40-year mortgages – Friend or Foe?

In a digital world characterised by short attention spans and a desire for instant rather than deferred gratification Habito is launching a range of long-term fixed-rate mortgages ranging from 10 to 40 years. But are such long term mortgages a good thing? Does the instant gratification of lower monthly mortgage payments risk blinding us to the total cost? There is also a risk that the lower monthly payments that enable homebuyers to borrow more will and push up house prices

Advantages of a long-term mortgage

Certainty

The fixed-rate mortgages provide certainty as the monthly payments will not change over the life of the mortgage.

Fewer mortgage arrangement fees

The Habito One mortgage comes with a fixed fee of £1,995. Habito believes that the average mortgage fee is around £1,000, which suggests if you used 2-year fixed-rate mortgages over a 30-year term, those fees would add up to £15,000.

No exit fees

The Habito One mortgage does not have any exit fees or early repayment charges.

Lower monthly payments

Borrowing the same amount of money over a longer period leads to lower monthly payments assuming the same mortgage interest rate.

Disadvantages of a long-term mortgage

The cost of certainty

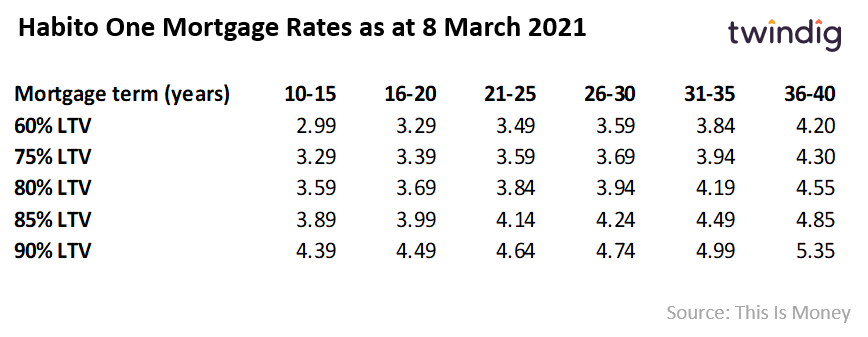

Certainty comes at a cost, the mortgage rates are higher than those charged on mortgages of shorter duration. The latest data from the Bank of England reports that the average mortgage rate on a 60% LTV 2 year fixed rate mortgages is 1.31%, compared to Habito’s 10-year rate of 2.99% rising to 4.20% for a 40-year mortgage and 5.35% for a 90% LTV 40-year mortgage

Lower monthly payments, but higher cost overall

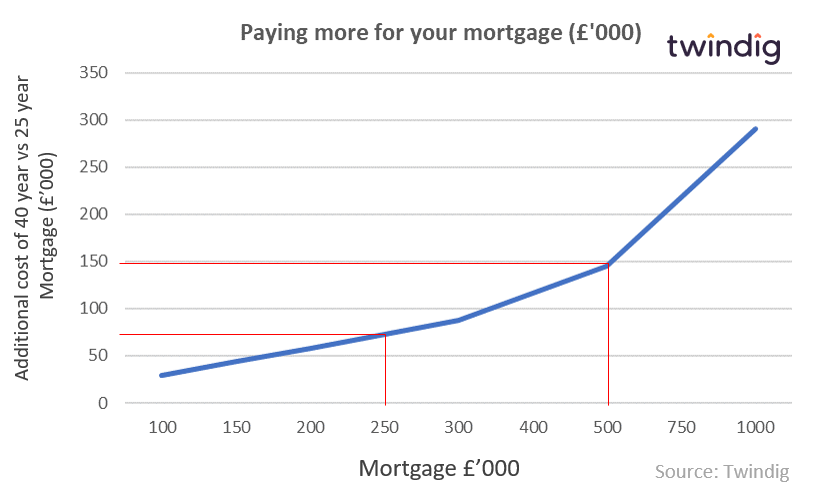

Spreading the mortgage over a longer period leads to lower monthly payments, but you will make more payments.

For instance, if one borrowed £250,000 with a mortgage rate of 3% over 40 rather than 25 years, the monthly mortgage payments would be £1,180 over 25 years or £889 over 40 years, the longer mortgage payments being £281 lower per month. However, the payments across the extra 15 years add up and the 40-year mortgage will cost £72,705 more over the life of the mortgage.

We show below the additional amounts paid by choosing a 40-year rather than a 25-year mortgages cost assuming a 3% mortgage rate

The dangers of long term mortgages are similar to those of interest only ones.

There is a danger that homebuyers will be attracted to a longer-term mortgage because of the lower monthly payments, without considering the total cost of the mortgage. The good news is that with a repayment mortgage there are no nasty (interest only)surprises at the end, but the bad news is that you will have paid more for your mortgage than if you had borrowed over a shorter term. Long term mortgages, therefore, penalise those with lower cash flow.

Will longer mortgages lead to higher house prices?

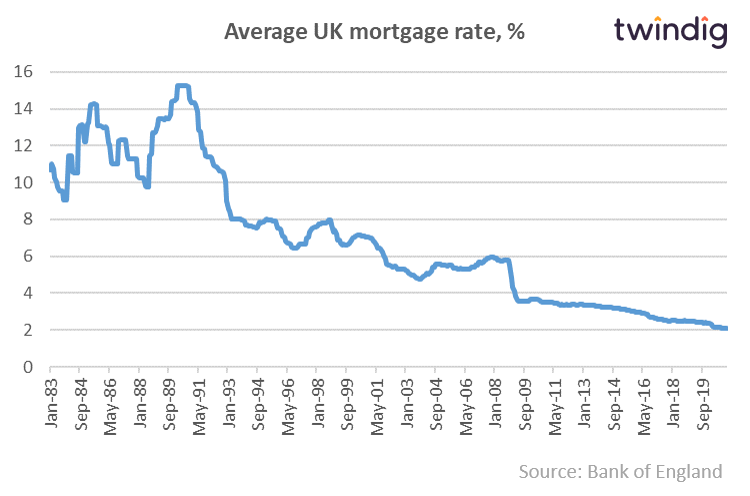

Many believe that the reduction in mortgage rates over time led to an acceleration of house price inflation. Lower mortgage rates meant that homebuyers could borrow more money and these larger mortgages pushed up house prices. Long term mortgages have a similar impact, allowing a homebuyer to borrow a larger sum, the lower monthly payments mean a household can fund a larger mortgage, which may push up house prices. Ironically a product that is, in part, designed to help first-time buyers to get on the housing ladder may actually make it harder to get on the first rung.

How much does the Habito One mortgage cost?

Weshow in the table below the initial mortgage rates charged by Habito One at its launch as reported in This Is Money

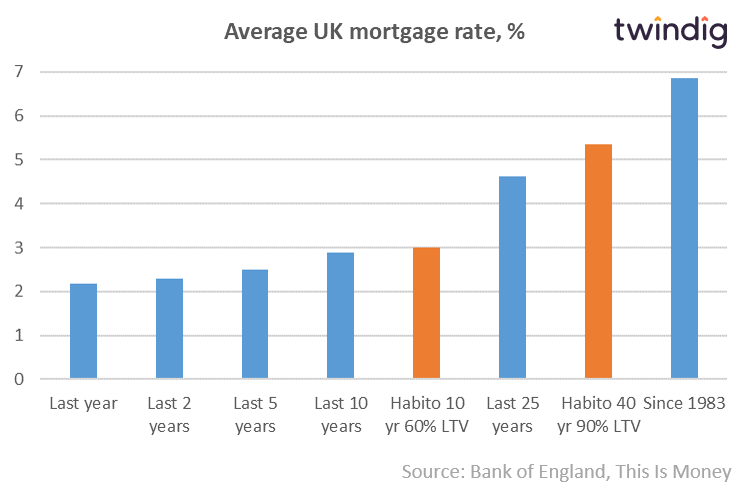

How Competitive are Habito One mortgage rates?

We show in the graph below the average mortgage rates over differing time periods compared to the range of Habito One mortgage rates. Whilst the rates are higher than the current average mortgage rate with respect to longer time periods they are broadly in line with historic average mortgage rates.

The past of course is no predictor of the future, but Habito's rates are not out of step with historic trends and with mortgage rates currently at or near record lows the longer-term trajectory of mortgages is more likely to be up than down, in our view.

For completeness, we show below a chart of average UK mortgages rates since January 1983