UK housing market: Does the UK housing market have herd immunity?

The UK Housing market continues to bounce back: house prices, mortgage approvals and mortgage rates all continue to rise. If it suffered at all from COVID-19 it did so with short rather than long COVID-19, however will its apparent immunity last or will the newly emerging virus strains cause the housing market to tumble. Whilst staying at home and within our support bubbles keeps us safe, housing bubbles rarely last and when they do burst, there are usually casualties. Is the housing market too big to be de-railed by COVID-19 or will it be a case of the bigger they come, the bigger they fall?

Bank of England Mortgage Approvals

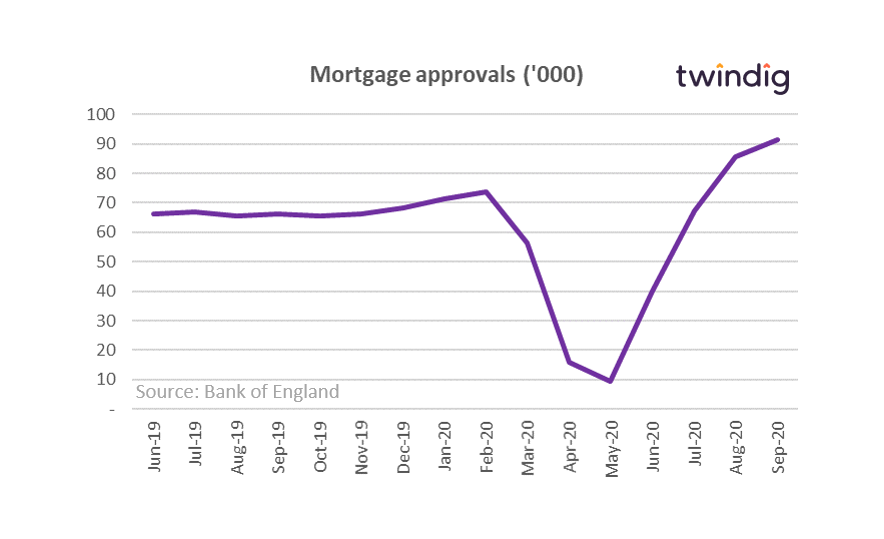

This week the Bank of England released its mortgage approval numbers for September 2020

What they said

Mortgage approvals for September 2020 were 91,454

This was an increase of around 7% over August 2020

This was an increase of 38% over September 2019

Twindig take

Mortgage approvals in Sep 2020 were 91,454 their highest level since Oct 2007. The number of Mortgage approvals is growing, but the growth is slowing and a mortgage approved is not a sale completed, but nonetheless, it shows the UK’s lenders are open for business when it comes to residential property.

Time will tell if these transactions in waiting complete before the end of the stamp duty holiday and with Lockdown II looking ever closer we should we wary of counting these approvals as transactions before they’ve hatched.

Bank of England Mortgage Rates

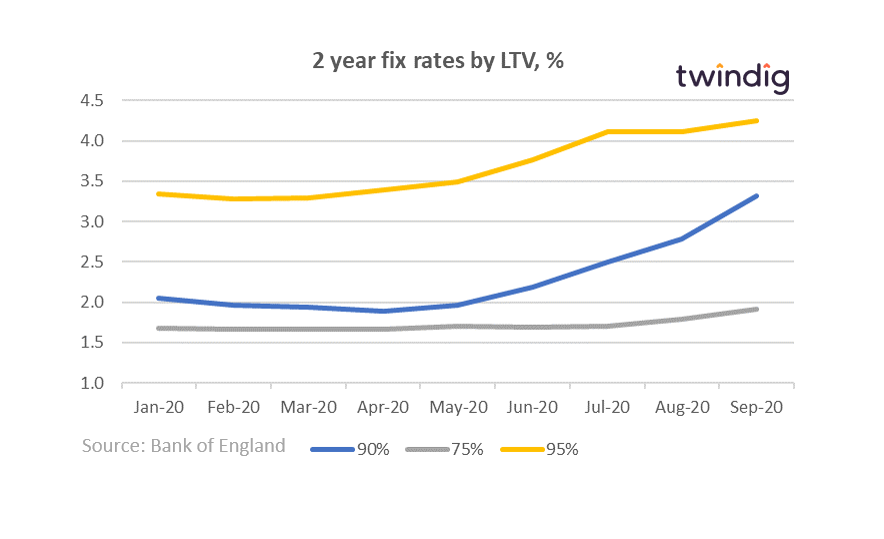

The Bank of England Bank Statistical release also included data on mortgage rates for September 2020

What they said

Mortgage rates continued to increase

90% LTV 2 year fixed mortgage rates increased by 19% in September to 3.32%

75% LTV 2-year fixed mortgage rates have increased by 23% since January 2020 to 1.74%

Twindig take

Interestingly, both mortgage rates and mortgage approvals are increasing, normally, one would expect demand to fall as prices rise, but we are not living in normal times. Either the banks are capitalising on the apparent housing market recovery to increase their profits (to make hay whilst the sun shines) or, despite positive comments on business activity levels, they are concerned about what is around the corner and are pricing in more risk. Time will tell and the truth probably lies somewhere between the two.

Nationwide House Price Index October 2020

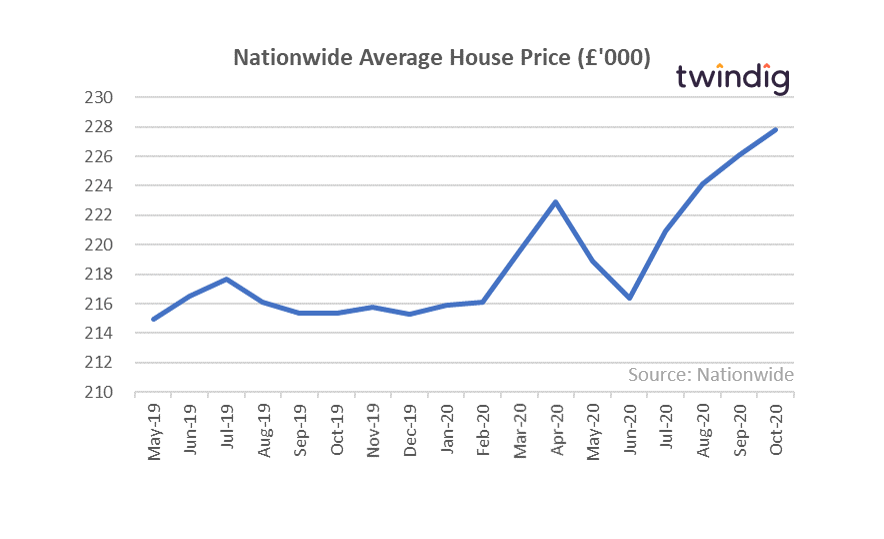

Nationwide released its House Price Index for October on Friday

What they said

Annual house price growth reached a five-year high in October at 5.8%

Average house prices were up 0.8% month on month

Twindig Take

In October annual house price growth reached a five-year high of 5.8%, the highest rate since January 2015. However, it is not clear why house prices should rise as the economy weakens and lockdown II looms large. Perhaps being told we are safer at home gives us false confidence in the value of our homes? One thing is clear, as furlough ends, redundancies increase and second waves rise there will be is less to be cheerful about than the house price headlines suggest.

Foxtons

Foxtons the London based estate agent issued its third-quarter trading statement this week

What they said

Business activity increased significantly in the third quarter

Lettings revenue down 10%

Sales revenue down 8%

Mortgage revenue up 4%

Twindig take

The macroeconomic data we have discussed so far is all very positive but at the coal face Foxtons painted a less rosy picture. Foxtons did say that business activity increased significantly in the third quarter, but their revenues were still down 10% on the prior year, suggesting that Foxtons glass is more than half full. Lettings revenue fell due to lower demand from overseas students and corporate relocations and sales revenue was down 18% caught between the rock and the hard place of a hangover from lockdown and uncertainty about the future driving higher transaction fall through rates.

Foxtons results seem at odds with the high- level optimism with the national levels of house prices and housing transactions and point to a fragile housing recovery beneath the bravado. A case of two in the bush rather than one in the hand.

Lloyds Banking Group Q3 results

High street lender Lloyds Bank issued its Q3 financial results this week

What they said

Activity levels picked up in Q3 after a contraction in the first six months of 2020

The outlook remains uncertain given the second wave of coronavirus

Impairment charges for the full year in the range of £4.5 billion to £5.5 billion

Twindig take

Lloyd’s base case for house prices is now less pessimistic they expect house price growth in 2020 of 2% whereas in June they were forecasting house price falls of 6%. Looking to 2021 they expect house price falls of 4% compared to their June forecast of a fall of just 0.1%. The impact of the pandemic being less severe but longer-lasting. If house prices were to fall by 4% next year then those looking to saving money via the stamp duty holiday may find that they can save even more by postponing their purchase until next year.