Is Help to Buy closing just as it is needed?

The Government released the Q3 2022 Help to Buy data this morning

What they said

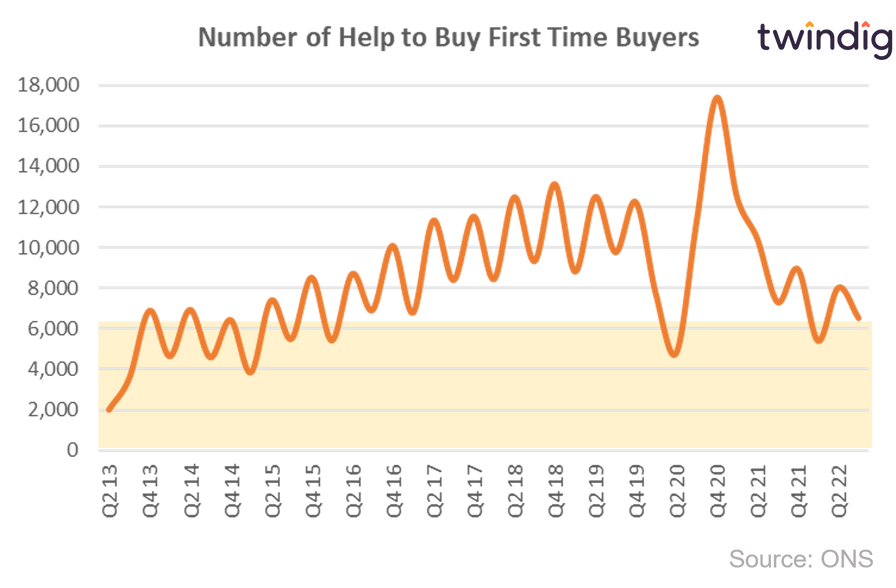

Between 1 July and 30 September 2022 6,531 properties were purchased with a Help to Buy equity loan

This was 11% lower than in the same period last year, and 19% lower than in the previous quarter

The value of Help to Buy Equity loans in Q3 2022 was £561.2m this was 11% higher than in the same period last year but 9% lower than in the previous quarter

Twindig Take

Help to Buy volumes fell in Q3 2022 as the scheme started to draw to a close. Concerns that transactions would not complete before the end of the scheme tempered sales in the third quarter.

It is perhaps ironic that just as the Help to Buy scheme is drawing to a close the housing market is starting to slow down, seeing falling house prices and transaction volumes. However, whilst the next few months may well be a shock to the system after a period of plenty, we see the current challenges as a transition to a more normal market, rather than the start of a housing slump.

Has Help to Buy Helped?

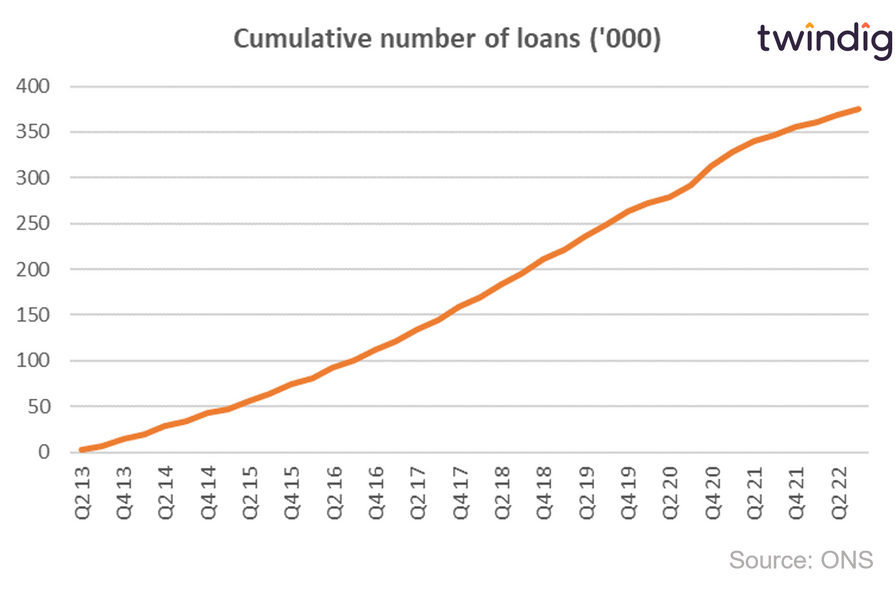

Yes, we believe it has helped, since its launch in 2013 it has helped more than 375,000 homebuyers buy a home.

Has Help to Buy been good for the taxpayer?

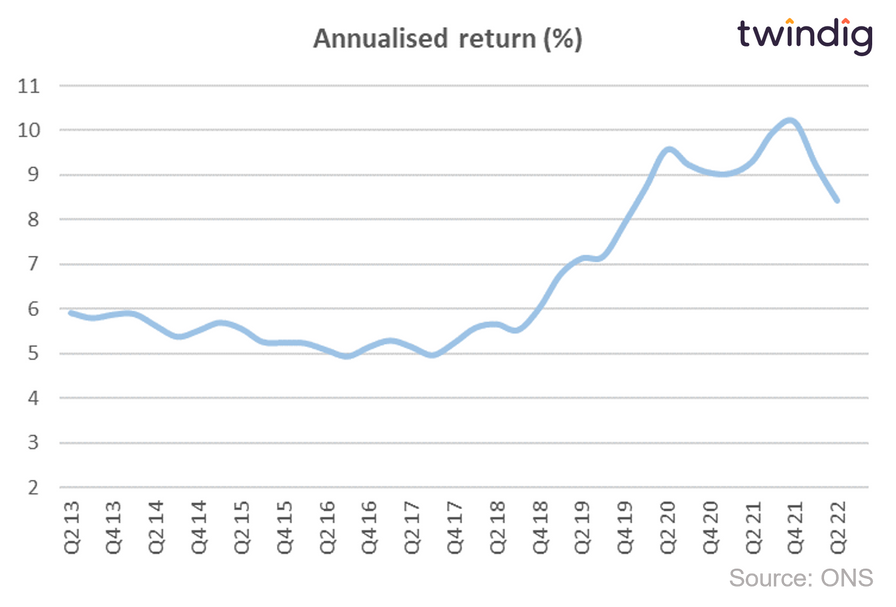

Yes, £23.7bn of Help to Buy Equity loans have been made since the launch of the Help to Buy scheme and we estimate that this has generated £6.6bn of potential gains. To estimate the gains we have calculated the house price inflation since the equity loan was made.

If we look at the annualised return by quarterly cohort (as shown in the graph below) we see that the average annual return has been 6.7%, a return significantly higher than those found in savings accounts and also attractive when compared to the stock market and bond market returns, in our view.

Will Help to Buy be extended?

It is perhaps ironic that Help to Buy is drawing to a close as the housing market is starting to feel a bit of pressure. Housebuilders have been to see the Chancellor of the Exchequer this week, but we understand this was to talk about housing market conditions rather than Help to Buy.

Politically, housing is a sensitive area and whilst homeowners are in the majority one can expect political parties of all persuasions to be sympathetic to the needs of homebuyers and home movers. However, critics of Help to Buy say it has inflated house prices and lined the pockets of housebuilders and at a time of rising living costs and required pay constraints, the Government is mindful of these concerns.

Our reading of the mood music is that Help to Buy will not be extended in the near future, but if the housing market conditions deteriorate considerably we would expect the Government to step in, but for now it's a watching brief.