UK housing market: The morning after the night before

Another strong week for housebuilders and house prices, with the Halifax House Price index reaching a record high in October, but will November turn out to be the “morning after the night before” as Lockdown II starts to bite? Or does the furlough scheme extension just push the hangover further down the road? Twindig investigates

Twindig Product News

Remember Remember Twindig reminders

In case you missed our ‘Remember Remember’ campaign – a quick reminder that you can set reminders in your twindig profile.

Whether its that boiler service, remembering to change energy tariffs or dare we say it.. that important birthday

Click: How to set a reminder in Twindig and we will take you through the process step by step

Can I move home during lockdown?

As we have now entered ‘Lockdown II’ many people have asked us am I able to move home during lockdown? The short answer is yes, but the longer answer is not as clear cut you can read our guide here: Can I move home during lockdown?

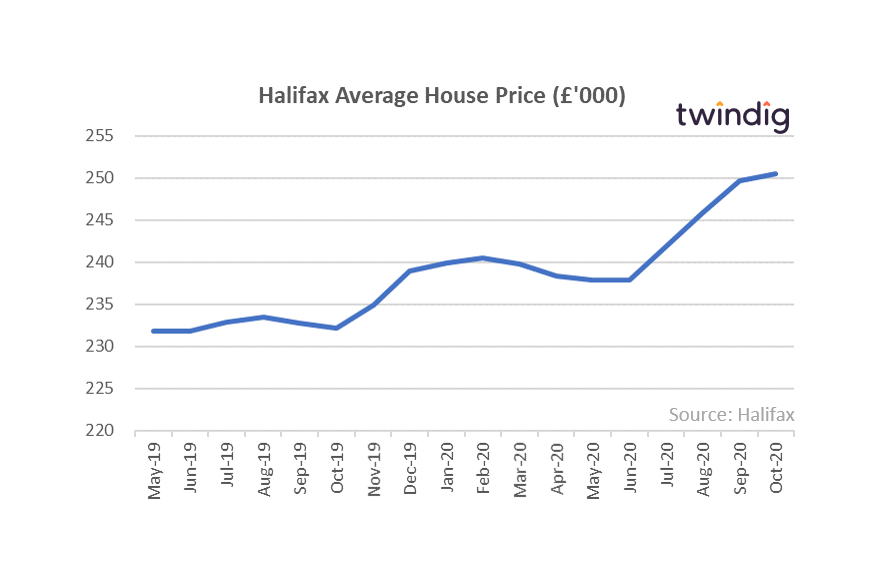

Halifax House Price Index

The UK's leading house price index published its October update on Friday

What they said

Average UK house prices rose by 0.3% in October to reach a record high of £250,457

The annual increase was 7.5% the strongest growth since the EU referendum

We expect to see greater downward pressure on house prices in 2021

Twindig Take

The Halifax reported that whilst house prices continued to increase in October 2020 to £250,547 the rate of growth is slow, up just 0.3% in October compared to a rise of 1.5% in September. Halifax also expects to see downward pressure on house prices as we move into 2021.

It seems that the short-term fix of the stamp duty holiday is just that, a holiday, providing an escape from the underlying reality of an economy in the doldrums and without an artificial stimulus house prices are likely to deflate. There is a grey cloud approaching, but perhaps a silver lining for those who will miss the stamp duty deadline – competition for homes as well as their prices may be lower next year.

Crest Nicholson

UK housebuilder issued its full-year trading update this week

What they said

Current sales rates slightly ahead of pre-Spring Lockdown level

Forward sales up 14% by number of homes

Forward sales up 27% in value terms

Reinstatement of dividend at 2.5x cover

Changes in customer behaviour due to WFH

Twindig take

The housing market is certainly open for business and whilst there are buyers in the market Crest Nicholson is very happy to sell homes to them. It is good to see a business (and sector) performing well in these challenging times.

We were particularly interested to see how WFH (Working From Home) has changed home buyer behaviour, which suggests they are seeing this as a permanent shift rather than a short term workaround. The ability to WFH which incorporates both internal space and high-speed broadband and the desire for outside space in a world of social distancing provides housebuilders with a great opportunity to innovate and cater to this emerging market.

Redrow

What they said

Average selling prices up 2% to £396,000

Forward sales up 10% on this time last year at £1.5bn

The Group continues to scale back its London operations

Dividend expected to be reinstated at the half-year

Twindig Take

Redrow has made good progress against the headwinds of the pandemic with house prices and orders ahead of the same period last year. As at 30 October, the Group had net cash of £115m and expects to be cash positive for the remainder of the financial year.

Redrow issued a positive trading update today. They are selling more homes at higher selling prices they have cash on the balance sheet and expect to reinstate the dividend at their half-year. However, the most insightful commentary refers to the shift in buyer behaviour. Redrow continues to scale back its London operations, WFH is moving us from the ‘commuter belt to the computer belt as households seek homes suitable for WFH outside of urban centres with outside space and high-speed broadband. Every day we see more evidence that WFH is a permanent shift rather than COVID Coping mechanism.