Help to Buy - levelling down not up?

The UK Government released its Help to Buy Statistics for Q3 2021 this morning

What they said

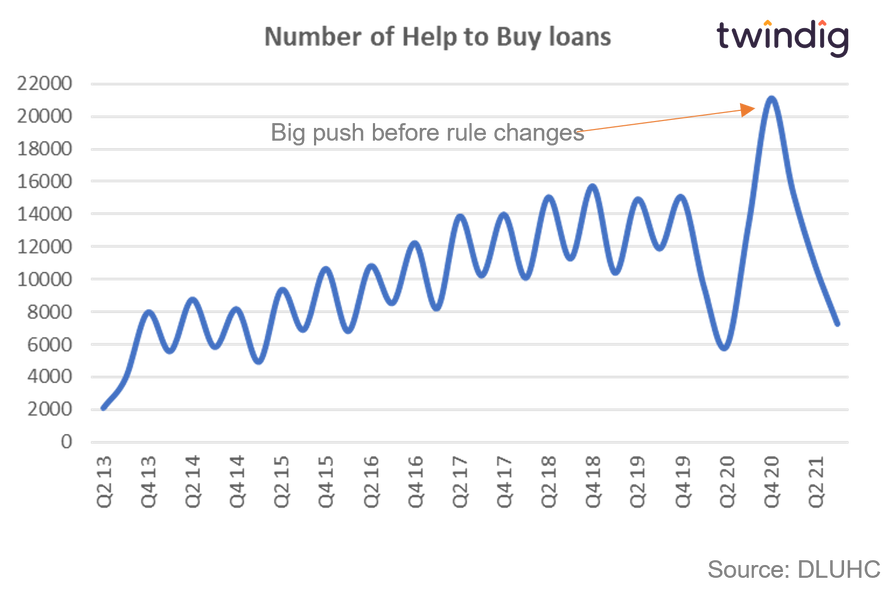

7,270 homes were purchased using Help to Buy in Q3 2021

This was 46% lower than the year before Q3 2020 and 33% lower than in Q2 2021

The value of help to buy equity loans made in Q3 2021 was £498m, which is 39% lower than in the previous quarter and almost half (48% lower) than Q3 2020

Twindig take

It seems that the Department of Levelling Up, Housing and Communities has its work cut out if it is to deliver on the promises or aspirations made in the Levelling Up white paper 'to quickly turn Generation Rent into Generation Buy' because the changes made to Help to Buy last year may have levelled the housing market down not up, helping fewer generation rent households become those in generation buy.

Changes made to help level up

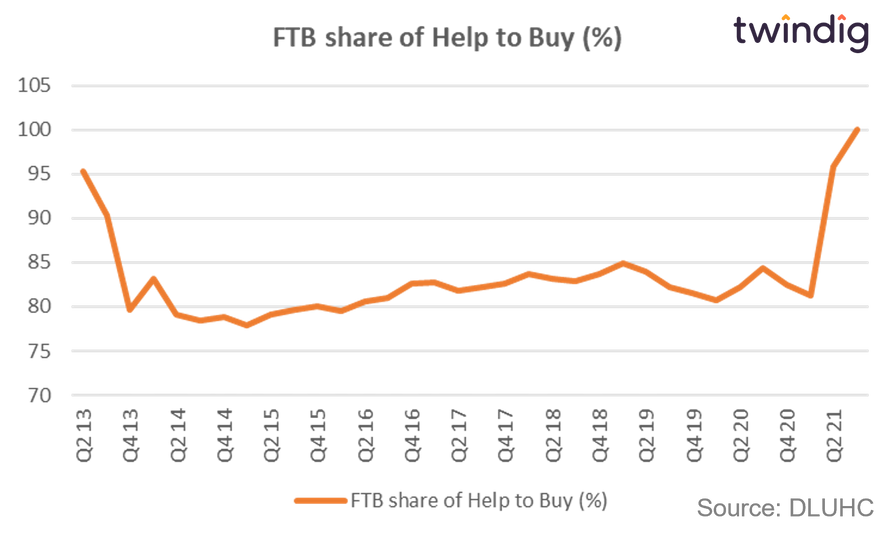

On paper, the April 2021 Help to Buy rule changes made sense. Restricting Help to Buy to first time buyers only would help turn generation rent into generation buy rather than help existing homeowners climb further up the housing ladder. The introduction of regional price caps was also a sensible move, in our view, to ensure that support was given to those who needed it most.

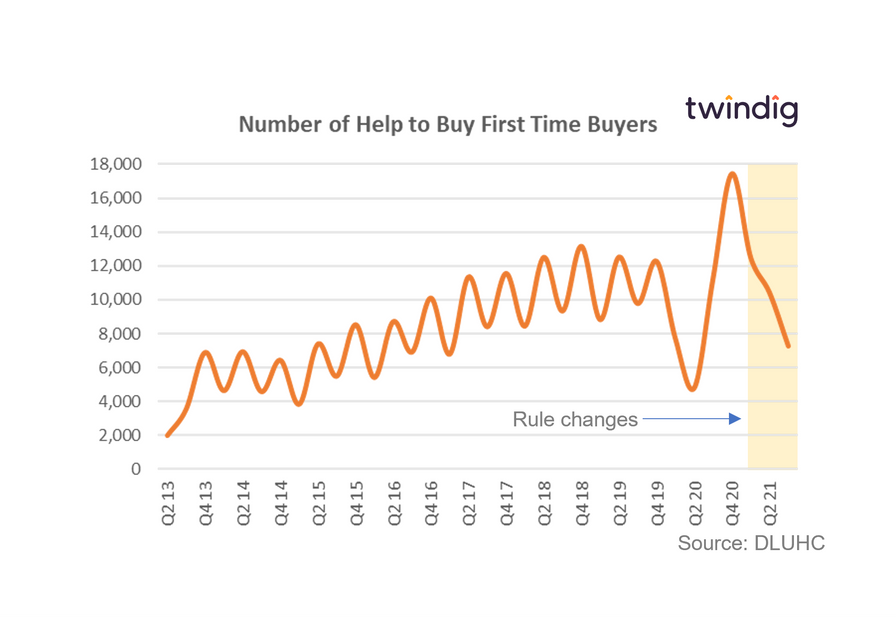

Not surprisingly there was a surge in Help to Buy activity before the rule changes came into place. Suggesting that existing homeowners and those looking at more expensive properties were looking to take advantage of Help to Buy whilst they could.

But have the changes levelled things up?

Yes and no...

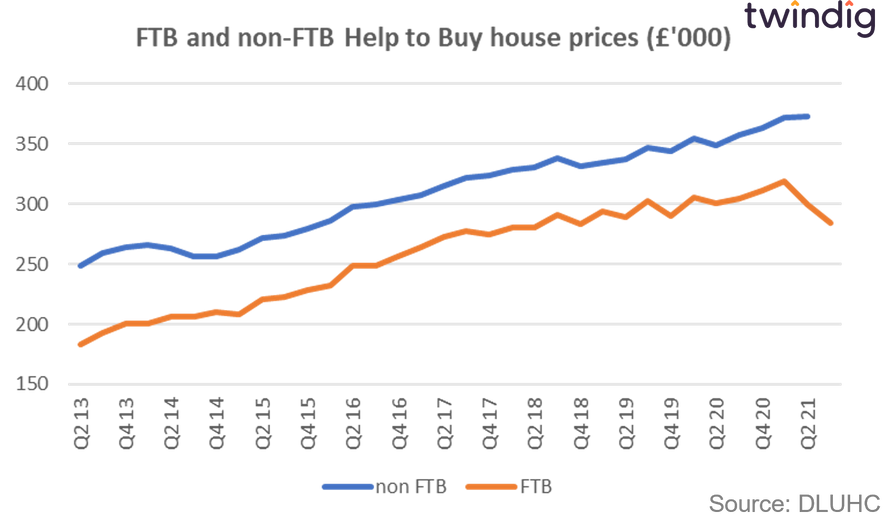

The average price of homes purchased using help to buy has reduced since the rules changed from £319,449 in Q1 2021 to £284,172 in Q3 2021 a reduction of 11%.

Homemovers using Help to Buy, as expected, tended to buy more expensive homes than first-time buyers. On average home movers help to buy homes cost 20% or around £52,000 more than those of first-time buyers using the scheme.

The rule changes have also led to help to Buy being first-time buyers only, although it was mainly used by first time buyers, who up until the rule changes accounted for 82% of Help to Buy Sales

Levelling down not up

However, when we delve into the detail of the data it appears things may have levelled down not up. Whilst 100% of help to buy sales are now made to first-time buyers, the number of first-time buyers using the scheme has reduced. As we said at the top: It seems that the Department of Levelling Up, Housing and Communities has its work cut out if it is to deliver on the promises or aspirations made in the Levelling Up white paper 'to quickly turn Generation Rent into Generation Buy.