Could house prices actually rise this year?

The Balance of market news was positive this week. Persimmon, one of the UK’s largest housebuilders published a robust set of first-half results and was confident about its prospects for the second half. HMRC housing transaction data showed that housing transactions have now been increasing for three months in a row. The data is provisional and subject to change, but the direction of travel is positive. The L&G Mortgage club’s latest research found out what estate agents and housebuilders already knew, there are more buyers than sellers which will keep prices firm whilst transactions are low.

Persimmon

H1 2020 results from one of the UK’s largest housebuilders

What they said

- Number of homes sold 4,900 (down 35%)

- Average selling price £225,066 (up 3.7%)

- Forward sales value £2.5bn (up 21%)

- Cash on Balance Sheet £829m (H1 19 £833m)

Twindig Take

Persimmon’s results remind us of the Credit Crunch, where the volume of housing transactions took a bigger hit than house prices. Peak to trough housing transactions fell 50% but house prices fell ‘only’ 20%. House prices are shielded but the ‘shortage’ of housing transactions. We expect the same theme to play out during the COVID Crunch.

Persimmon reported that house prices increased in the first half and are expected to nudge up further in the second half. This suggests that demand is outstripping supply and is further evidence that the paucity of supply is underpinning house prices.

The Group also expects to complete more homes in the second half of 2020 than it did in the second half of 2019, further evidence that new homes are in demand and that UK homebuyers are not letting COVID get in the way of major life decisions.

Persimmon not only hit the ground running when the housing market re-opened it left the blocks quicker than Usain Bolt. It was able to do this because it was match ready, it didn’t furlough staff, it kept paying subcontractors it kept sales offices open. Taken together these actions allowed it to gather extremely detailed market intelligence to build a complete ‘real-time’ picture of housing demand and have the productive capacity in place to meet this demand when the market re-opened.

The only note of caution we could see in the results was that the Group remains cautious on land purchases. One could say that is because they have enough land already, but many a housebuilder will tell you that ‘you can never have enough land’. In our view, it is because they believe that there will be better land deals to be struck in the future than today.

Land Registry Housing Data

The gold standard of house price and housing transaction data for the UK

What they said

- Average UK house price in April 2020: £234,612

- Up 2.6% in the year to April 2020

- Down 0.2% during April 2020

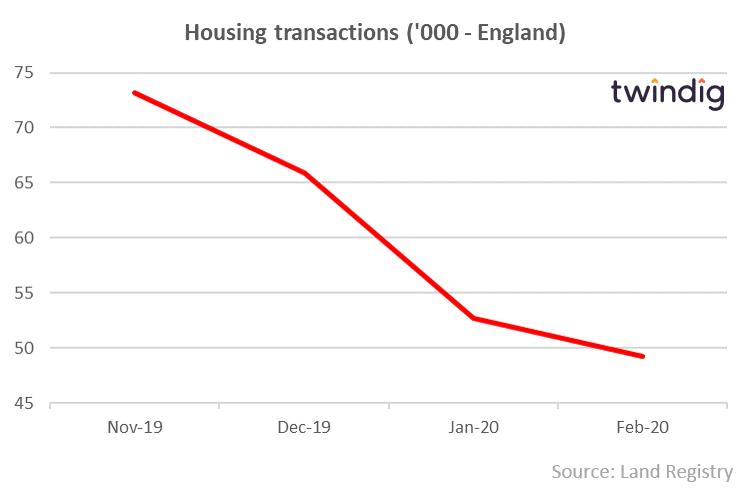

- Housing Sales volumes February 2020: England 49,194 (down 14% on February 2019)

Twindig Take

Further evidence that housing transactions are hit harder than house prices in times of market stress. The Land Registry house price data for April 2020 tells a similar story to that of the Halifax House Price index, adding credence to the Halifax figure rather than adding new information.

The transaction data is however new and is very interesting. Many have spoken of the ‘Boris Bounce’ that a clear election result in December reduced uncertainty allowing the UK housing market to get moving again. However, we see no evidence of the bounce in the Land Registry data housing transactions in England have been in decline since December 2019 well before the start of the COVID crunch and in the three months ending February 2020 were 7.5% below the same period last year. Housing transactions were therefore already falling before the COVID crunch and before lockdown.

It will be interesting to see what the actual transaction levels were in March, April and May and to see how the rest of 2020 unfolds.

HMRC Housing transaction data

The first provisional look at the most recent level of housing transactions

What they said

- The provisional seasonally adjusted estimate of UK residential property transactions in July 2020 is 70,710

- 27.4% lower than July 2019 and

- 14.5% higher than June 2020

Twindig Take

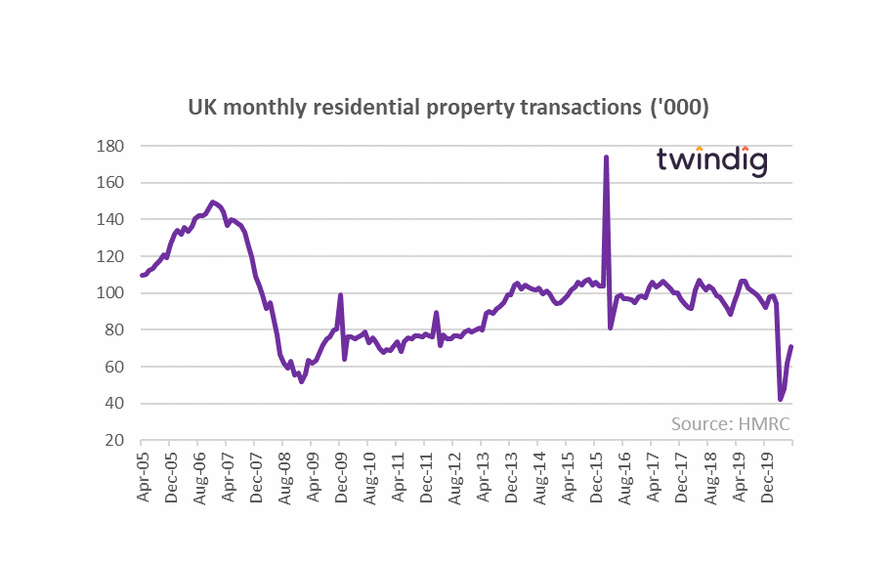

It is no surprise that housing transactions have increased since the market re-opened. The increase is not quite the ‘v’ shaped one we have seen in retail sales, but the housing market is not as fast-moving as the retail and consumer goods markets and the supply of houses is much more constrained than the supply of retail goods. However, the fact that housing transactions are increasing since the re-opening of the market is a good thing.

It is too early to see if the Stamp Duty Holiday is working, but such holidays usually lead to a rush of transactions as the holiday ends rather than a steady increase during the holiday itself as illustrated in the graph where the spikes are either the end of a stamp duty holiday or a change in stamp duty rates

L&G Mortgage Club

Research shows demand for homes dwarfs supply

What they said

- 25% planning to buy and a further 28% considering buying a home

- 4% looking to sell and a further 12% considering a sale

Twindig Take

If the L&G data is indicative of the whole market we could see house prices rise rather than fall this year as the number of buyers significantly exceeds the number of sellers. In London, 69% of survey respondents were looking to buy but only 12% looking to sell. In Wales 50% looking to buy and 11% looking to sell and for Scotland the figures were 49% (looking to buy) and 17% looking to sell. The smallest gap was in the South West, but even here demand was significantly ahead of supply with 52% looking to buy and 23% looking to sell.

The lifeblood of the UK housing market is the volume of transactions. Demand is great, but without supply, we may see fewer transactions and higher prices which will put an end to the dream of homeownership for many aspiring first time buyers.