How the pandemic changed our homes

The Future of Home

The Future of Home is a collaborative report, published by the Nationwide Building Society, which looked at the impact of the pandemic on the housing market and how it has changed our homes. The report also used the pause caused by the pandemic as an opportunity to bring together a range of experts and organisations to take a fresh look at the key issues facing the UK housing market today: Availability, Affordability and Sustainability.

You can read the full report here or our summary below:

The impact of the pandemic on the housing market

Homeowners are happier

In the main, the Future of Home found that the pandemic magnified existing trends in the housing market as longstanding inequalities between homeowners and renters deepened. Homeowners are more content with their homes and report better physical and mental health than renters.

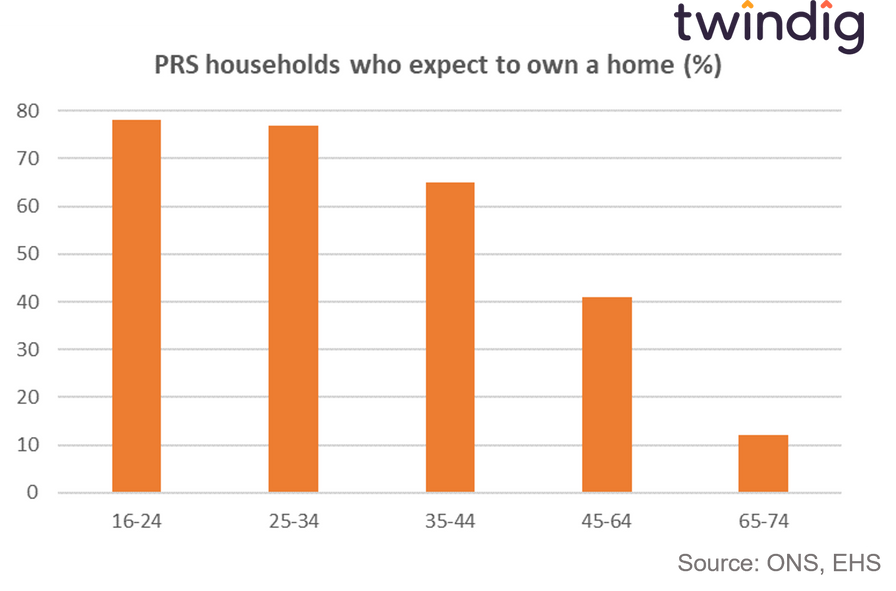

Homeownership aspirations remain high

Eight out of ten people aspire to become homeowners, this level of aspiration has been stable for a very long time. Interestingly the Future of Home Report suggests that almost two million more households would own their own home if the UK had maintained homeownership levels at their 2003 peak. Whilst homeownership aspirations remain high, for many the COVID pandemic has caused those dreams to move further away.

Escape to the Country?

We reported last week in Zoomtown-on-Sea anyone? that working from home has started to turn the tide on the long term trend towards urbanisation as they are freed from the constraints of the commuter belt.

As people move further afield, they are looking for more space: for some a room specifically for working from home, for others a garden and for many a combination of the two. In our view a moving out is a win-win, your money goes further in housing terms, and your spending boosts the local economy, which could help the levelling up we so badly need.

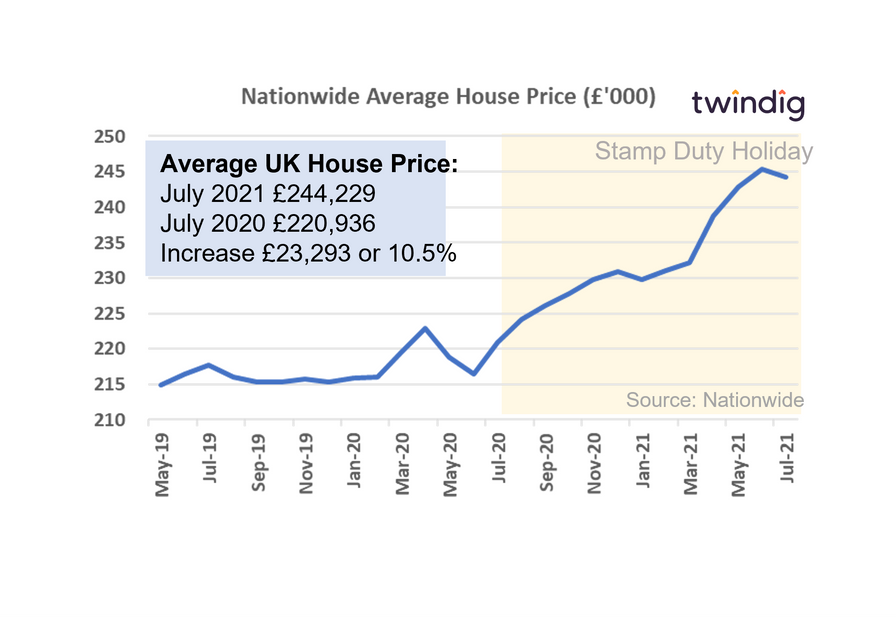

House prices rising

Perhaps the strangest result of the pandemic was the record rise in house prices, as the economy lockdown and we stayed at home house prices reached record levels. Several factors came together to drive house prices up:

Changing lifestyles Being stuck at home made many reappraise their housing needs

Limited opportunities to spend With limited opportunities to spend money, many of those who remained in work saw their savings rise and the mortgages reduce, allowing them to fund a house purchase.

Stamp Duty Holiday In our view, the largest catalyst for house price growth in the face of such uncertainty was the stamp duty holiday announced by the UK Government on 8 July 2020. Ironically, the main beneficiaries were home sellers, homeowners and those involved and earning fees and income from the selling of homes. Homebuyers were actually worse off as house prices across the country increased by significantly more than the stamp duty that was being saved.

Availability of housing

Changing tenures

Although we are a nation obsessed with homeownership, it was only in 1971 that homeownership reached a majority, and at the end of the second world war only around one in four wanted to buy their own home.

The shift came due to the availability of finance, which created opportunity and opportunity created aspirations.

Availability of finance coupled with changes in rental regulations and the launch of the Assured Shorthold Tenancy (AST) saw the explosion of the buy to let market pitting property investors against first-time buyers a battle largely won by the investors.

Changing homes

The supply of homes is, to a large extent, governed by the planning regulations. For instance, Planning Policy Guidance 3 (PPG3) steered policy away from the development of large spacious family homes on greenfield sites towards higher density developments using brownfield or urban locations wherever possible. Some might argue that this lead to a higher number of smaller homes and apartments being built in places where people didn’t want to live and a lower number of homes built where they did…

The pendulum started to swing the other way following the credit crunch and the launch of Help to Buy as urban centres were avoided and more family homes were built than apartments.

The upshot of these policy toings and froings is that we have a mismatch of supply and demand of homes. We have too few family homes and too few age-appropriate homes for older households and perhaps too many small homes and apartments.

It is difficult to adjust the mix of housing in the short term. The UK has a housing stock of around 28.5 million homes and, in a good year, we build around 300,000 – a replacement rate of almost 100 years. This supply and demand imbalance leads us to the next big issue facing the UK housing market: Affordability.

The housing affordability paradox

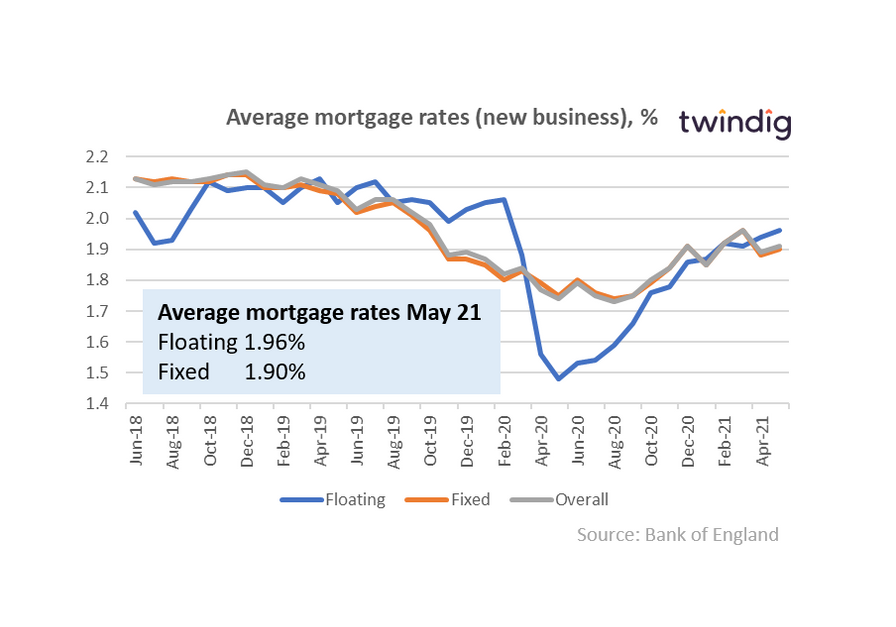

Mortgage rates are low

Many ask why, with interest rates at their lowest for 300 years, why is it so hard to get onto the housing ladder?

The simple answer is that house prices are high compared to incomes. One of the most used housing affordability measures is the house price-earnings ratio (house prices divided by your income – or how many years of income you need to buy a home).

The house price-earnings ratio is close to its all-time high. According to Nationwide, the average first-time buyers home costs 5.6x the average income, compared to the long-run average of 3.7x.

A mortgage company will limit how much it will lend to a homebuyer and this is often expressed as an earnings multiple. If your mortgage provider will lend 4x your income, but the house price is 5.6x, you will need a deposit of 1.6x your income (1 year and 7 months of gross income)

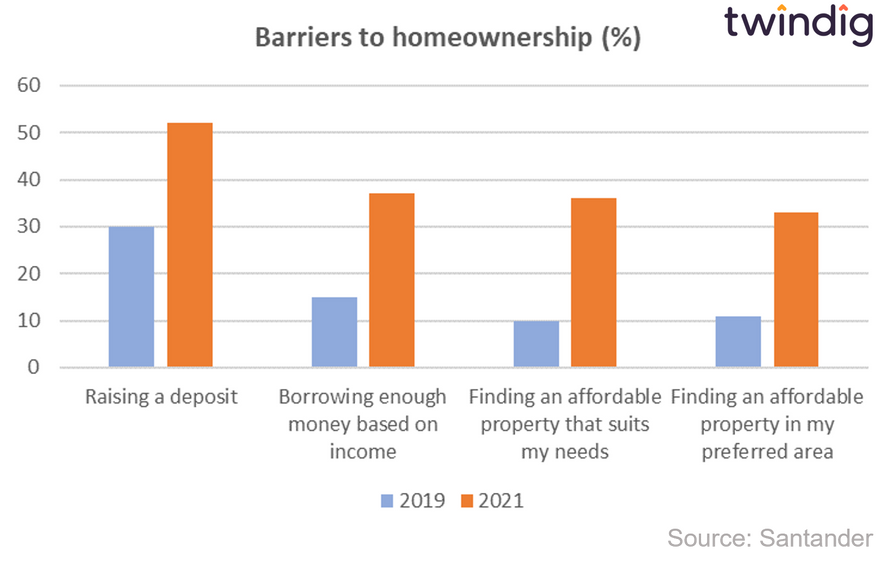

But, deposit requirements are high

Nationwide believes that although almost one in five renters are currently saving for a deposit, it will take them between 6 and 16 years to save for the required deposit.

Research from lenders Nationwide and Santander both conclude that saving for a deposit remains the biggest barrier to homeownership and that the COVID pandemic has raised the deposit barrier.

Bank of Mum and Dad

Research from Nationwide earlier this year found that in 2018-19 around 40% of first-time buyers used money from either an inheritance, gift or loan from family or friends to help raise a deposit, up from 25% in 1995-96.

Sustainability

As climate change continues it is becoming clear that Governments around the globe are turning to taxation to encourage more climate-sensitive behaviour. Be it the growing use of city-centre congestion charges or the phasing out of diesel and petrol-powered cars and subsidies for buying electric vehicles, tax is turning green.

Home carbon emissions

The Nationwide reports that the UK’s homes directly produce around 15% of the UK’s carbon emissions. When it comes to carbon neutralising our homes there are challenges ahead.

For many, costs are the biggest barrier to reducing their home’s carbon footprint. Guy Anker of Money Saving Expert points out that more people are using green energy now that there is no longer a premium for getting it, he points out that ‘When it cost more, there wasn’t that demand’.

In our view aside from taxing homes with lower EPC ratings, the UK Government will need to support a range of ‘green home loans’ to help and encourage homeowners to makes the investments required to reduce their home’s carbon emissions.

Unfortunately reducing carbon emissions from our homes will not be as easy as reducing them from our cars. Research from the BRE Trust found that the UK has the oldest housing stock in Europe with 10 million homes built before 1944 and almost 6 million over 100 years old. These cannot all be easily replaced or adapted.

Whilst we are left scratching our heads as to how to solve the sustainability issue, we take heart from the fact that when J F Kennedy announced he was going to put a man on the moon he didn’t know how it was going to be done, but the clever experts found a way. The task ahead of us is a bigger one and it impacts all of us, we hope that together we will find and implement a solution.