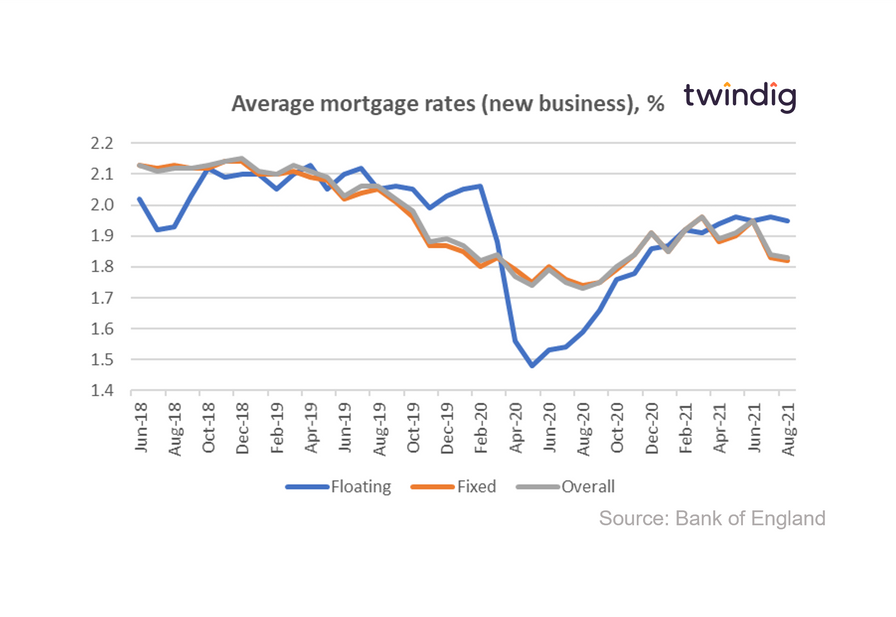

Mortgage rates continue to fall

The Bank of England released the latest average mortgage rate data this week.

What they said

Average floating mortgage rate 1.95%

Average fixed mortgage rate 1.82%

Average overall mortgage rate 1.83%

Twindig take

Average mortgage rates fell across the board in August. The average floating mortgage rate for new business (residential mortgages agreed in the month) fell by 0.51% to 1.95% and fixed rates for new business fell by 0.55% to 1.82%.

A fall in mortgage rate typically means that mortgage lenders are looking to grow market share and are feeling more positive about the outlook for house prices and the prospects for the UK housing market.

Interestingly new business mortgage rates are now lower than they were in January 2020 before the start of the COVID-19 pandemic.

Despite the falling mortgage rates, the number of mortgages approved in August also fell. This may suggest that homebuyers are less sanguine about the housing market than the lenders themselves, although, in our view, it is more likely to be due to the impending ending of the stamp duty holiday - demand falling as homebuyers will now not benefit from the stamp duty savings.

In our view, the outlook for mortgage rates is positive. There appears to be little pressure to raise the underlying Bank Rate and lenders will be fighting hard to win new mortgage business as the housing market pauses for breath in the weeks following the end of the stamp duty holiday.

With the stamp duty holiday heat taken out of the housing market now could be a good time to start thinking about buying.