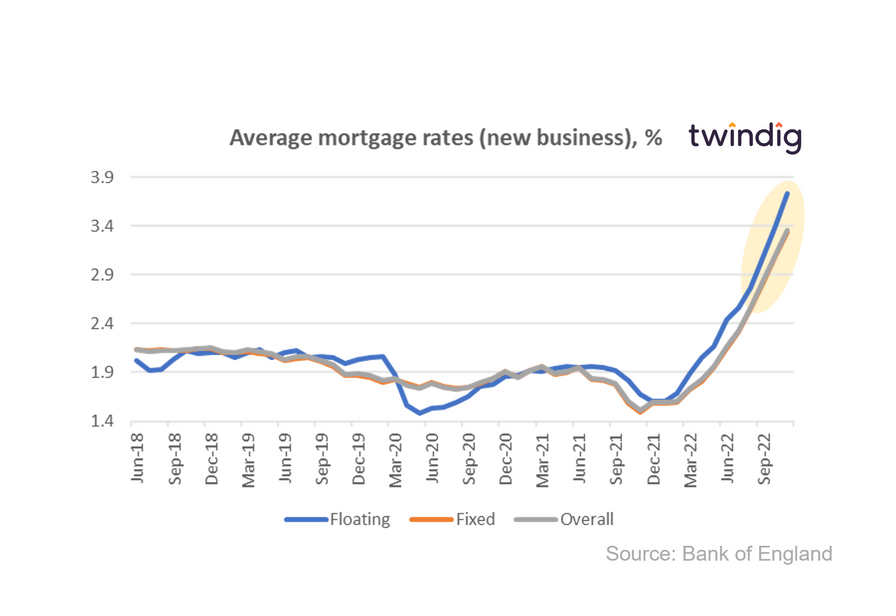

Mortgage rates more than double in a year

The latest data from the Bank of England revealed that overall average mortgage rates for new business increased again in November 2022, rising by more than 8%.

What the Bank of England said

The average floating mortgage rate for new business was 3.73%

The average fixed mortgage rate for new business was 3.34%

The average overall mortgage rate for new business was 3.36%

Twindig take

Once again mortgage rates have risen, and in our view, they are likely to keep rising as the Bank of England raises interest rates (Bank Rate) to tackle inflation.

Average UK mortgage rates increased by 8.4% in November to 3.36%, with much of this increase driven by the impact of the mini-budget on the financial markets and the recent increases in Bank Rate.

Average floating rate mortgage rates increased by 9.7% in the month to 3.73% some 122% higher than they were one year ago when the average floating rate was just 1.68%.

Average fixed-rate mortgage rates increased by 8.1% to 3.34%, some 124% higher than they were in November 2021 when the average rate was 1.49%

Overall the average mortgage rate increased by 8.4% in October to 3.36% which is 123% above its November 2021 level of 1.51%.

If you are worried about your mortgage payments or want to see the impact of changes to mortgage rates on your mortgage payments, you can use our mortgage payments calculator by clicking the link below: