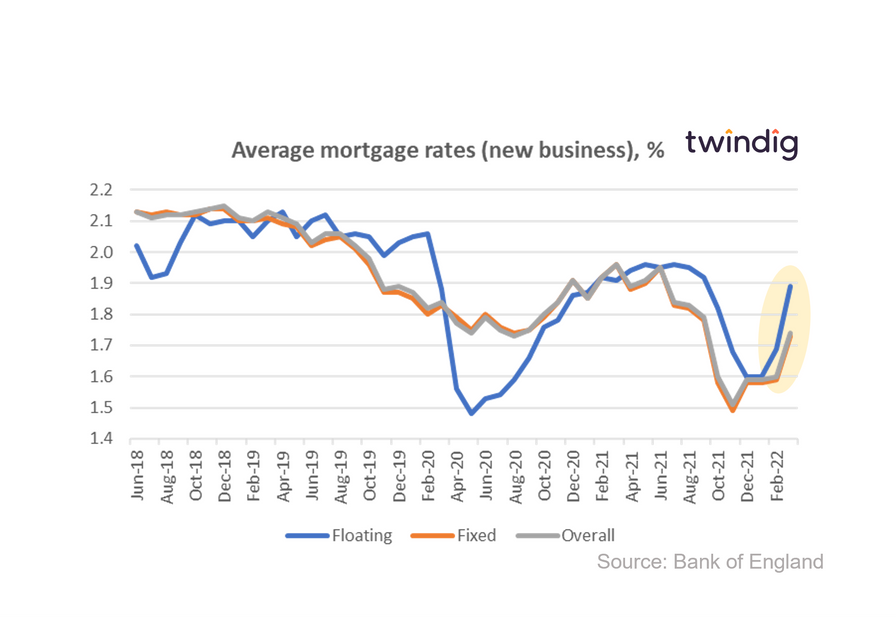

Average mortgage rates leap in March 22

The latest data from the Bank of England revealed that overall average mortgage rates for new business increased significantly in March 2022.

What they said

The average floating mortgage rate for new business 1.89%

The average fixed mortgage rate for new business 1.73%

The average overall mortgage rate for new business 1.74%

Twindig take

The graph above says it all really, 'hold on to your hats, mortgage rates are going up!'

Average mortgage rates for new business (those mortgages agreed during March) increased at a faster rate than they did during the early stages of the COVID-19 pandemic.

Should we be worried at the pace of mortgage rate rises?

The graph above says it all really, 'hold on to your hats, mortgage rates are going up!'

Average mortgage rates for new business (those mortgages agreed during March) increased at a faster rate than they did during the early stages of the COVID-19 pandemic.

In our view, the increases in average mortgage rates are more a reflection of the recent hikes in Bank Rate than lender's concerns about the near or medium-term future of the UK housing market. The Bank of England's Bank Rate sets the tone for all other interest rates and as Bank Rate rises from historic lows, it is inevitable that mortgage rates will follow.

However, although the rate of change in mortgage rates in March was significant, in absolute terms, mortgage rates remain very low. The average mortgage rate for a new floating rate mortgage in March was 1.89%, somewhat less than my first floating rate mortgage rate of 6.79% albeit some 23 years ago...

Mortgage rates are likely to continue to rise for the foreseeable future, so although the record lows are behind us, there will still be a period of opportunity where those buying a home and those remortgaging their existing home will be able to secure relatively low mortgage rates.