Generation buy, will it really help first time buyers?

In his virtual conference keynote speech, UK Prime Minister Boris Johnson vowed to help turn generation rent into generation buy through a Government-backed long term fixed-rate mortgage scheme. In this article, we look at what we know about the scheme, answer questions about the scheme and look at 20 most expensive and 20 most affordable areas in the country to live, if you are able to work from home and are therefore location-agnostic you might find your dream home where you least expected it.

What is the proposed ‘Generation Buy’ scheme?

The UK Government has correctly identified that the biggest barrier to homeownership in the UK is saving for a big enough deposit. The Generation Buy scheme aims to kick start the market for high Loan-To-Value (LTV) mortgages, in particular, 95% LTV mortgages, by providing Government backing to long term fixed-rate mortgages of up to 95% LTV. This means that buyers will only need to provide a deposit equal to 5% of the purchase price of the home they are looking to buy.

What form will the Government backing take?

The UK Government has yet to disclose the form and structure of the backing, although it is likely, in our view, to take the form of an indemnity guarantee in favour of the mortgage lender. This means that the Government would protect the lender from some or all of the losses arising from the mortgages it backs.

Why would the Government support the lenders in this way?

High LTV mortgages are riskier than low LTV mortgages. For example, if you purchased a house for £100,000 and house prices fell by 15%, your home would now be worth £85,000. If you had a 95% LTV mortgage you would be in negative equity of £10,000 which means that your house is worth £10,000 less than your mortgage. If you sold your house either you would have to find an additional £10,000 to pay off the mortgage or the lender would lose £10,000.

If you had purchased the same house with a 60% LTV mortgage your mortgage is for £60,000 and if you sold your house for £85,000, you can fully repay your mortgage and have £25,000 leftover, but you would also have lost £15,000 the difference between your purchase price (£100,000) and the sale proceeds of £85,000. You had a deposit of £40,000 but now only have £25,000. In this situation, you lose rather than the lender.

Lenders, therefore, charge more for high LTV mortgages than they do for less risky lower LTV mortgages.

Lenders have also significantly reduced the supply of high LTV mortgages which makes it harder for first time buyers without large deposits to get on the housing ladder.

But house prices are going up so what is the problem?

House prices are indeed going up, but lenders are worried that what goes up may come down. Some believe that the stamp duty holiday is driving up house prices. The Stamp Duty Holiday has led to an increase in the number of buyers but the supply of homes for sale has not increased to the same extent and with more buyers than sellers, prices rise. The Stamp Duty Holiday is shielding the UK Housing market from the impacts of the COVID pandemic and economic recession.

This ‘extra’ demand may disappear when the Stamp Duty Holiday ends and if we take away the protective shield and unleash the pandemic onto the UK housing market house prices may start to fall. If they fall lenders are most worried about their high LTV mortgages. The fact that lenders have reduced the number of high LTV mortgages for sale suggests to us that the lenders themselves believe that UK house prices are likely to fall.

Should I not buy a house then?

To answer that question, we need to look at the reasons for buying a home in the first place. If you are looking to buy a house purely as a financial asset then you may be better of waiting because any COVID related fall in house prices is likely to be bigger than any stamp duty saving.

However, a home is much more than a financial asset, it provides shelter, security and a place to live (and increasingly to work from) and provides a safe, secure and protected environment in which to raise a family.

If you have a housing need right now, which can be met by homeownership and you can afford to buy and are in a secure financial position then buying a home right now may well be the right thing to do.

Over the long term house prices have risen more often than they have fallen and once you have purchased a home, house price falls are only an issue if you need to sell or refinance your home (re-new your mortgage).

Is the Generation Buy Scheme a good idea then?

We believe it is. We are currently experiencing a period of extremely low mortgage rates, the ability to secure a long term fixed-rate mortgage, when mortgages rates are so low could be a very smart thing to do.

If you borrowed £100,000 at 3% pa the monthly repayments would be £472, but at a 5% mortgage rate, these payments increase by £106/month to £578. Over a 25-year mortgage term, you would pay back £141,633 if the mortgage rate was 3% but at 5% you would pay back £173,441 almost £32,000 more.

Long term fixed rates also give you long term certainty, you know what your mortgage payments will be each month for the entire duration of the fixed term.

When does the Generation Buy scheme start?

No start date has been announced, so we would advise homebuyers wishing to use the scheme to focus on saving that deposit and getting their finances in good health. Aside from the deposit, there are lots of other things to buy (such as furniture) and pay for (solicitors fees) when buying a home and few homebuyers complain that they had more savings than they needed.

Is there a catch?

We wouldn’t say that there is a catch, but high LTV mortgages do not solve every house purchase problem. We also have to look at Loan-To-Income (LTI) and Debt Service Ratios (DSR) ratios in order to work out the upper limits of what is reasonable to borrow

What is a Loan-To-Income Ratio?

The Loan-To-Income ratio is is the ratio of your mortgage to your income, or to put it another way, your mortgage divided by your income. If you borrow £120,000 and your income is £40,000 you have an LTI ratio of 3 (£120,000 / £40,000).

What is a Debt Service Ratio?

A Debt Service Ratio (DSR) can be understood as monthly mortgage repayment as a share of monthly income.

Why are LTIs and DSRs important?

Research following the Global Financial Crisis (or Credit Crunch) found that households with higher LTIs and DSRs were more likely to get into financial difficulties than those with lower LTIs and lower DSRs. The Bank of England, therefore, recommended that no more than 15% of a lender's new mortgage lending has an LTI above 4.5 or higher. LTIs go hand in hand with DSRs. The Bank of England found that when a DSR rises above the range of 35-40% the mortgage holder is increasingly likely to experience mortgage repayment difficulties.

So how much can I borrow?

With a 5% deposit, it is sensible, in our view, not to borrow more than 4.5 times your income AND to not have a DSR above 40% of your income. We would expect that any UK Government-backed scheme would work within such a framework based on either the household income of the mortgage holder or mortgage holders in the case of a joint mortgage (where you and another party – usually your partner – take out a mortgage together.

Where can I afford to buy a house?

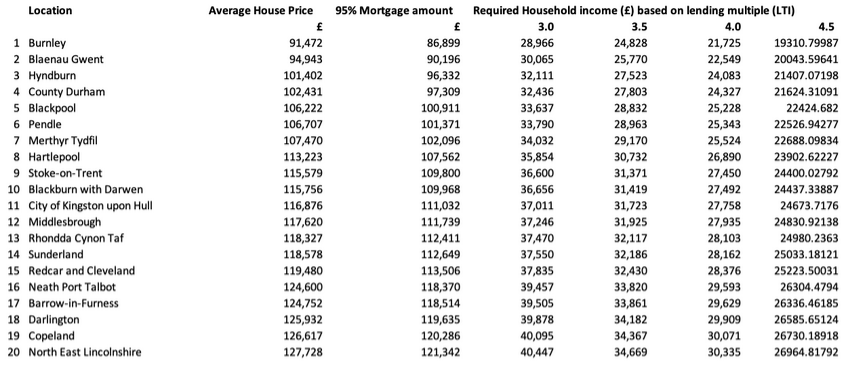

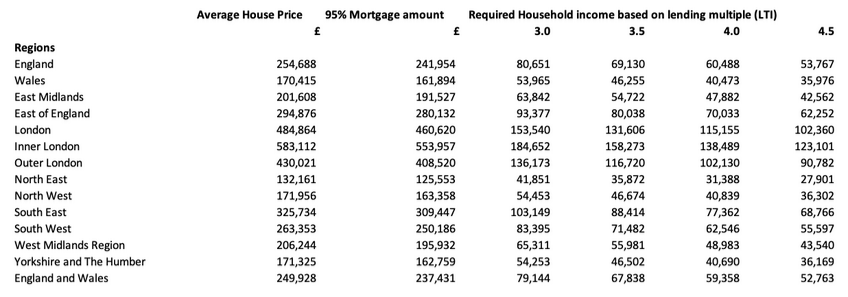

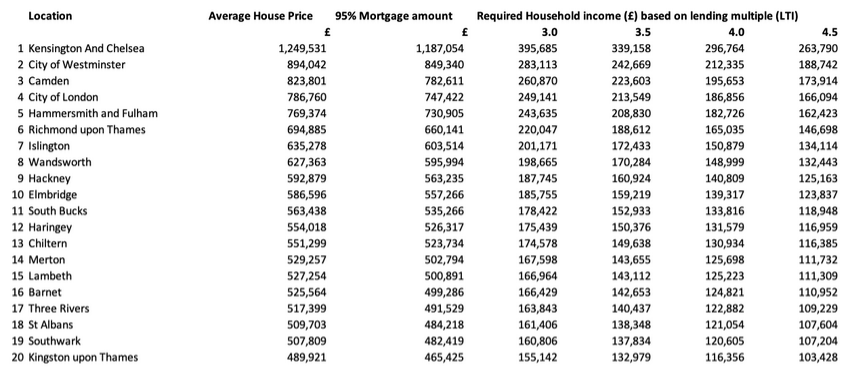

In the tables below we show average house prices by region and the 20 most expensive and 20 most affordable areas in the country.

Based on a 95% loan to value mortgage the tables show the level of household income you would need to secure the mortgage for a range of Loan to Income ratios.

Generation Buy Table 1: House prices by region

Generation Buy Table 2: The 20 most expensive areas to buy

Generation Buy Table 3: The 20 most affordable areas to buy