One up three down

The Royal Institution of Chartered Surveyors (RICS) released their UK residential survey for July today

What they said

New buyer enquiries and newly agreed sales dip over the month

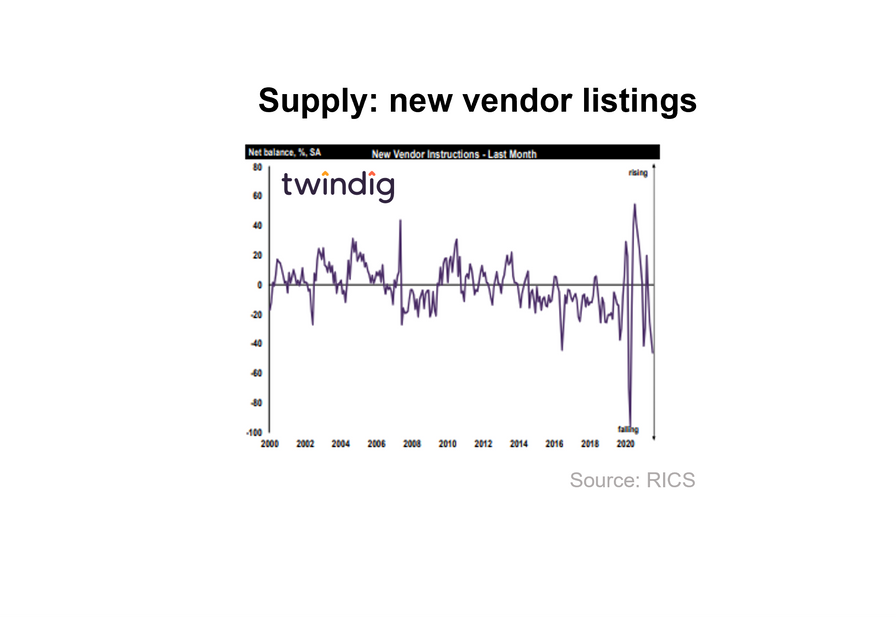

The volume of fresh listings coming onto the sales market remains in decline

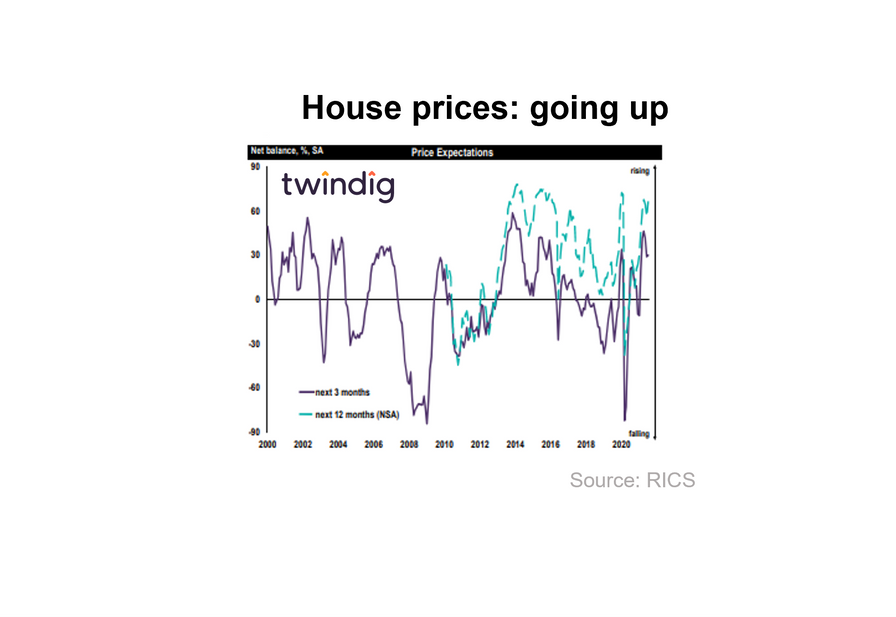

Lack of supply still underpinning house price growth

Twindig Take

Following the first step down in the Stamp Duty Holiday benefit, it is of no huge surprise that housing market activity in July was lower than that seen in June as homebuyers rushed to complete their house purchases before the 30 June to take advantage of the £500,000 Stamp Duty Holiday limit before it reduced to £250,000 on 1 July.

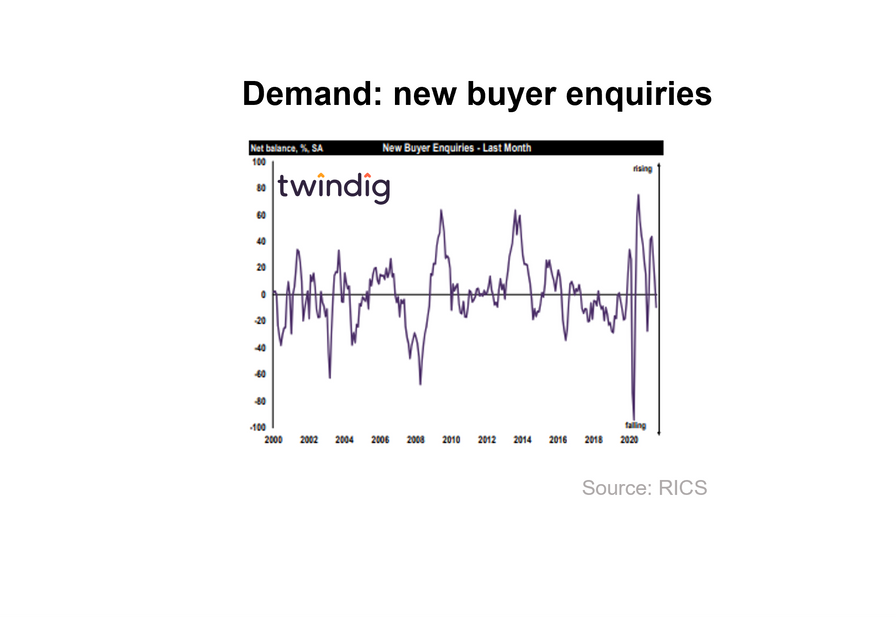

Falling demand

At a national level, RICS reported that the net balance of new buyer enquiries had a net balance of minus 9% (-9%) ending a run of four successive positive balances in the previous four months as the stamp duty race got well and truly underway.

Newly agreed sales fell, posting a net balance of minus 21% (-21%) compared to a neutral reading in June.

Falling supply

As widely reported by the agents we are regularly in contact with new listings (the number of homes being listed for sale on the market) fell to minus 46% (-46%) on a net balance basis in July, the weakest reading since April 2020 the first full month of lockdown one.

Rising house prices?

It might seem odd that when the lead indicators of supply and demand appear to be falling that we expect house prices to continue to rise. We believe that the tight supply will underpin prices and that for those who have to move it will continue to be a seller's market.

RICS members appear to agree with us, a net balance of 66% (+66%) anticipate that house prices will be higher in a year than they are now.

Where is the catch? (falling housing transactions)

The ‘catch’, although we do not see it is as a catch is that transaction levels are likely to fall. So whilst home sellers may be sitting pretty those who make their money from transaction-based fees (ie estate agents) may find themselves tightening their belts after the stamp duty holiday period of fun and feasting.