Help to Buy volumes drop as rules change

The UK Government released the Q2 2021 Help to Buy Statistics this morning

What they said

10,824 properties were bought with Help to Buy

This was a decrease of 30% from Q1, but an increase of 85% over Q2 2020

The value of Help to Buy Equity loans made in Q2 2021 was £808.2m

Twindig take

The latest Help to Buy statistics have been keenly anticipated as they are the first statistics released since the Help to Buy rule changes in April.

What were the Help to Buy rule changes?

Since April 2021 Help to Buy has been operating under new rules, it has been restricted to first-time buyers and regional price caps have been put in place

Have the Help to Buy rule changes had a big impact?

In a word, ‘yes’. The number of homes sold using help to buy has fallen by 30% since the introduction of the new rules.

Around half of that reduction was due to home movers no longer being eligible for Help to Buy and the other half being a reduction in the number of First Time Buyers. In our view, the reduction in the number of First Time Buyers is due to the introduction of the regional price caps.

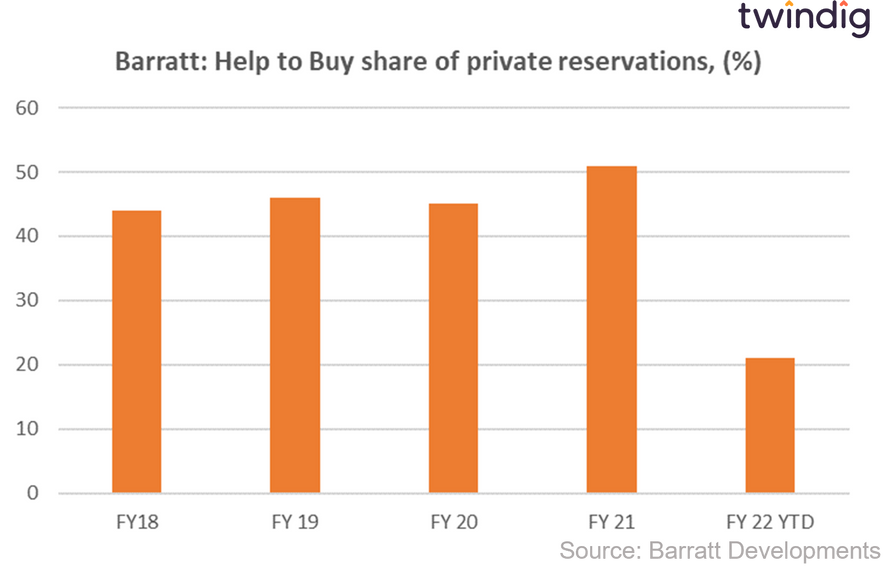

We show in the graph below data from Housebuilder Barratt Developments which illustrates how many homes it sells using Help to Buy. Over the last few years, it has been as high as 52% but never less than 44%. However, following the rule changes this share of help to buy sales fell to just 21%, from one in two sales to one in five.

Are the Help to Buy price caps reasonable?

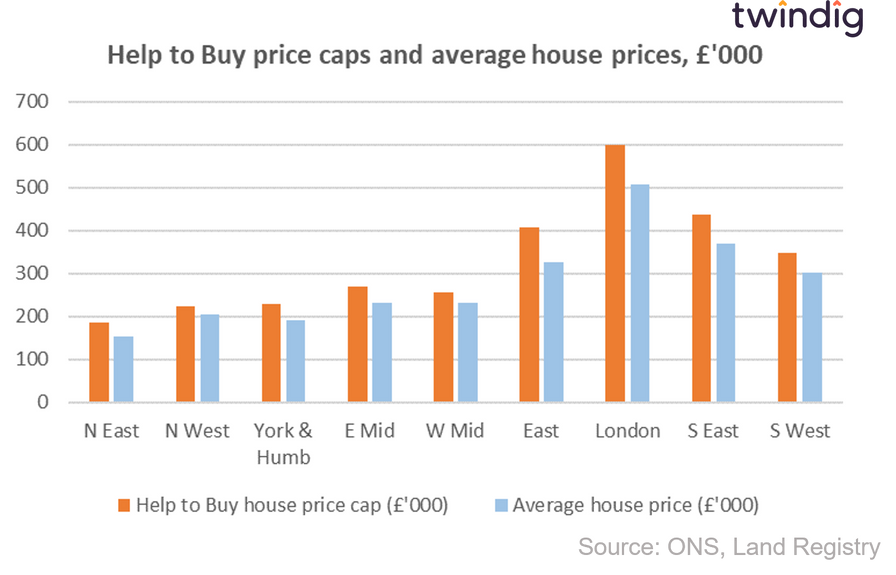

We think they are. We show in the chart below the regional Help to Buy price caps alongside the latest average regional house prices from the Land Registry.

In every region across the country, the Help to Buy price cap is higher than the average house price. Given that Help to Buy is now solely focused on First Time Buyers, the price caps, in theory, should not be a major constraint as typically first time buyers are buying smaller, less expensive houses than their more equity-rich home mover counterparts.

However, the significant reduction in sales for housebuilders such as Barratt suggests to us that many homebuyers were using Help to Buy not to get on the housing ladder, but to get further up the ladder than they could without the assistance of Help to Buy.

What next for Help to Buy?

The Help to Buy Scheme will continue in its current form until 31 March 2023 when the scheme will close. The closing of the scheme, will be a big blow for both housebuilders and deposit poor first-time buyers.

We expect that the housebuilders will adapt their product ranges to take into account the potential lost sales, but it will be much harder for aspiring first-time buyers to fill the deposit gap left by the closure of the Help to Buy scheme.