot afford to do it.

This is why we believe that a Help to Green ISA could be the answer. Homeowners who need help to improve the energy efficiency of their homes, sell a small part of their home to pay for the energy efficiency improvements. The homeowner benefits from reduced energy bills without the cash costs of the energy improvements.

Aspiring first time buyers get an opportunity to start building housing wealth and green-minded investors are provided with an investment opportunity that helps to reduce greenhouse gas emissions.

Help to Green we need a catalyst

Deep down none of us like change. The status quo is easy and we usually need a catalyst (or a rocket up our backsides) to change our behaviour.

Help to Green sticks

We have seen car tax become linked to emissions, this ‘nudge’ is having the desired effect, diesel car sales are falling and electric car sales are rising.

Within the housing market and the corridors of power, there seems to be a continual ongoing debate about how best to tax residential property. Many see council and stamp duty taxes as unfair and inefficient. We think it is only a matter of time before residential properties are taxed on their emissions as well as their value.

In the future EPC ratings will impact house prices and by 2030 mortgage rates are very likely to be determined by EPC ratings. The UK Government wants mortgage lenders to be involved in getting us to Net-Zero. By 2030 the Government wants to see an average EPC rating of C across every lender's mortgage book. We suspect that lenders will link mortgage rates to EPC ratings to help effect the changes necessary. Homeowners will need to improve the energy efficiency of their homes to secure the best mortgage rates.

We see Help to Green equity loans as a great tool to help homeowners secure not only the best mortgage deals but also to reduce their energy bills and enhance the value of their homes.

Help to Green carrots

Taxes can be both carrots and sticks, the carrot of a Help to Green ISA would be that the gains it makes are tax-free and a more generous ISA allowance would possibly see more money put to work getting us closer to net Zero. Green Investment funds could also benefit from tax-free returns where funds are used to specifically reduce carbon emissions.

First Time Buyers could also be helped by matched Government Funding. The new build Help to Buy scheme is due to come to a close in March 2023, could a Help to Green scheme where homebuyers rather than developers are helped replace it? New builds are very energy efficient, but it will take more than 100 years to replace our current housing stock at current build rates. Help to Green could be used to incentivise first-time buyers to buy homes that are currently energy inefficient and help them improve the energy efficiency of the home.