First Time Buyers Face an Uphill Struggle

This article sets out the key statistics relating to first-time buyers in the UK from how many there are to how much do they pay for houses and how big a deposit do they need. The statistics speak for themselves: first-time buyers face an uphill struggle to get onto the property ladder.

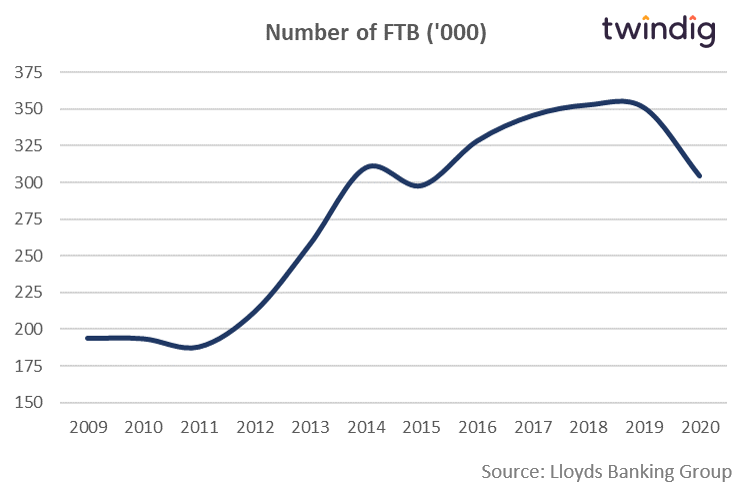

1. How many first-time buyers are there?

In 2020 there were 304,657 first time buyer housing transactions, 13.3% fewer than in 2019 (351,260). The increase in numbers of first-time buyers from 2013 was aided by the UK Government's Help to Buy Scheme which allowed first-time buyers to buy a new home with a low deposit (from as little as 5%).

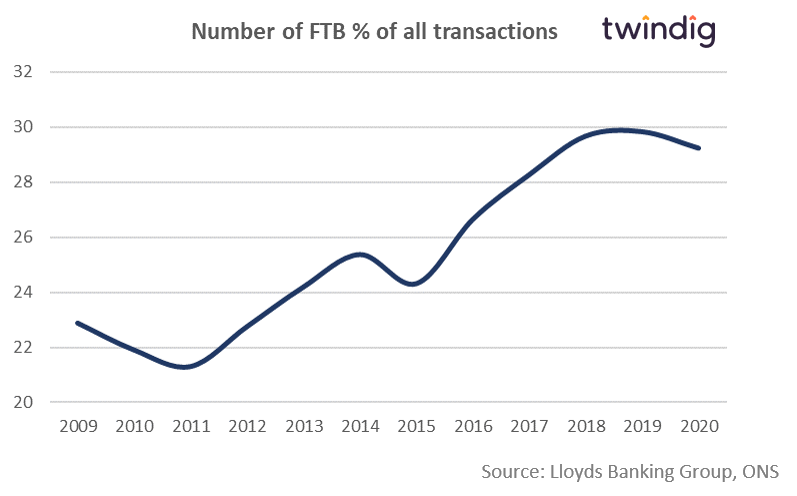

2. What percentage of homebuyers are first-time buyers?

Despite the fall in the number of transactions as a percentage of overall housing transactions, the number of first-time buyers remains relatively high at almost one in three (29%)

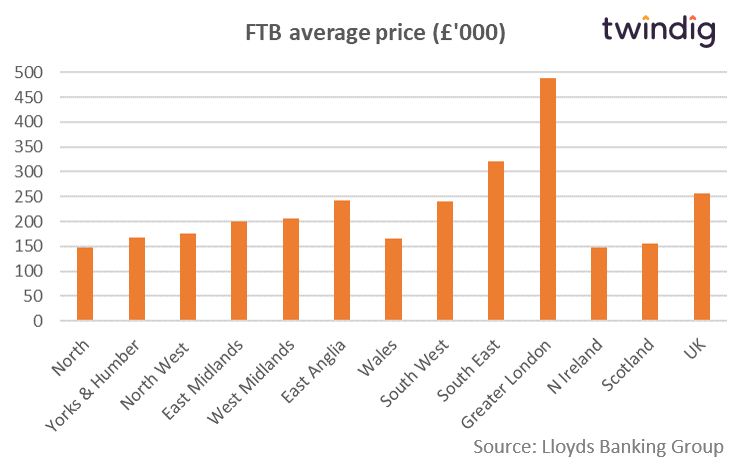

3. How much do first-time buyers pay for houses?

In 2020 the average first-time buyer paid £256,057 for their home, an increase of £22,939 on the previous year an increase equivalent to nine months gross (before tax) wages. The prices varied considerably by region with the North the lowest at £147,081 and Greater London the highest at £489,098

Looking to buy your first home? Why not use the Twindig mortgage payment calculator to see how much you can afford?

4. First Time Buyer Affordability

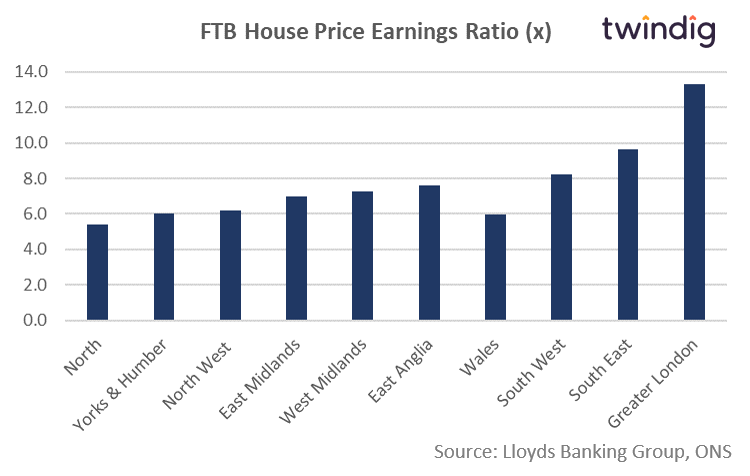

The often-quoted ‘House Price Earnings Ratio’ is used by many as a benchmark for housing affordability. The ratio shows the house price as a multiple of your wages. A house price-earnings ratio of 5.0x implies the house price is five times higher than your annual wages.

On this basis, the average House Price Earnings Ratio for England and Wales is 7.7x, but as with house prices, the range is large from 5.4x in the North to 13.3x in London.

5. First Time Buyer Deposits

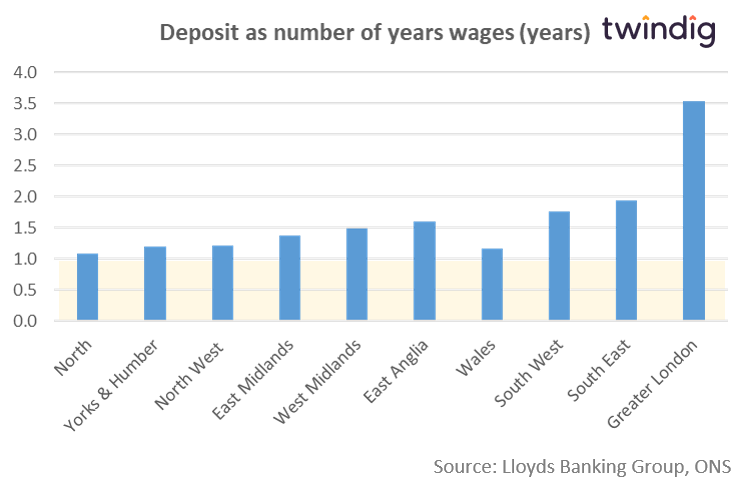

In our view, the key barrier to homeownership is the level of deposit required to secure the home purchase. If you have access to deposit, homeownership is relatively affordable. The challenge is securing the deposit.

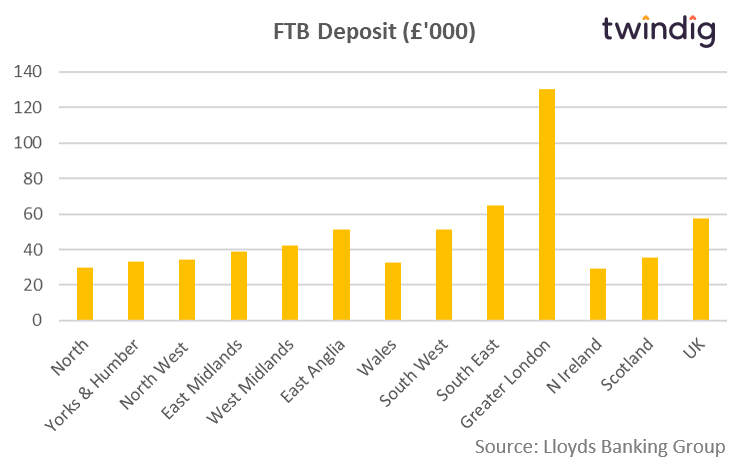

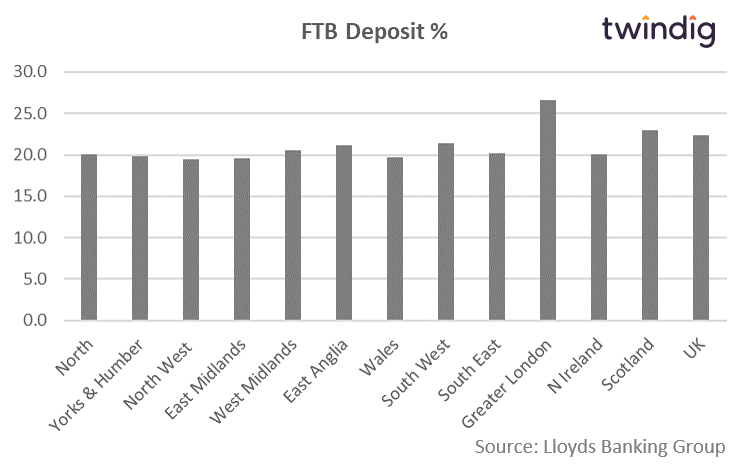

The average first-time buyer deposit in 2020 was £57,278, which equates to 22.4% of the purchase price. We show in the chart below the average first-time buyer deposit by region across the country.

The average first-time buyer deposit is a large amount of money, equivalent to almost two years of the median UK full-time wage. The majority of first-time buyers will need financial help from mum and dad or friends and family to build up a sufficient deposit. The average first-time buyer deposit in London was £130,357 which equates to 3.5 years of London's median average wage.

6. The most affordable places for First-Time Buyers

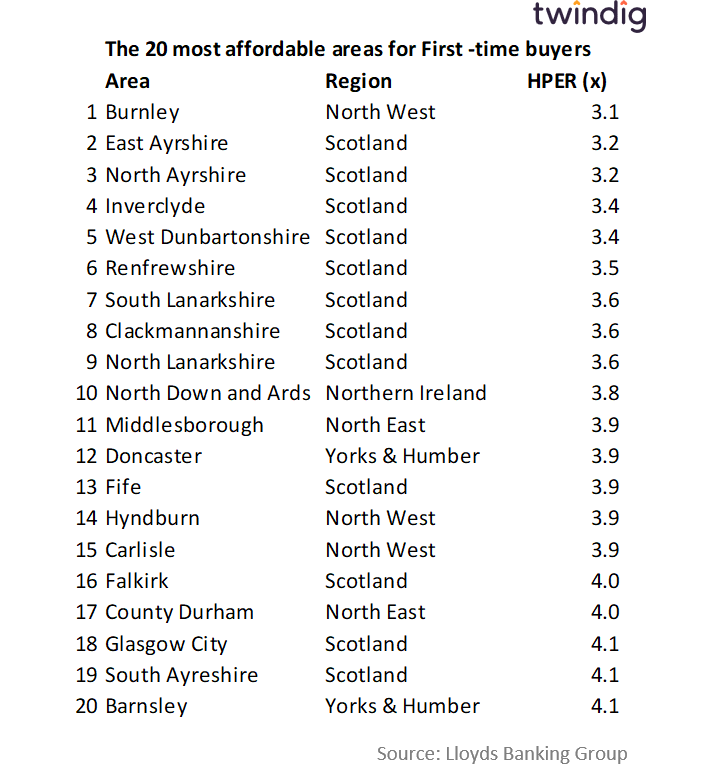

We show in the table below the top 20 most affordable areas for first-time buyers.

Topping the table is Burnley in the North West with a House Price Earnings Ratio (HPER) of just 3.1x. However, although not the most affordable area, Scotland makes up 8 of the top 10 and has a further three areas in the second half of the affordability table. Scotland, therefore, should attract first time buyers and will prove to be a happy hunting ground for those living there and those able to relocate.

Maybe you are one of the 7.2 million households across the UK who already know where they want to love next. With Twindig you can find and follow any home whether or not it is currently for sale allowing you to keep track of the price of your next home.

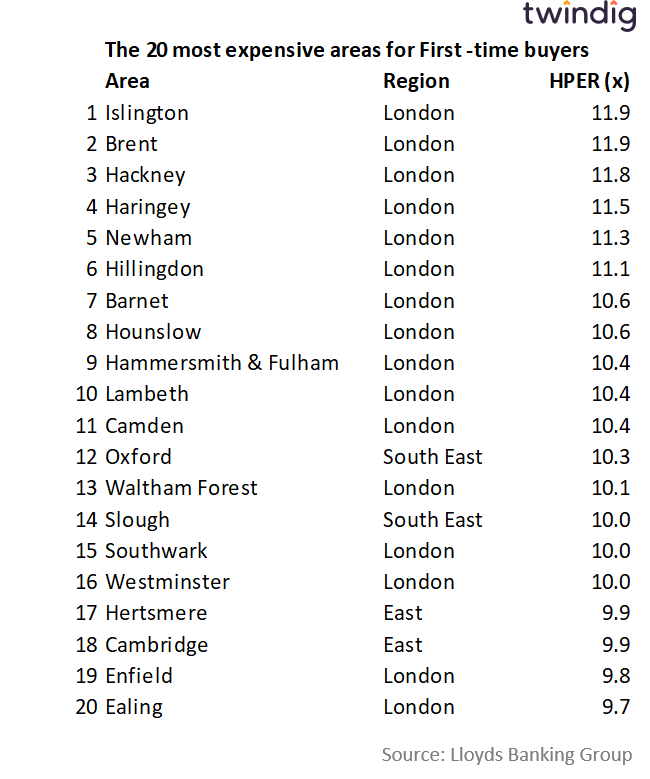

7. The 20 most expensive areas for First-time buyers

Not surprisingly, London is the most expensive area for First-time buyers. London dominates the top 20 taking up all the top 10 slots and 6 of the next ten, 16 of the 20 most expensive places for first- time buyers to live are in London. Islington takes the top slot with an HPER of 11.3x. Outside of the capital Oxford, Slough, Hertsmere and Cambridge complete the top 20.